OPEN-SOURCE SCRIPT

已更新 Momentum Probability Oscillator [SS]

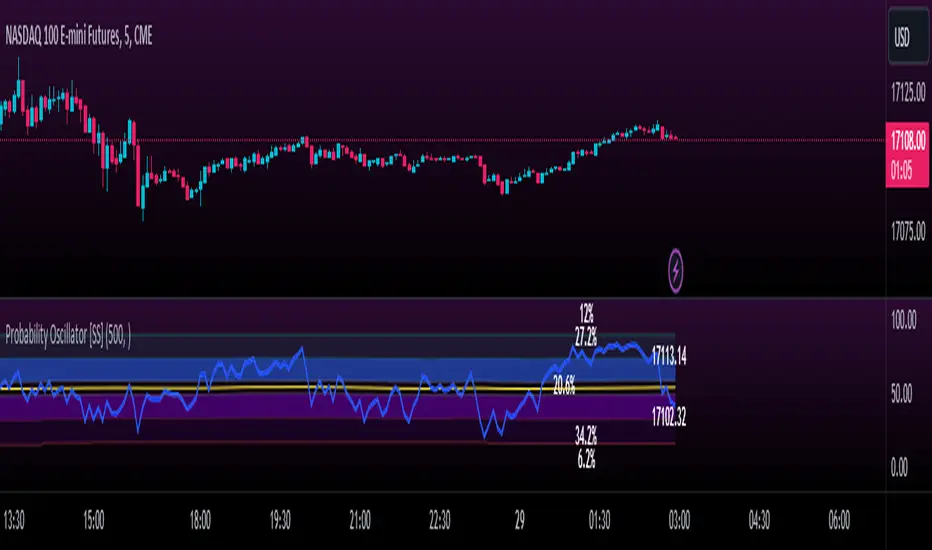

This is the momentum based probability indicator.

What it does?

This takes the average of MFI, Stochastics and RSI and plots it out as an independent oscillator.

It then tracks bullish vs bearish instances. Bullish is defined as a greater move from open to high than open to low and inverse for bearish.

It stores this data and these averages and plots these levels as a graph.

The graph depicts the max bullish values at the top, the min bearish values at the bottom and the averages in between:

It will plot the average "threshold" value in yellow:

The threshold value is key. A ticker trading above the threshold is generally bullish. Below is bearish.

The threshold value frequently acts as support and resistance levels (see below):

Resistance:

Support:

The indicator also shows you the amount of time a ticker has spent in each region, over a defined lookback period (defaulted to 500):

When you see that cumulatively, more time has been spent in a bullish range or a bearish range, it can help you ascertain the prevailing sentiment at that time.

The indicator will also calculate the average price range based on the underlying oscillator value. It does this through use of ATR based techniques, as its not usually possible to calculate a price from an oscillator:

This is intended as a general reference and not a precise target, as it is using ATR as opposed to the actual technical value itself.

As this is an oscillator, you can use it to look for divergences as well. The advantage to having it formulated in this way is:

a) You get the power of all 3 indicators (stochastics, MFI and RSI) in one and

b) You are adding context to the underlying technical reading. The indicator is plotting out the average, max and min ranges for the selected ticker and performing assessments based on these ranges that add context to the current PA.

You also have the ability to see the specific technical levels associated with each specific technical indicator. If you open up the settings menu and select "Show Table", this will appear:

This will show you the exact values of each of the technicals the indicator is using in its range assessment.

And that is basically the bulk of the indicator!

I use this predominately on the smaller timeframes, especially when there is a lot of chop, to ascertain the overall sentiment.

I also will reference it on the 1 hour to see what the prevailing sentiment is and whether the stock is at an area of technical resistance or support. For example, here is what I referenced on SPY today:

QUICK NOTE:

It works best with RTH (regular trading hours) turned on and ETH (extended trading hours) turned off!

That's it!

Hopefully you like it and leave your comments and suggestions below!

What it does?

This takes the average of MFI, Stochastics and RSI and plots it out as an independent oscillator.

It then tracks bullish vs bearish instances. Bullish is defined as a greater move from open to high than open to low and inverse for bearish.

It stores this data and these averages and plots these levels as a graph.

The graph depicts the max bullish values at the top, the min bearish values at the bottom and the averages in between:

It will plot the average "threshold" value in yellow:

The threshold value is key. A ticker trading above the threshold is generally bullish. Below is bearish.

The threshold value frequently acts as support and resistance levels (see below):

Resistance:

Support:

The indicator also shows you the amount of time a ticker has spent in each region, over a defined lookback period (defaulted to 500):

When you see that cumulatively, more time has been spent in a bullish range or a bearish range, it can help you ascertain the prevailing sentiment at that time.

The indicator will also calculate the average price range based on the underlying oscillator value. It does this through use of ATR based techniques, as its not usually possible to calculate a price from an oscillator:

This is intended as a general reference and not a precise target, as it is using ATR as opposed to the actual technical value itself.

As this is an oscillator, you can use it to look for divergences as well. The advantage to having it formulated in this way is:

a) You get the power of all 3 indicators (stochastics, MFI and RSI) in one and

b) You are adding context to the underlying technical reading. The indicator is plotting out the average, max and min ranges for the selected ticker and performing assessments based on these ranges that add context to the current PA.

You also have the ability to see the specific technical levels associated with each specific technical indicator. If you open up the settings menu and select "Show Table", this will appear:

This will show you the exact values of each of the technicals the indicator is using in its range assessment.

And that is basically the bulk of the indicator!

I use this predominately on the smaller timeframes, especially when there is a lot of chop, to ascertain the overall sentiment.

I also will reference it on the 1 hour to see what the prevailing sentiment is and whether the stock is at an area of technical resistance or support. For example, here is what I referenced on SPY today:

QUICK NOTE:

It works best with RTH (regular trading hours) turned on and ETH (extended trading hours) turned off!

That's it!

Hopefully you like it and leave your comments and suggestions below!

版本注释

Some asthetic changes and updating the code to reflect some changes in the request.security parameters.No functional change!

版本注释

Quick fix版本注释

Per request,Added an alert for a crossover and crossunder of the average median line.

You can now set this to alert you of a cross.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Get:

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Get:

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

- Live Updates,

- Discord access,

- Access to my Proprietary Merlin Software,

- Access to premium indicators,

patreon.com/steversteves

Now on X!

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。