INVITE-ONLY SCRIPT

STATEMAP | QuantEdgeB

Introducing STATEMAP by QuantEdgeB

🔍 Overview

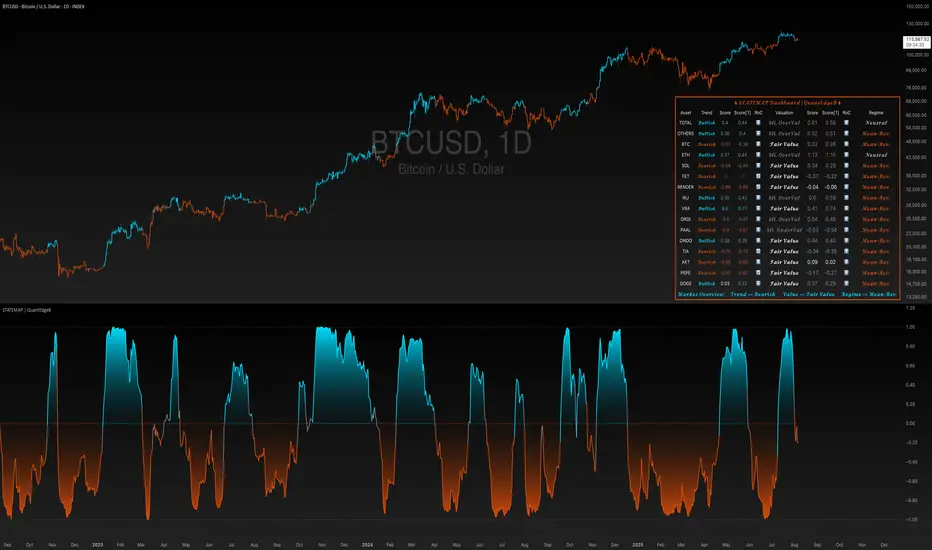

STATEMAP | QuantEdgeB is a holistic Trend & Valuation dashboard for 16 key crypto and index assets. It distills each asset’s momentum regime and valuation state into two live averages—trend average and valuation average—and presents them via color-coded candles, dynamic plots, and a comprehensive bottom-right table. Switch effortlessly between Trend and Valuation views to spot regime shifts across the market.

✨ Key Features

• 🧭 Trend vs. Valuation Toggle

Flip between viewing the overall market’s trend average or its valuation average with a single input.

• 📊 Trend Average

Aggregates each asset’s directional bias (bullish vs. bearish) into one composite gauge that flags risk-on vs. risk-off regimes.

• 💎 Valuation Average

Blends each asset’s statistical valuation score to highlight extreme under-/over-valued conditions.

• 🎨 Color-Coded Visualization

Candles turn blue for bullish, red for bearish, and gray for neutral; fills and horizontal bands reinforce regime thresholds.

• 🗺️ Live Asset Matrix

A 16×8 table shows for each symbol:

• Current Trend (Bullish/Bearish)

• Score & Prior Score with direction arrows (⬆️/⬇️/🔄)

• RoC (momentum change)

• Valuation State label (e.g. “Strong UnderValued”)

• Valuation value & prior value with change indicator

• 🚦 Market Stage Banner

A top-row line combines both averages into a concise “Market Stage” message (e.g. “Trend ⟹ Bullish Value ⟹ Sli. OverValued”).

⚙️ How It Works

• Universal Trend Assessment

Uses a library of trend-following logic to classify each asset as bullish or bearish, then averages those signals into the trend average.

• Adaptive Valuation Mapping

Evaluates each asset’s statistical valuation band, maps it into intuitive labels (under-/fair-/over-valued), and averages into the valuation average.

• Regime Thresholds

• Trend average above +0.1 ⇒ risk-on (bullish); below –0.1 ⇒ risk-off (bearish); otherwise neutral.

• Valuation average buckets assign six states from “Strong UnderValued” to “Strong OverValued.”

• Dynamic Visualization

Color-coded candlesticks and filled plot areas highlight when the market crosses key levels, making regime changes immediately apparent.

🎯 Who Should Use It

• Systematic Traders looking for a unified regime filter across multiple assets

• Portfolio Managers wanting a pulse on market momentum vs. valuation before reallocations

• Swing & Position Traders confirming cross-asset alignment or spotting divergences

• Risk Managers monitoring broad contractions (trend bearish) vs. expansions (trend bullish) alongside valuation extremes

🧬 Default Settings

• View Mode: Trend

• Bar color: Yes

• Assets Covered: TOTAL market cap, TOTAL OTHERS, BTC, ETH, SOL, FET, RNDR, INJ, VRA, ORDI, PAAL, ONDO, TIA, AKT, PEPE, DOGE

📌 Conclusion

STATEMAP | QuantEdgeB delivers a clear, emoji-tagged map of where the crypto market stands in both momentum and valuation space. With an easy toggle and a rich dashboard, it empowers you to make regime-aware trading and allocation decisions at a glance.

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

🔍 Overview

STATEMAP | QuantEdgeB is a holistic Trend & Valuation dashboard for 16 key crypto and index assets. It distills each asset’s momentum regime and valuation state into two live averages—trend average and valuation average—and presents them via color-coded candles, dynamic plots, and a comprehensive bottom-right table. Switch effortlessly between Trend and Valuation views to spot regime shifts across the market.

✨ Key Features

• 🧭 Trend vs. Valuation Toggle

Flip between viewing the overall market’s trend average or its valuation average with a single input.

• 📊 Trend Average

Aggregates each asset’s directional bias (bullish vs. bearish) into one composite gauge that flags risk-on vs. risk-off regimes.

• 💎 Valuation Average

Blends each asset’s statistical valuation score to highlight extreme under-/over-valued conditions.

• 🎨 Color-Coded Visualization

Candles turn blue for bullish, red for bearish, and gray for neutral; fills and horizontal bands reinforce regime thresholds.

• 🗺️ Live Asset Matrix

A 16×8 table shows for each symbol:

• Current Trend (Bullish/Bearish)

• Score & Prior Score with direction arrows (⬆️/⬇️/🔄)

• RoC (momentum change)

• Valuation State label (e.g. “Strong UnderValued”)

• Valuation value & prior value with change indicator

• 🚦 Market Stage Banner

A top-row line combines both averages into a concise “Market Stage” message (e.g. “Trend ⟹ Bullish Value ⟹ Sli. OverValued”).

⚙️ How It Works

• Universal Trend Assessment

Uses a library of trend-following logic to classify each asset as bullish or bearish, then averages those signals into the trend average.

• Adaptive Valuation Mapping

Evaluates each asset’s statistical valuation band, maps it into intuitive labels (under-/fair-/over-valued), and averages into the valuation average.

• Regime Thresholds

• Trend average above +0.1 ⇒ risk-on (bullish); below –0.1 ⇒ risk-off (bearish); otherwise neutral.

• Valuation average buckets assign six states from “Strong UnderValued” to “Strong OverValued.”

• Dynamic Visualization

Color-coded candlesticks and filled plot areas highlight when the market crosses key levels, making regime changes immediately apparent.

🎯 Who Should Use It

• Systematic Traders looking for a unified regime filter across multiple assets

• Portfolio Managers wanting a pulse on market momentum vs. valuation before reallocations

• Swing & Position Traders confirming cross-asset alignment or spotting divergences

• Risk Managers monitoring broad contractions (trend bearish) vs. expansions (trend bullish) alongside valuation extremes

🧬 Default Settings

• View Mode: Trend

• Bar color: Yes

• Assets Covered: TOTAL market cap, TOTAL OTHERS, BTC, ETH, SOL, FET, RNDR, INJ, VRA, ORDI, PAAL, ONDO, TIA, AKT, PEPE, DOGE

📌 Conclusion

STATEMAP | QuantEdgeB delivers a clear, emoji-tagged map of where the crypto market stands in both momentum and valuation space. With an easy toggle and a rich dashboard, it empowers you to make regime-aware trading and allocation decisions at a glance.

🔹 Disclaimer: Past performance is not indicative of future results. No trading strategy can guarantee success in financial markets.

🔹 Strategic Advice: Always backtest, optimize, and align parameters with your trading objectives and risk tolerance before live trading.

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系QuantEdgeB。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Please check out our Whop page for access!!

https://whop.com/quantedgeb/?a=quantedge17

🔹 Get access to our premium tools:

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系QuantEdgeB。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Please check out our Whop page for access!!

https://whop.com/quantedgeb/?a=quantedge17

🔹 Get access to our premium tools:

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

whop.com/basetrustcapital 💎

🔹 Unlock our free toolbox:

tradinglibrary.carrd.co/ 🛠️

Disclaimer: All resources and indicators provided are for educational purposes only

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。