PROTECTED SOURCE SCRIPT

RamanVol with Bull Snort Candles and Power Volumes

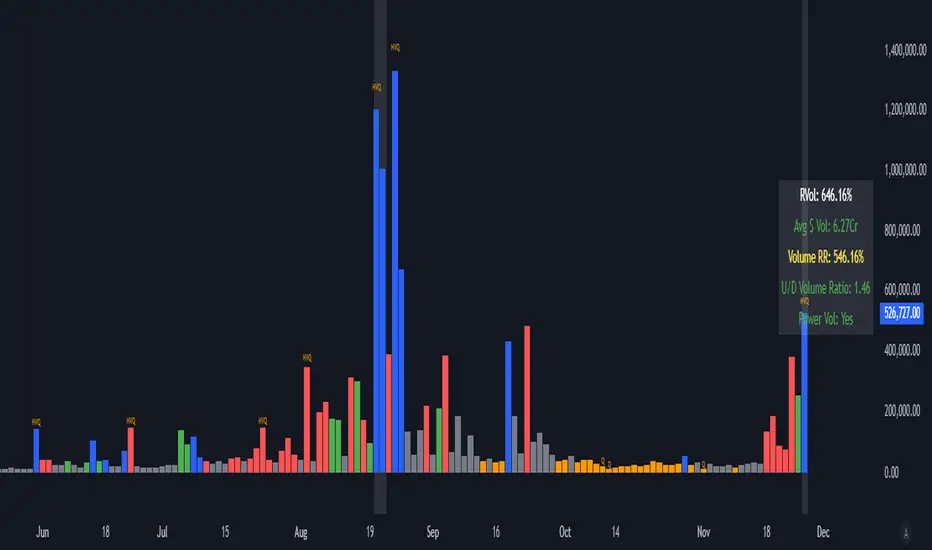

1. Volume Analysis and Conditions:

Pocket Pivot Volume (PPV): A condition where a bar's volume on an up day is greater than the highest down-day volume in the last lookbackPeriod (e.g., 10 days). This indicates strong buying interest and is highlighted with blue bars.

High Down-Bar Volume: Identifies high volume on down days, with the volume greater than the 50-period moving average. This is represented by red bars.

High Up-Bar Volume: Identifies high volume on up days, with the volume greater than the 50-period moving average, represented by green bars.

Low Volume: When the volume is below 20% of the moving average volume (lowVolumeFraction), the bar is colored orange, indicating a "dry" or low volume day.

HVE (Highest Volume Ever): Marks the highest volume ever observed, indicated by a purple label above the bar.

HVQ (Highest Volume in Quarter): Marks the highest volume in the last quarter (63 days), indicated by an orange label (Q).

LVQ (Lowest Volume in Quarter): Marks the lowest volume in the last quarter, indicated by a Q label above the bar.

LVY (Lowest Volume in Year): Marks the lowest volume in the last year, indicated by a Y label.

2. Bull Snort Candles:

A Bull Snort candle is a specific type of candle that meets the following criteria:

Volume is more than 3 times the 50-period volume moving average.

The price closes within the top 35% of the day's range.

The close is higher than the previous bar's close.

When a Bull Snort is detected, the background color of the chart turns purple, and a small dot is plotted below the bar (if enabled).

3. Power Volume:

Power Volume occurs when the volume exceeds a certain threshold (e.g., 500,000) and the price moves at least 5% on that bar.

When these conditions are met, the background of the chart is highlighted with a yellow headlight effect, indicating a significant volume and price movement.

4. Relative Volume (RVol):

Relative Volume compares the current volume to the moving average of volume (50-period), showing how much higher or lower the volume is relative to the average. This is expressed as a percentage (e.g., 200% if today's volume is twice the average volume).

5. Table Display:

The indicator updates a table on the right side of the chart with the following metrics:

RVol: Displays the relative volume as a percentage.

Avg Dollar Volume: Shows the average dollar volume (average volume * average price).

Volume RR (Run Rate): Displays the percentage by which today's volume is higher or lower than the moving average.

Up/Down Volume Ratio: A measure of the ratio of total volume on up days to down days. If this ratio is greater than 1, it's considered bullish.

6. Background Highlights:

Bull Snort Candles: The background turns purple when Bull Snort candles are detected.

Power Volumes: The background turns yellow when Power Volume conditions are met.

Low Volume: Days with very low volume are marked with orange bars.

CREDITS: finallynitin, Mark Minervini, Gill Morales, Dr Chris, Oliver Kell

Pocket Pivot Volume (PPV): A condition where a bar's volume on an up day is greater than the highest down-day volume in the last lookbackPeriod (e.g., 10 days). This indicates strong buying interest and is highlighted with blue bars.

High Down-Bar Volume: Identifies high volume on down days, with the volume greater than the 50-period moving average. This is represented by red bars.

High Up-Bar Volume: Identifies high volume on up days, with the volume greater than the 50-period moving average, represented by green bars.

Low Volume: When the volume is below 20% of the moving average volume (lowVolumeFraction), the bar is colored orange, indicating a "dry" or low volume day.

HVE (Highest Volume Ever): Marks the highest volume ever observed, indicated by a purple label above the bar.

HVQ (Highest Volume in Quarter): Marks the highest volume in the last quarter (63 days), indicated by an orange label (Q).

LVQ (Lowest Volume in Quarter): Marks the lowest volume in the last quarter, indicated by a Q label above the bar.

LVY (Lowest Volume in Year): Marks the lowest volume in the last year, indicated by a Y label.

2. Bull Snort Candles:

A Bull Snort candle is a specific type of candle that meets the following criteria:

Volume is more than 3 times the 50-period volume moving average.

The price closes within the top 35% of the day's range.

The close is higher than the previous bar's close.

When a Bull Snort is detected, the background color of the chart turns purple, and a small dot is plotted below the bar (if enabled).

3. Power Volume:

Power Volume occurs when the volume exceeds a certain threshold (e.g., 500,000) and the price moves at least 5% on that bar.

When these conditions are met, the background of the chart is highlighted with a yellow headlight effect, indicating a significant volume and price movement.

4. Relative Volume (RVol):

Relative Volume compares the current volume to the moving average of volume (50-period), showing how much higher or lower the volume is relative to the average. This is expressed as a percentage (e.g., 200% if today's volume is twice the average volume).

5. Table Display:

The indicator updates a table on the right side of the chart with the following metrics:

RVol: Displays the relative volume as a percentage.

Avg Dollar Volume: Shows the average dollar volume (average volume * average price).

Volume RR (Run Rate): Displays the percentage by which today's volume is higher or lower than the moving average.

Up/Down Volume Ratio: A measure of the ratio of total volume on up days to down days. If this ratio is greater than 1, it's considered bullish.

6. Background Highlights:

Bull Snort Candles: The background turns purple when Bull Snort candles are detected.

Power Volumes: The background turns yellow when Power Volume conditions are met.

Low Volume: Days with very low volume are marked with orange bars.

CREDITS: finallynitin, Mark Minervini, Gill Morales, Dr Chris, Oliver Kell

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。