INVITE-ONLY SCRIPT

已更新 Cyatophilum Bands Definitive Edition

█ OVERVIEW

A Swing Trade indicator providing backtest and alerts which can be used as a long, short or reversal strategy.

Its main goal is to catch breakouts and huge moves, and to try and beat the Buy & Hold Return.

█ CONCEPTS

The strategy consists of a unique custom indicator that works like this:

A Smoothed Donchian Channel combined with a consolidation check will trigger an entry.

The entry is then guided by a faster channel used as a trailing stop.

█ HOW TO USE

The most effective way to use this indicator is on high timeframes, from 2H to 1D.

The recommended pairs are trending pairs with consolidation areas. Yes, I'm especially looking at crypto.

The first appproach would be to catch long and short breakouts, and ride the trend using the trailing stop.

Adjust the Bands wisely to trigger entries at the right time.

The second approach is to go longs only, and try to beat the Buy & Hold return.

For this, click "Go long" and use an order size of 100% equity. Then adjust the Bands, trailing stop and chart timeframe.

The Buy & Hold comparator will come handy when backtesting.

█ INDICATOR SETTINGS

Strategy Direction

Choose wether to go long only, short only or both directions.

Bands Configuration

The bands lookback, smoothing and consolidation % are used to change the behavior of the bands. More info in the settings tooltips.

Trailing Stop

The "speed" of the trailing stop can be configured, allowing more or less room for the price to move before exiting.

Volume Condition

In addition to the consolidation condition, you can add a volume check to your entry. Is the volume rising or not? Useful in most scenarios.

Exit Alert Type

If you want to receive alerts during bars or prefer to ignore wicks.

Backtest Settings

This is where you choose the backtest period which is also used to calculate the B&H return.

Graphics

The configuration panel with all the indicator settings backtest info.

The buy & Hold Comparator is an additional panel that turns green when the strategy's return is greater than the Buy & Hold return.

Note: The Strategy Return is the strategy netprofit + the strategy openprofit.

█ ALERTS

Configure your alert messages for all events in the indicator settings.

Then click "Add Alert". In the popup window, select the option "alert() function calls only", give the alert a name and you are good to go!

█ BACKTEST RESULTS

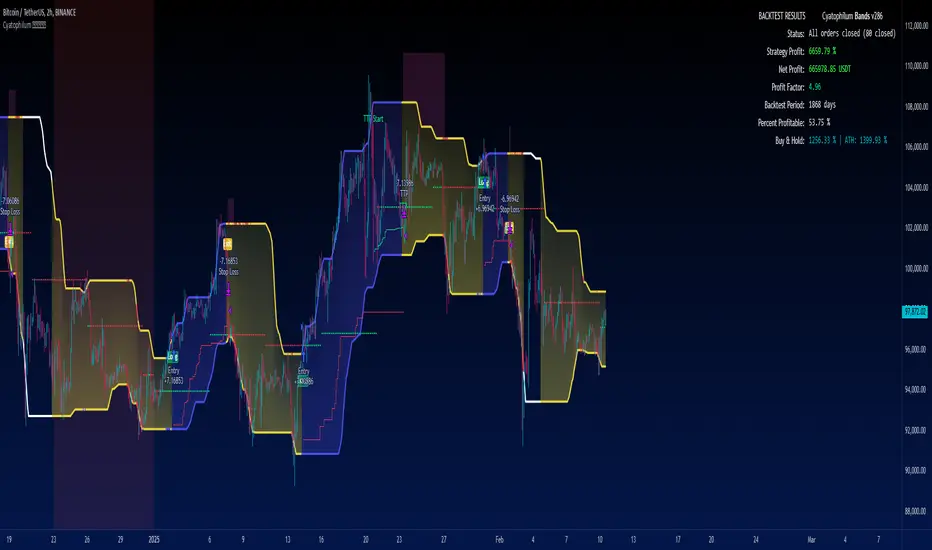

The backtest settings used in this snapshot are the following:

The Indicator settings used for this are shown in the main chart above.

A Swing Trade indicator providing backtest and alerts which can be used as a long, short or reversal strategy.

Its main goal is to catch breakouts and huge moves, and to try and beat the Buy & Hold Return.

█ CONCEPTS

The strategy consists of a unique custom indicator that works like this:

A Smoothed Donchian Channel combined with a consolidation check will trigger an entry.

The entry is then guided by a faster channel used as a trailing stop.

█ HOW TO USE

The most effective way to use this indicator is on high timeframes, from 2H to 1D.

The recommended pairs are trending pairs with consolidation areas. Yes, I'm especially looking at crypto.

The first appproach would be to catch long and short breakouts, and ride the trend using the trailing stop.

Adjust the Bands wisely to trigger entries at the right time.

The second approach is to go longs only, and try to beat the Buy & Hold return.

For this, click "Go long" and use an order size of 100% equity. Then adjust the Bands, trailing stop and chart timeframe.

The Buy & Hold comparator will come handy when backtesting.

█ INDICATOR SETTINGS

Strategy Direction

Choose wether to go long only, short only or both directions.

Bands Configuration

The bands lookback, smoothing and consolidation % are used to change the behavior of the bands. More info in the settings tooltips.

Trailing Stop

The "speed" of the trailing stop can be configured, allowing more or less room for the price to move before exiting.

Volume Condition

In addition to the consolidation condition, you can add a volume check to your entry. Is the volume rising or not? Useful in most scenarios.

Exit Alert Type

If you want to receive alerts during bars or prefer to ignore wicks.

Backtest Settings

This is where you choose the backtest period which is also used to calculate the B&H return.

Graphics

The configuration panel with all the indicator settings backtest info.

The buy & Hold Comparator is an additional panel that turns green when the strategy's return is greater than the Buy & Hold return.

Note: The Strategy Return is the strategy netprofit + the strategy openprofit.

█ ALERTS

Configure your alert messages for all events in the indicator settings.

Then click "Add Alert". In the popup window, select the option "alert() function calls only", give the alert a name and you are good to go!

█ BACKTEST RESULTS

The backtest settings used in this snapshot are the following:

- Initial Capital: 10 000$

- Order size: 100% equity (It indeed compounds and this is intended since the main goal of the strategy is to compare to Buy & Hold return)

- Commission: 0.1%

- Slippage : 10 ticks

The Indicator settings used for this are shown in the main chart above.

版本注释

Added new Backtest Results panelYou can disable it by going in the style tab -> tables, or by clicking the indicator setting "Backtest Results Table".

You can also change its size if you want to make it bigger or smaller.

It replaces the Buy & Hold Comparator

版本注释

fix backtest closing orders with calc on every tick 版本注释

Added alerts for TP 1 & TP 2版本注释

Small visual bug fix (when using once per bar exit type sometimes the trailing line was off)版本注释

Added an option to switch from Donchian Channels to Bollinger Bands + another option to filter stronger breakouts based on Keltner channels.版本注释

Updated Alert text inputs. Now allows line returns!版本注释

Never miss a single breakout with the new 'Keltner' Band option!Added Bands settings: Multiplicator and Offset

版本注释

Updated config panel版本注释

Added tooltipRemoved multiplicator for DC channel

Fix some visual bug with Take Profit line continuing when SL was hit

Added custom order size setting

版本注释

Added alert placeholdersAll alerts:

{price} will return the close price

{ticker} symbol name without exchange prefix

{tickerid} symbol name with exchange prefix

Buy & Sell alert:

{TP}, {TP2}, {SL} will return the TP & SL prices

版本注释

Added EMA Trendline as filter版本注释

- Inputs (quality of life)

- New ATR trailing stop option

- Backtest Table new design and options (colors, position)

- Added Alerts placeholders

- Plots (gradients, yay!)

版本注释

bugfixes (backtest table, limit take profit)- Added a take profit option to NOT take profit when the global trend is in our direction

- The strategy will no longer enter a trade immediately after take profit is hit

版本注释

New inputs: - Bands Timeframe: Make the Bands higher timeframe and go trade on lower timeframes without changing bands settings!

- Bands Source: Choose between 'Donchian', 'SMA' or 'EMA' to create your bands. Note that SMA and EMA are meant to be used with the new ATR and STDEV inputs but can work on their own!

- Add Standard Deviation to the Bands: This input replaces the previous 'Bollinger Bands' input, and allows more customisation.

- Add Average True Range to the Bands: This input replaces the previous 'Keltner Channels' input, and allows more customisation. Can be combined with the previous inputs!

Bug fixes:

Only graphical fixes within the backtest panel: open profit % is now correct!

New plot: Take Profit EMA used for Trend condition (option released in a previous update)

版本注释

Bugfixes: Backtest settings period input for trades.版本注释

Added the option "Entry alert type"版本注释

Added new features:Strategy Direction

- reverse order option

Bands Settings

- Range Filter

Prevents fakeouts from previously touched support/resistance (recommended)

- Trend Filter

Creates a MTF pivot to filter trades (recommended)

Stop Loss

- Mode 'Auto', '%', 'pips', 'ATR'.

- Trailing Stop Loss Mode 'Classic', 'ATR', MTF.

Take Profit

- Mode '%', 'pips', 'Auto'.

Alerts

- Take Profit, Exit and Stop loss alerts are all grouped into a single 'EXIT' alert for easier setup.

版本注释

Fix of the reverse orders feature版本注释

Backtest Panel: added ATH buy and hold, which is the maximum return a holder can get if he sold at ATH. Useful to compare with your strategy returns, because the buy and hold captured at the end of a bear market is easier to beat.Added ATR settings for the trailing stop.

版本注释

Fix "once per bar" bands exit condition版本注释

The faster exit band is improved to better adapt to the type of bands used, (donchian, true range, standard deviation..)Added ATR settings for stop loss start price

版本注释

Added alert messages for Long & Short TP / SL, in case the unique exit alert wasn't enough.版本注释

Bug fixes版本注释

Fixes: - "long/short sl alert type" input

- "exit alert (faster band)" replaces "exit all" alert

版本注释

Added MTF Trend Filters:'EXTERNAL', 'Tilson T3', 'Adaptive Tilson T3', 'EMA', 'SMA', 'WMA', 'HULL MA', 'Adaptive HULL MA', 'KAMA', 'ALMA', 'RMA', 'SWMA', 'VWMA','SMMA','VIDYA','FRAMA','DEMA'.

Added NASDAQ/BTC.D Filters.

- Add a filter for long: do not enter when NASDAQ/BTC.D are falling.

- Add a filter for long: only enter when NASDAQ/BTC.D are rising.

版本注释

Added entry options "rebounds/bounce entries on pivot supports"- Pick a higher timeframe (for ex 5 days)

- select which supports to enable (ex S2 to S5)

In contrary to the breakouts, the rebound entry can only happen when price is not consolidated.

The rebound entries are affected by the Nasdaq/BTC.D filter.

These rebounds do not happen often but give great buy opportunity.

Long only (for now)

版本注释

- Fixed a repainting issue with the nasdaq/BTC.D filter

- Code optimisation

版本注释

- Added a "Fast & Simple" Graphics mode to further reduce loading time and chart graphics

版本注释

- Added Alert tutorial label

版本注释

Updated Backtest Panel- Increased readability

- Added tooltips

版本注释

- Pivot rebounds will now trigger a short exit event when shorts enabled

- Inputs clarification

版本注释

- Updated to pine version 6

- Added Trailing Take Profit feature

- Added Correlation Filter (replaces Nasdaq Filter)

The TTP can be anchored to the Take Profit, and/or triggered by custom conditions (see screenshot).

The Correlation Filter is now more customisable (not limited to Nasdaq) and can use 2 symbols.

版本注释

Fixes on correlation filter版本注释

Fixes and updated default settings版本注释

Added 'WMA' to the "band source" input dropdown menu.Combine the Weighted Moving Average with 2+ Average True Range multiplier to get nice results.

版本注释

Trailing Take Profit: Added an input for "alert type", either 'Once per bar close' or 'once per bar'.版本注释

Fixed an issue with the stop loss alert when using Trailing Take Profit.版本注释

Fixed repainting introduced when converting to pine v6版本注释

Bug fixes: repainting when using higher timeframes仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系cyatophilum。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Get Your Free Trial at https://blockchainfiesta.com/strategy/Cyatophilum-Bands-Definitive-Edition/40/

🔥Get the Cyatophilum Indicators today and automate them on Binance! => blockchainfiesta.com/strategies/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系cyatophilum。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

Get Your Free Trial at https://blockchainfiesta.com/strategy/Cyatophilum-Bands-Definitive-Edition/40/

🔥Get the Cyatophilum Indicators today and automate them on Binance! => blockchainfiesta.com/strategies/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。