OPEN-SOURCE SCRIPT

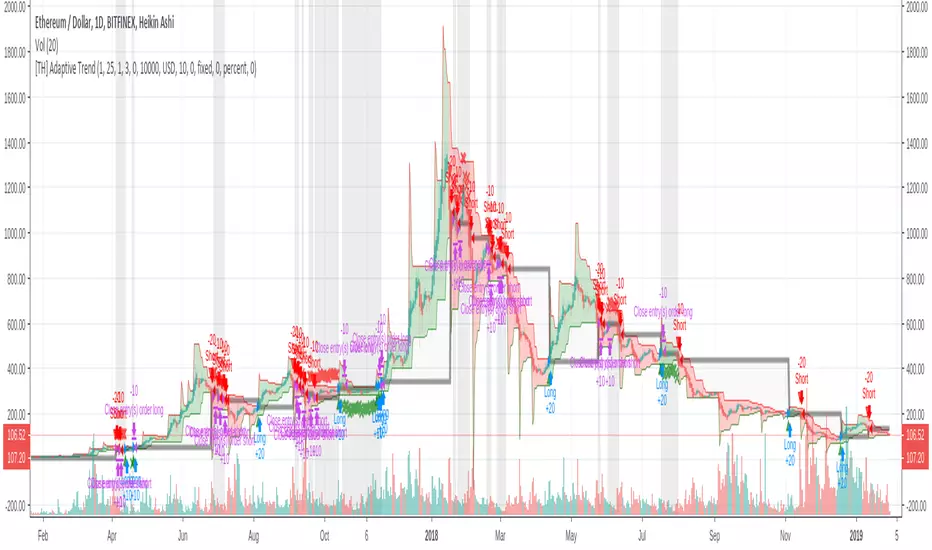

[TH] Adaptive Trend : Strategy

Adaptive Trend : Strategy

*** It should be used with 'heikin ashi' chart ***

*** It should be used with 'heikin ashi' chart ***

- Super Trend

Basically, it is super trend strategy ( Rajandran R Supertrend )

- My idea is,

1. (scale) Factor of super trend is related with sensitivity of Up/Down trend change

2. Constant Factor cause failure of super trend strategy when market prices variance is low ( ie. high Factor ==> miss short trend )

3. By using variance measure ( like BollingerBand ) as a varying Factor, maybe we can catch short trend and long trend together - Loss Cut

The silver thick line is loss cut line & silver background means exit position status

I found that silver background is appear usually when price moves horizontally

1. It is set to open price of actual position entry ( heikin ashi chart's open price = loss cut line = (open + close)/2 )

2. If position is long

==> loss cut is executed when low price is lower than loss cut line

==> re-entry when low price is higher than loss cut line

3. If Position is short

==> loss cut is executed when high price is higher than loss cut line

==> re-entry when high price is lower than loss cut lin

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。