OPEN-SOURCE SCRIPT

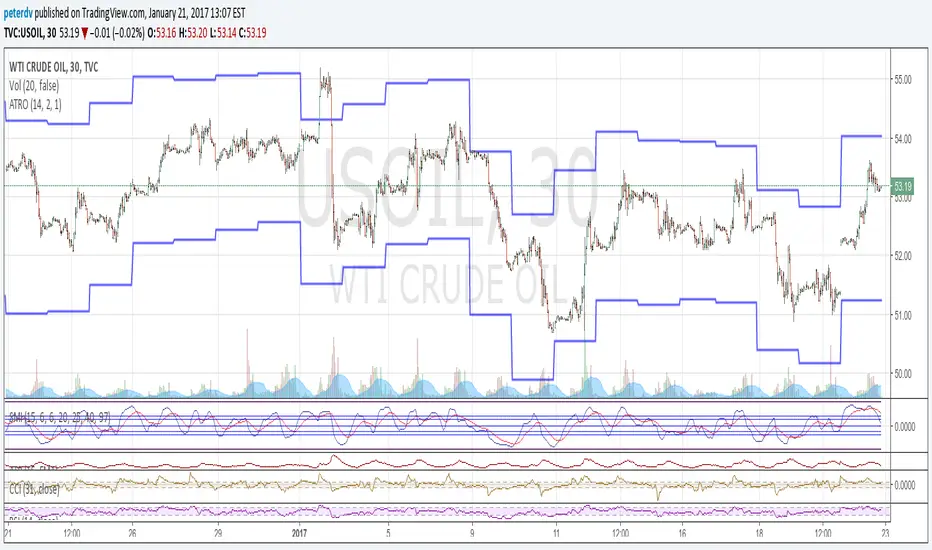

Average True Range Overlay

Plots ATR calculated on a daily basis as an overlay on the current chart.

Implemented using the builtin atr function.

ATR is a volatility indicator

originally developed by J. Welles Wilder, Jr. for commodities:

New Concepts in Technical Trading Systems. Greensboro, NC: Trend Research. ISBN 978-0-89459-027-6.

The range of a day's trading is simply R = high − low.

The true range extends it to yesterday's closing price if it was outside of today's range:

TR = max[(high-low), abs(high-close(previous)), abs(low - close(previous))]

The average true range is an N-day smoothed moving average of the TR values.

A first stab at a sensible stop loss level might be 3*ATR below recent peak.

Implemented using the builtin atr function.

ATR is a volatility indicator

originally developed by J. Welles Wilder, Jr. for commodities:

New Concepts in Technical Trading Systems. Greensboro, NC: Trend Research. ISBN 978-0-89459-027-6.

The range of a day's trading is simply R = high − low.

The true range extends it to yesterday's closing price if it was outside of today's range:

TR = max[(high-low), abs(high-close(previous)), abs(low - close(previous))]

The average true range is an N-day smoothed moving average of the TR values.

A first stab at a sensible stop loss level might be 3*ATR below recent peak.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。