OPEN-SOURCE SCRIPT

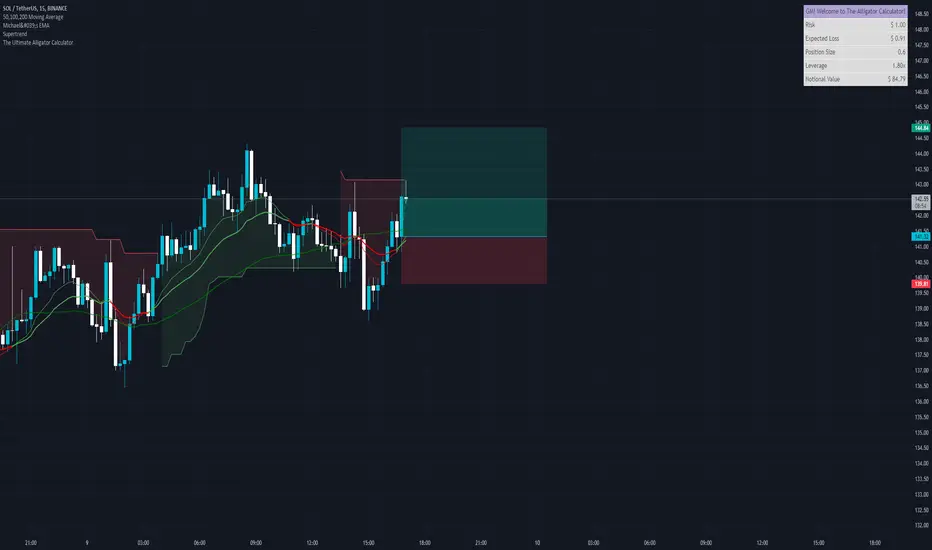

The Ultimate Alligator Calculator

GM Blue Belts!

Welcome to The Alligator Calculator: Trading View Edition!

The calculator is easy to use.

The calculator will tell you the exact risk, expected loss and position size with leverage as well, if needed.

Just tell it your portfolio size and your desired risk and it will do all of the work for you after it has received the entry and stop loss values.

It saves the data so do not worry about having to enter your CEX settings every single time.

It should make sure that you never deviate more than 10% and that your position size fits the minimum position size allowed on your chosen CEX and Coin!

This does not mean that it is not possible to deviate too much! Super high slippage or weirdly filled orders can happen! This is on the CEX side and is not something I can do anything about.

Color adjustments are available in the settings!

The Ultimate Alligator Calculator: Quick Guide

Calculator Inputs:

Entry Price

Input the price at which you enter the trade.

Stop Loss Price

Input the price at which you will exit the trade to limit losses.

Portfolio Size

Input the total size of your trading portfolio.

Desired Risk

Input the amount of risk you are willing to take.

CEX Settings:

Entry Fee (%)

Input the fee percentage for entering a trade.

Exit Fee (%)

Input the fee percentage for exiting a trade.

Minimum Position Size

Specify the smallest allowable position size.

Advanced Settings:

Leverage Buffer

Input a buffer value for leverage calculations.

Upside Deviation Allowed (%)

Set the maximum acceptable increase in risk as a percentage.

Downside Deviation Allowed (%)*

Set the maximum acceptable decrease in risk as a percentage.

Calculator Outputs:

Risk

Displays either the desired risk or adjusted risk based on the validity check.

This is your RISK and the one you input into your trading sheet!

Expected Loss

Displays the Final Expected Loss and it is the one you input into your trading sheet!

Position Size

Displays the Final Position Size and it is the one you input into your trading sheet!

Leverage

Determines the leverage needed if the notional value exceeds the portfolio size, ensuring sufficient leverage is maintained.

Notional Value

Computes the total value of the position based on the entry price.

Calculations:

Price Move

Calculates the price difference between the entry and stop-loss price.

Initial Fees

Computes the initial cost of entering and exiting a trade.

Initial Notional Values

Calculates the initial total value of the position based on entry price.

Initial Expected Loss

Estimates potential loss considering fees and price move.

Initial Position Size

Determines the size of the initial position based on expected loss and price move.

Adjusted Position Size

Rounds the initial position size to the nearest allowable size.

Adjusted Expected Loss

Recalculates potential loss based on the adjusted position size.

Adjusted Notional Value

Updates the total value of the position considering the adjusted size.

Adjusted Fees (USD)

Recomputes the fees based on the adjusted notional value.

Adjusted Risk

Calculates the total risk by adding adjusted expected loss and fees.

Valid Risk?

Verifies if the adjusted risk is within the allowed deviation limits of the desired risk.

Welcome to The Alligator Calculator: Trading View Edition!

The calculator is easy to use.

The calculator will tell you the exact risk, expected loss and position size with leverage as well, if needed.

Just tell it your portfolio size and your desired risk and it will do all of the work for you after it has received the entry and stop loss values.

It saves the data so do not worry about having to enter your CEX settings every single time.

It should make sure that you never deviate more than 10% and that your position size fits the minimum position size allowed on your chosen CEX and Coin!

This does not mean that it is not possible to deviate too much! Super high slippage or weirdly filled orders can happen! This is on the CEX side and is not something I can do anything about.

Color adjustments are available in the settings!

The Ultimate Alligator Calculator: Quick Guide

Calculator Inputs:

Entry Price

Input the price at which you enter the trade.

Stop Loss Price

Input the price at which you will exit the trade to limit losses.

Portfolio Size

Input the total size of your trading portfolio.

Desired Risk

Input the amount of risk you are willing to take.

CEX Settings:

Entry Fee (%)

Input the fee percentage for entering a trade.

Exit Fee (%)

Input the fee percentage for exiting a trade.

Minimum Position Size

Specify the smallest allowable position size.

Advanced Settings:

Leverage Buffer

Input a buffer value for leverage calculations.

Upside Deviation Allowed (%)

Set the maximum acceptable increase in risk as a percentage.

Downside Deviation Allowed (%)*

Set the maximum acceptable decrease in risk as a percentage.

Calculator Outputs:

Risk

Displays either the desired risk or adjusted risk based on the validity check.

This is your RISK and the one you input into your trading sheet!

Expected Loss

Displays the Final Expected Loss and it is the one you input into your trading sheet!

Position Size

Displays the Final Position Size and it is the one you input into your trading sheet!

Leverage

Determines the leverage needed if the notional value exceeds the portfolio size, ensuring sufficient leverage is maintained.

Notional Value

Computes the total value of the position based on the entry price.

Calculations:

Price Move

Calculates the price difference between the entry and stop-loss price.

Initial Fees

Computes the initial cost of entering and exiting a trade.

Initial Notional Values

Calculates the initial total value of the position based on entry price.

Initial Expected Loss

Estimates potential loss considering fees and price move.

Initial Position Size

Determines the size of the initial position based on expected loss and price move.

Adjusted Position Size

Rounds the initial position size to the nearest allowable size.

Adjusted Expected Loss

Recalculates potential loss based on the adjusted position size.

Adjusted Notional Value

Updates the total value of the position considering the adjusted size.

Adjusted Fees (USD)

Recomputes the fees based on the adjusted notional value.

Adjusted Risk

Calculates the total risk by adding adjusted expected loss and fees.

Valid Risk?

Verifies if the adjusted risk is within the allowed deviation limits of the desired risk.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。