INVITE-ONLY SCRIPT

TradeX Labs PriceAction

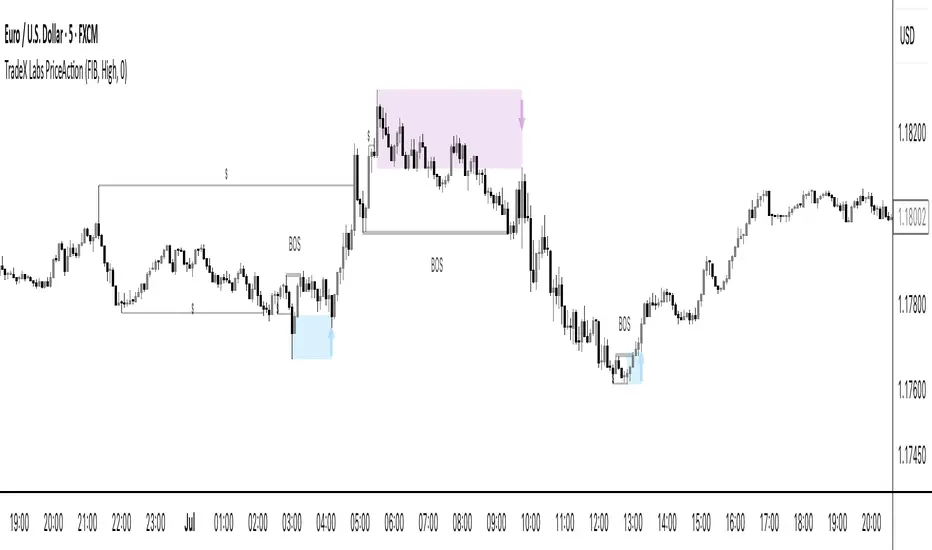

TradeX Labs Price Action — Multi-Layered Market Structure & Liquidity Visualizer

This invite-only script is a unified price-action framework for traders who want a clear, multi-timeframe visual map of structure, liquidity events, and execution zones. It is not a simple combination of existing tools — all modules are custom-built in-house and designed to work from a shared data model, ensuring every feature interacts seamlessly with the others.

Purpose & Core Design

The script’s foundation is a fractal-based swing engine that detects high-quality structural pivots. These pivots form the anchor points for:

BOS (Break of Structure) and structural shift detection

Liquidity sweep identification for stop hunts and inducements

Session range mapping (e.g., Asian high/low)

Rule-based zone projection using displacement and retracement logic

Rather than plotting isolated indicators, every detection method feeds into a single structure model so that BOS, liquidity events, and zones are all derived from the same underlying market map.

Zone Generation & Entry Mapping

Zones are calculated from swing-to-swing displacement legs and projected using Fibonacci presets (50 %, 61.8 %, 78.6 %). Users can select:

Calculation method: Fibonacci, Point of Interest (POI), or both

Zone frequency: High (wider), Medium (balanced), or Low (deeper) retracement levels

Extension length: Forward projection in bars to match chart timeframe

This ensures zones are consistent, structurally relevant, and adaptable to different styles.

Inducement & Liquidity Filters

For refined context, setups can be filtered by inducement type:

Minor: Sweeps of current day/session highs or lows

Medium: Sweeps of previous day’s highs/lows

Major: Sweeps of weekly highs/lows

Filters may run independently or in combination, hiding zones that lack interaction with key liquidity levels.

QuickStrikes Session Filter

QuickStrikes is an optional filter that checks BOS and/or entry levels against the Asian session high/low:

V1 (BOS validation): BOS position relative to session range

V2 (Entry validation): Entry zone position relative to session range

V3 (Combined): Both BOS and entry must meet positional criteria

Multiple modes can be active simultaneously, and all selected conditions must pass for a setup to display.

Custom Visuals & Usability

Every plotted element — zones, BOS labels, inducement levels, arrows, risk/reward boxes — can be styled to match any chart theme. The optional visual panel provides an at-a-glance risk-to-reward display.

Disclaimer

This is an original, closed-source TradeX Labs tool built entirely from proprietary logic referencing known concepts (e.g., Fibonacci ratios, session ranges, swing detection) within a rule-based framework. It produces visual analysis only and does not predict price or guarantee results. Default settings are for illustration; traders should adjust to their instrument and timeframe.

This invite-only script is a unified price-action framework for traders who want a clear, multi-timeframe visual map of structure, liquidity events, and execution zones. It is not a simple combination of existing tools — all modules are custom-built in-house and designed to work from a shared data model, ensuring every feature interacts seamlessly with the others.

Purpose & Core Design

The script’s foundation is a fractal-based swing engine that detects high-quality structural pivots. These pivots form the anchor points for:

BOS (Break of Structure) and structural shift detection

Liquidity sweep identification for stop hunts and inducements

Session range mapping (e.g., Asian high/low)

Rule-based zone projection using displacement and retracement logic

Rather than plotting isolated indicators, every detection method feeds into a single structure model so that BOS, liquidity events, and zones are all derived from the same underlying market map.

Zone Generation & Entry Mapping

Zones are calculated from swing-to-swing displacement legs and projected using Fibonacci presets (50 %, 61.8 %, 78.6 %). Users can select:

Calculation method: Fibonacci, Point of Interest (POI), or both

Zone frequency: High (wider), Medium (balanced), or Low (deeper) retracement levels

Extension length: Forward projection in bars to match chart timeframe

This ensures zones are consistent, structurally relevant, and adaptable to different styles.

Inducement & Liquidity Filters

For refined context, setups can be filtered by inducement type:

Minor: Sweeps of current day/session highs or lows

Medium: Sweeps of previous day’s highs/lows

Major: Sweeps of weekly highs/lows

Filters may run independently or in combination, hiding zones that lack interaction with key liquidity levels.

QuickStrikes Session Filter

QuickStrikes is an optional filter that checks BOS and/or entry levels against the Asian session high/low:

V1 (BOS validation): BOS position relative to session range

V2 (Entry validation): Entry zone position relative to session range

V3 (Combined): Both BOS and entry must meet positional criteria

Multiple modes can be active simultaneously, and all selected conditions must pass for a setup to display.

Custom Visuals & Usability

Every plotted element — zones, BOS labels, inducement levels, arrows, risk/reward boxes — can be styled to match any chart theme. The optional visual panel provides an at-a-glance risk-to-reward display.

Disclaimer

This is an original, closed-source TradeX Labs tool built entirely from proprietary logic referencing known concepts (e.g., Fibonacci ratios, session ranges, swing detection) within a rule-based framework. It produces visual analysis only and does not predict price or guarantee results. Default settings are for illustration; traders should adjust to their instrument and timeframe.

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系tradexictsmc。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

To request access, click TradingView’s “Request access to script” button on this page or visit tradexlabs.com for details.

All scripts and content from TradeX Labs are educational purposes only. Past performance does not guarantee future returns

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系tradexictsmc。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

To request access, click TradingView’s “Request access to script” button on this page or visit tradexlabs.com for details.

All scripts and content from TradeX Labs are educational purposes only. Past performance does not guarantee future returns

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。