PROTECTED SOURCE SCRIPT

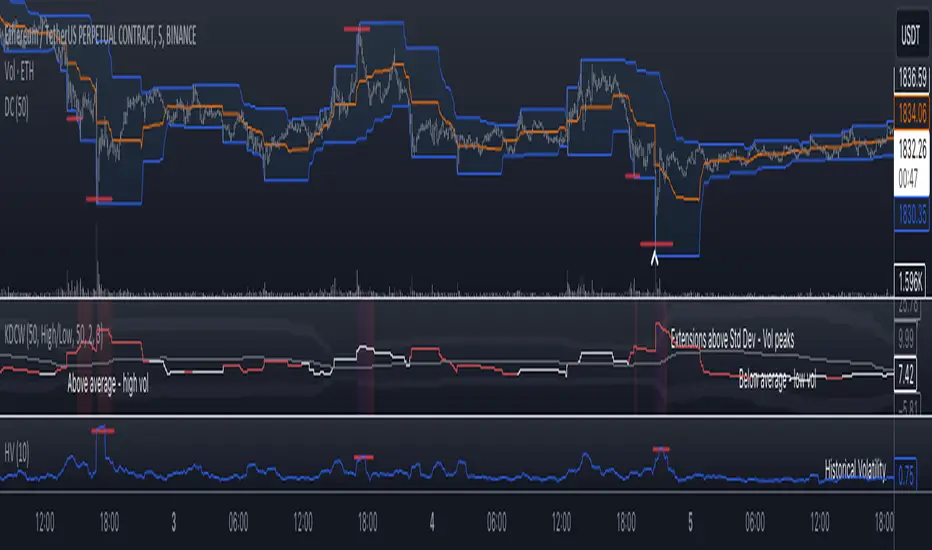

Koalafied Donchian Channel Width

Donchian Channel Width indicator with average channel width value and Standard Deviations shown.

Experimental gauge of volatility. Channel Width greater than average over lookback period shows higher levels of volatility, whereas channel width below average is correlated to low historical volatility. Extensions of width over user selected standard deviations show peaks in volatility.

Unique as average channel width is taken from array of value changes updating only when prior high/lows are breached instead of bar by bar like similar indicators.

Size of array (lookback) is user adjustable.

Experimental gauge of volatility. Channel Width greater than average over lookback period shows higher levels of volatility, whereas channel width below average is correlated to low historical volatility. Extensions of width over user selected standard deviations show peaks in volatility.

Unique as average channel width is taken from array of value changes updating only when prior high/lows are breached instead of bar by bar like similar indicators.

Size of array (lookback) is user adjustable.

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。