OPEN-SOURCE SCRIPT

London ORB + Session High/Low + FVG

London ORB + Session High/Low + FVG

📘 Script Description: London ORB + Session High/Low + Fair Value Gap

This script is designed to assist intraday traders during the London session open by combining:

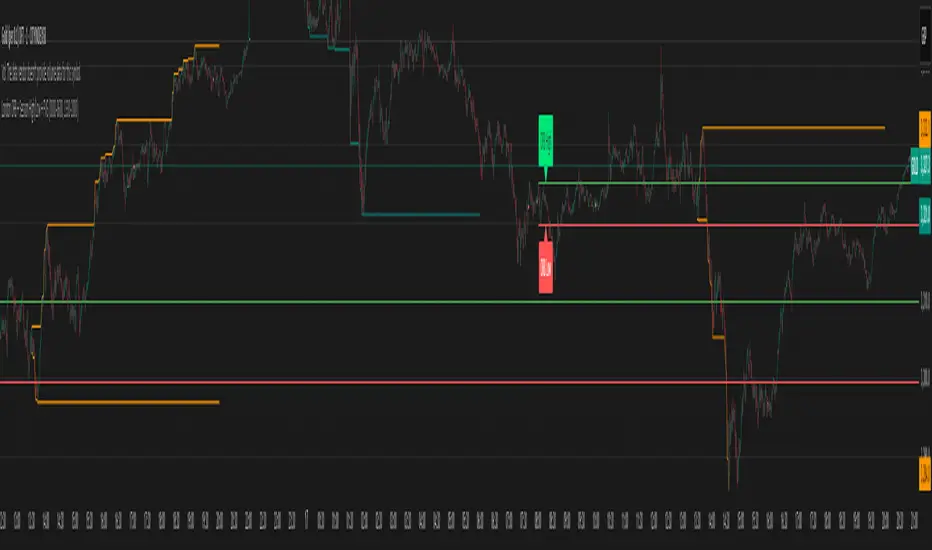

🕒 1. Opening Range Breakout (ORB)

Captures the high and low of the first 15-minute candle after the London open (08:00–08:15 GMT).

Draws lines and labels for the ORB High and Low levels.

Detects breakouts above or below the ORB and plots a triangle signal at the breakout bar.

🌐 2. Asian & US Session Levels

Automatically marks the highs and lows of the Asian (00:00–06:00 GMT) and US (13:30–20:00 GMT) sessions.

Useful for identifying prior session liquidity zones, key support/resistance levels, and potential reaction areas.

📉 3. Fair Value Gaps (FVG)

Highlights imbalances in price action between non-overlapping candles (also known as FVGs or inefficiencies).

Draws a shaded box between candles where gaps exist:

Green for bullish FVGs

Red for bearish FVGs

🔔 4. Alert Support

Optional alerts are built in for:

Long breakout (price breaks above ORB)

Short breakout (price breaks below ORB)

🎯 Use Case

Perfect for:

Day traders looking to capitalize on early volatility at the London open

Traders using liquidity-based strategies, retests, or gap-fills

Visualizing and aligning with prior session highs/lows for structure and context

📘 Script Description: London ORB + Session High/Low + Fair Value Gap

This script is designed to assist intraday traders during the London session open by combining:

🕒 1. Opening Range Breakout (ORB)

Captures the high and low of the first 15-minute candle after the London open (08:00–08:15 GMT).

Draws lines and labels for the ORB High and Low levels.

Detects breakouts above or below the ORB and plots a triangle signal at the breakout bar.

🌐 2. Asian & US Session Levels

Automatically marks the highs and lows of the Asian (00:00–06:00 GMT) and US (13:30–20:00 GMT) sessions.

Useful for identifying prior session liquidity zones, key support/resistance levels, and potential reaction areas.

📉 3. Fair Value Gaps (FVG)

Highlights imbalances in price action between non-overlapping candles (also known as FVGs or inefficiencies).

Draws a shaded box between candles where gaps exist:

Green for bullish FVGs

Red for bearish FVGs

🔔 4. Alert Support

Optional alerts are built in for:

Long breakout (price breaks above ORB)

Short breakout (price breaks below ORB)

🎯 Use Case

Perfect for:

Day traders looking to capitalize on early volatility at the London open

Traders using liquidity-based strategies, retests, or gap-fills

Visualizing and aligning with prior session highs/lows for structure and context

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。