OPEN-SOURCE SCRIPT

CPI Inflation Monitor (Change YoY & MoM)

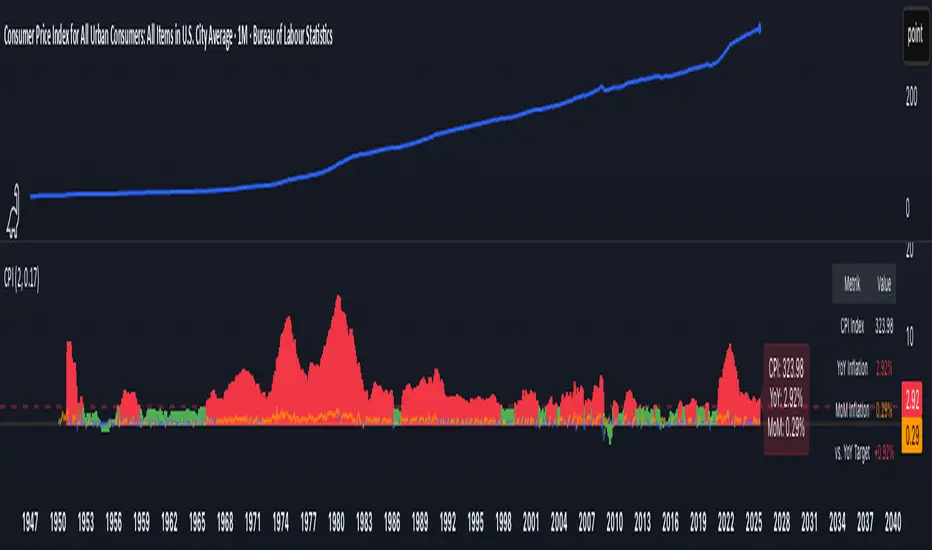

📊 CPI Inflation Monitor - Complete Macro Analysis Tool

This indicator provides a comprehensive view of Consumer Price Index (CPI) inflation trends, essential for understanding monetary policy, market conditions, and making informed trading decisions.

🎯 KEY FEATURES:

- Dual Perspective Analysis:

- Year-over-Year (YoY): Histogram bars showing annual inflation rate

- Month-over-Month (MoM): Line overlay showing monthly price changes

- Visual Reference System:

- Dashed line at 2% (Fed's official inflation target for YoY)

- Dotted line at 0.17% (equivalent monthly target for MoM)

- Color-coded bars: Red above target, Green below target

- Real-Time Data Table:

- Current CPI Index value

- YoY inflation rate with color coding

- MoM inflation rate with color coding

- Deviation from Fed target

- Automated Alerts:

- YoY crosses above/below 2% target

- MoM crosses above/below 0.17% target

- Perfect for staying informed without constant monitoring

📈 WHY THIS MATTERS FOR TRADERS:

CPI is the most widely reported inflation metric and directly influences:

- Federal Reserve interest rate decisions

- Bond yields and currency valuations

- Stock market sentiment (especially growth vs. value rotation)

- Cryptocurrency and risk asset performance

Rising inflation (red bars) typically leads to:

→ Higher interest rates → Negative for growth stocks, crypto

→ Stronger USD → Pressure on commodities

Falling inflation (green bars) typically leads to:

→ Rate cut expectations → Positive for growth stocks, crypto

→ Weaker USD → Support for commodities

🔍 HOW TO USE:

1. Strategic Positioning: Use YoY trend (thick bars) for long-term asset allocation

2. Tactical Timing: Use MoM trend (thin line) to identify turning points early

3. Divergence Trading: When MoM falls but YoY remains high, anticipate trend reversal

4. Fed Policy Prediction: Distance from 2% target indicates Fed's likely hawkishness

💡 PRO TIPS:

- Multiple months of MoM above 0.3% = Accelerating inflation → Fed turns hawkish

- MoM turning negative while YoY still elevated = Peak inflation → Position for pivot

- Compare with PPI and PCE indicators for complete inflation picture

- Use alerts to catch important threshold crossings automatically

📊 DATA SOURCE:

Official CPI data from FRED (Federal Reserve Economic Data), updated monthly mid-month when new data releases occur.

🎨 CUSTOMIZATION:

Fully customizable through settings:

- Toggle YoY/MoM displays

- Adjust target levels

- Customize colors for visual preference

- Show/hide absolute CPI values

Perfect for: Macro traders, swing traders, long-term investors, and anyone wanting to understand the inflation environment affecting their portfolio.

Note: This indicator works on any chart timeframe as it loads external monthly economic data.

This indicator provides a comprehensive view of Consumer Price Index (CPI) inflation trends, essential for understanding monetary policy, market conditions, and making informed trading decisions.

🎯 KEY FEATURES:

- Dual Perspective Analysis:

- Year-over-Year (YoY): Histogram bars showing annual inflation rate

- Month-over-Month (MoM): Line overlay showing monthly price changes

- Visual Reference System:

- Dashed line at 2% (Fed's official inflation target for YoY)

- Dotted line at 0.17% (equivalent monthly target for MoM)

- Color-coded bars: Red above target, Green below target

- Real-Time Data Table:

- Current CPI Index value

- YoY inflation rate with color coding

- MoM inflation rate with color coding

- Deviation from Fed target

- Automated Alerts:

- YoY crosses above/below 2% target

- MoM crosses above/below 0.17% target

- Perfect for staying informed without constant monitoring

📈 WHY THIS MATTERS FOR TRADERS:

CPI is the most widely reported inflation metric and directly influences:

- Federal Reserve interest rate decisions

- Bond yields and currency valuations

- Stock market sentiment (especially growth vs. value rotation)

- Cryptocurrency and risk asset performance

Rising inflation (red bars) typically leads to:

→ Higher interest rates → Negative for growth stocks, crypto

→ Stronger USD → Pressure on commodities

Falling inflation (green bars) typically leads to:

→ Rate cut expectations → Positive for growth stocks, crypto

→ Weaker USD → Support for commodities

🔍 HOW TO USE:

1. Strategic Positioning: Use YoY trend (thick bars) for long-term asset allocation

2. Tactical Timing: Use MoM trend (thin line) to identify turning points early

3. Divergence Trading: When MoM falls but YoY remains high, anticipate trend reversal

4. Fed Policy Prediction: Distance from 2% target indicates Fed's likely hawkishness

💡 PRO TIPS:

- Multiple months of MoM above 0.3% = Accelerating inflation → Fed turns hawkish

- MoM turning negative while YoY still elevated = Peak inflation → Position for pivot

- Compare with PPI and PCE indicators for complete inflation picture

- Use alerts to catch important threshold crossings automatically

📊 DATA SOURCE:

Official CPI data from FRED (Federal Reserve Economic Data), updated monthly mid-month when new data releases occur.

🎨 CUSTOMIZATION:

Fully customizable through settings:

- Toggle YoY/MoM displays

- Adjust target levels

- Customize colors for visual preference

- Show/hide absolute CPI values

Perfect for: Macro traders, swing traders, long-term investors, and anyone wanting to understand the inflation environment affecting their portfolio.

Note: This indicator works on any chart timeframe as it loads external monthly economic data.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。