OPEN-SOURCE SCRIPT

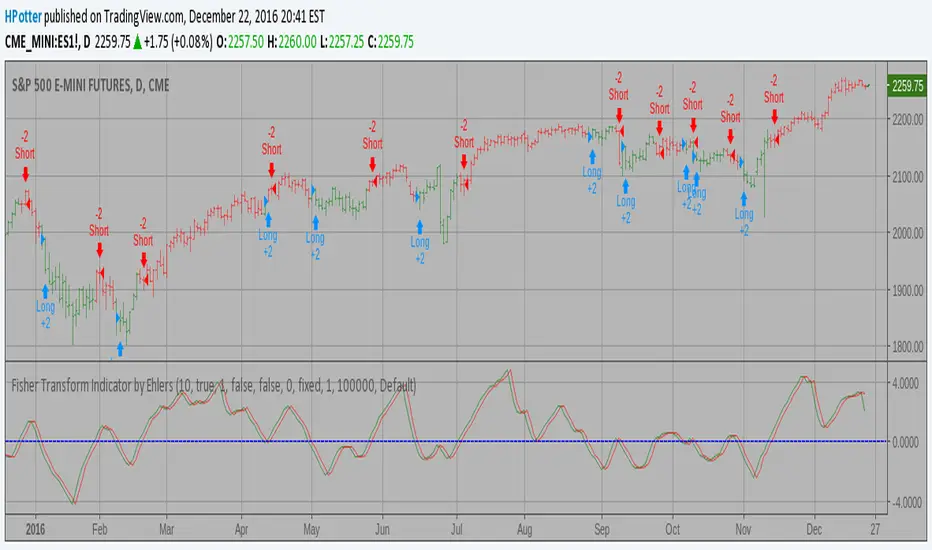

Fisher Transform Indicator by Ehlers Backtest v 2.0

Market prices do not have a Gaussian probability density function

as many traders think. Their probability curve is not bell-shaped.

But trader can create a nearly Gaussian PDF for prices by normalizing

them or creating a normalized indicator such as the relative strength

index and applying the Fisher transform. Such a transformed output

creates the peak swings as relatively rare events.

Fisher transform formula is: y = 0.5 * ln ((1+x)/(1-x))

The sharp turning points of these peak swings clearly and unambiguously

identify price reversals in a timely manner.

For signal used zero.

You can change long to short in the Input Settings

Please, use it only for learning or paper trading. Do not for real trading.

as many traders think. Their probability curve is not bell-shaped.

But trader can create a nearly Gaussian PDF for prices by normalizing

them or creating a normalized indicator such as the relative strength

index and applying the Fisher transform. Such a transformed output

creates the peak swings as relatively rare events.

Fisher transform formula is: y = 0.5 * ln ((1+x)/(1-x))

The sharp turning points of these peak swings clearly and unambiguously

identify price reversals in a timely manner.

For signal used zero.

You can change long to short in the Input Settings

Please, use it only for learning or paper trading. Do not for real trading.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。