PROTECTED SOURCE SCRIPT

已更新 PDH/PDL + Alerts + Liquidity Sweep Reversal

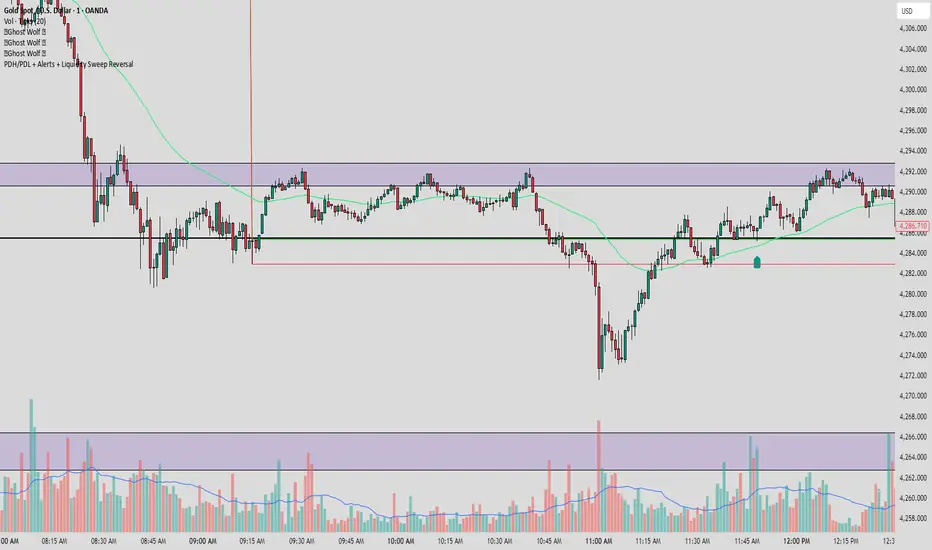

This indicator is designed for traders who utilize Price Action to identify high-probability reversal zones at daily liquidity levels. It automatically plots the Previous Day High (PDH) and Previous Day Low (PDL) and monitors them for institutional "fake-outs" or liquidity sweeps.

Core Functionality

Daily Liquidity Levels: Automatically fetches and plots the PDH and PDL with custom labels and line styles.

Strict Reversal Logic: Unlike standard breakout indicators, this script looks for specific "trap" behavior where price pierces a level and is immediately rejected.

Institutional Precision Tooltips: Includes built-in precision guides for Wick Percentages and Lookback counts based on professional trading standards.

The "Strict Reversal" Setup

The indicator only triggers a Buy/Sell label when three specific criteria are met:

The Lookback: The level must have been respected as a boundary for a user-defined number of candles (Default: 7), confirming its strength.

The Sequence: The candle must open on the "safe" side of the level, pierce through it to grab liquidity, and then close back on the original side.

The Rejection (Wick %): The candle must leave a significant wick (Default: 72%). This 72% threshold aligns with the 2.5x Wick-to-Body ratio, signaling a violent institutional rejection.

Alert Options

The script features four consolidated alert conditions for seamless automation:

Sell Signal (Rejection): Triggers on strict bearish wick sweeps at key levels.

Buy Signal (Rejection): Triggers on strict bullish wick sweeps at key levels.

Price Cross Up: Alerts when price breaks above either PDH or PDL.

Price Cross Down: Alerts when price breaks below either PDH or PDL.

How to Use

Scalping: Use a 3–5 candle lookback on the 1m or 5m timeframe.

Intraday Reversals: Use the 7–10 candle lookback on the 5m or 15m timeframe for standard SMC setups.

Swing Trading: Use the 15+ candle lookback on the 1h or 4h timeframe to target major daily liquidity pools.

Core Functionality

Daily Liquidity Levels: Automatically fetches and plots the PDH and PDL with custom labels and line styles.

Strict Reversal Logic: Unlike standard breakout indicators, this script looks for specific "trap" behavior where price pierces a level and is immediately rejected.

Institutional Precision Tooltips: Includes built-in precision guides for Wick Percentages and Lookback counts based on professional trading standards.

The "Strict Reversal" Setup

The indicator only triggers a Buy/Sell label when three specific criteria are met:

The Lookback: The level must have been respected as a boundary for a user-defined number of candles (Default: 7), confirming its strength.

The Sequence: The candle must open on the "safe" side of the level, pierce through it to grab liquidity, and then close back on the original side.

The Rejection (Wick %): The candle must leave a significant wick (Default: 72%). This 72% threshold aligns with the 2.5x Wick-to-Body ratio, signaling a violent institutional rejection.

Alert Options

The script features four consolidated alert conditions for seamless automation:

Sell Signal (Rejection): Triggers on strict bearish wick sweeps at key levels.

Buy Signal (Rejection): Triggers on strict bullish wick sweeps at key levels.

Price Cross Up: Alerts when price breaks above either PDH or PDL.

Price Cross Down: Alerts when price breaks below either PDH or PDL.

How to Use

Scalping: Use a 3–5 candle lookback on the 1m or 5m timeframe.

Intraday Reversals: Use the 7–10 candle lookback on the 5m or 15m timeframe for standard SMC setups.

Swing Trading: Use the 15+ candle lookback on the 1h or 4h timeframe to target major daily liquidity pools.

版本注释

This indicator is designed for traders who utilize Price Action to identify high-probability reversal zones at daily liquidity levels. It automatically plots the Previous Day High (PDH) and Previous Day Low (PDL) and monitors them for institutional "fake-outs" or liquidity sweeps.Core Functionality

Daily Liquidity Levels: Automatically fetches and plots the PDH and PDL with custom labels and line styles.

Strict Reversal Logic: Unlike standard breakout indicators, this script looks for specific "trap" behavior where price pierces a level and is immediately rejected.

Institutional Precision Tooltips: Includes built-in precision guides for Wick Percentages and Lookback counts based on professional trading standards.

The "Strict Reversal" Setup

The indicator only triggers a Buy/Sell label when three specific criteria are met:

The Lookback: The level must have been respected as a boundary for a user-defined number of candles (Default: 7), confirming its strength.

The Sequence: The candle must open on the "safe" side of the level, pierce through it to grab liquidity, and then close back on the original side.

The Rejection (Wick %): The candle must leave a significant wick (Default: 72%). This 72% threshold aligns with the 2.5x Wick-to-Body ratio, signaling a violent institutional rejection.

Alert Options

The script features four consolidated alert conditions for seamless automation:

Sell Signal (Rejection): Triggers on strict bearish wick sweeps at key levels.

Buy Signal (Rejection): Triggers on strict bullish wick sweeps at key levels.

Price Cross Up: Alerts when price breaks above either PDH or PDL.

Price Cross Down: Alerts when price breaks below either PDH or PDL.

How to Use

Scalping: Use a 3–5 candle lookback on the 1m or 5m timeframe.

Intraday Reversals: Use the 7–10 candle lookback on the 5m or 15m timeframe for standard SMC setups.

Swing Trading: Use the 15+ candle lookback on the 1h or 4h timeframe to target major daily liquidity pools.

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。