OPEN-SOURCE SCRIPT

FCBI Brake Pressure

Brake Pressure (FCBI − USIRYY)

Concept

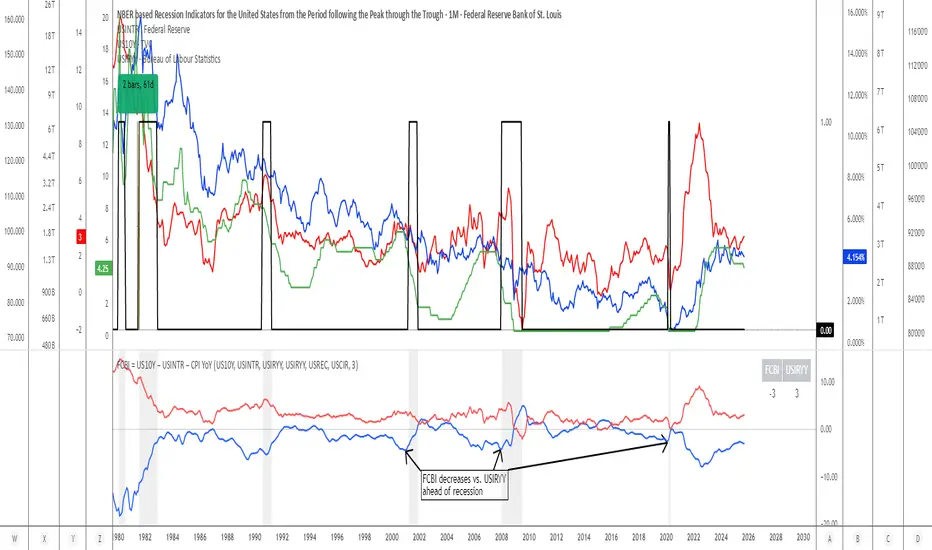

The Brake Pressure indicator quantifies whether the bond market is braking or releasing liquidity relative to real yields (USIRYY).

It is derived from the Financial-Conditions Brake Index (FCBI) and expresses the balance between long-term yield pressure and real-rate dynamics.

Formula

Brake Pressure = FCBI − USIRYY

where FCBI = (US10Y) − (USINTR) − (CPI YoY)

Purpose

While FCBI measures the intensity of financial-condition pressure, Brake Pressure shows when that brake is being applied or released.

It captures the turning point of liquidity transmission in the financial system.

How to Read

Brake Pressure < 0 (orange) → Brake engaged → financial conditions tighter than real-rate baseline; liquidity constrained.

Brake Pressure ≈ 0 → Neutral zone → transition phase between tightening and easing.

Brake Pressure > 0 (teal) → Brake released → financial conditions looser than real-rate baseline; liquidity flows freely → late-cycle setup before recession.

Zero-Cross Logic

Cross ↑ above 0 → FCBI > USIRYY → brake released → liquidity acceleration → typically 6–18 months before recession.

Cross ↓ below 0 → FCBI < USIRYY → brake re-engaged → tightening resumes.

Historical Behavior

Each major U.S. recession (2001, 2008, 2020) was preceded by a Brake Pressure cross above zero after a negative phase, signaling that long yields had stopped resisting Fed cuts and liquidity was expanding.

Practical Use

• Identify late-cycle turning points and liquidity inflection phases.

• Combine with FCBI for a complete macro transmission picture.

• Watch for sustained positive readings as early macro-recession warnings.

Current Example (Oct 2025)

FCBI ≈ −3.1, USIRYY ≈ +3.0 → Brake Pressure ≈ −6.1 → Brake still engaged. When this crosses above 0, it signals that liquidity is free flowing and the recession countdown has begun.

Summary

FCBI shows how tight the brake is. Brake Pressure shows when the brake releases.

When Brake Pressure > 0, the system has entered the liquidity-expansion phase that historically precedes a U.S. recession.

Concept

The Brake Pressure indicator quantifies whether the bond market is braking or releasing liquidity relative to real yields (USIRYY).

It is derived from the Financial-Conditions Brake Index (FCBI) and expresses the balance between long-term yield pressure and real-rate dynamics.

Formula

Brake Pressure = FCBI − USIRYY

where FCBI = (US10Y) − (USINTR) − (CPI YoY)

Purpose

While FCBI measures the intensity of financial-condition pressure, Brake Pressure shows when that brake is being applied or released.

It captures the turning point of liquidity transmission in the financial system.

How to Read

Brake Pressure < 0 (orange) → Brake engaged → financial conditions tighter than real-rate baseline; liquidity constrained.

Brake Pressure ≈ 0 → Neutral zone → transition phase between tightening and easing.

Brake Pressure > 0 (teal) → Brake released → financial conditions looser than real-rate baseline; liquidity flows freely → late-cycle setup before recession.

Zero-Cross Logic

Cross ↑ above 0 → FCBI > USIRYY → brake released → liquidity acceleration → typically 6–18 months before recession.

Cross ↓ below 0 → FCBI < USIRYY → brake re-engaged → tightening resumes.

Historical Behavior

Each major U.S. recession (2001, 2008, 2020) was preceded by a Brake Pressure cross above zero after a negative phase, signaling that long yields had stopped resisting Fed cuts and liquidity was expanding.

Practical Use

• Identify late-cycle turning points and liquidity inflection phases.

• Combine with FCBI for a complete macro transmission picture.

• Watch for sustained positive readings as early macro-recession warnings.

Current Example (Oct 2025)

FCBI ≈ −3.1, USIRYY ≈ +3.0 → Brake Pressure ≈ −6.1 → Brake still engaged. When this crosses above 0, it signals that liquidity is free flowing and the recession countdown has begun.

Summary

FCBI shows how tight the brake is. Brake Pressure shows when the brake releases.

When Brake Pressure > 0, the system has entered the liquidity-expansion phase that historically precedes a U.S. recession.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。