OPEN-SOURCE SCRIPT

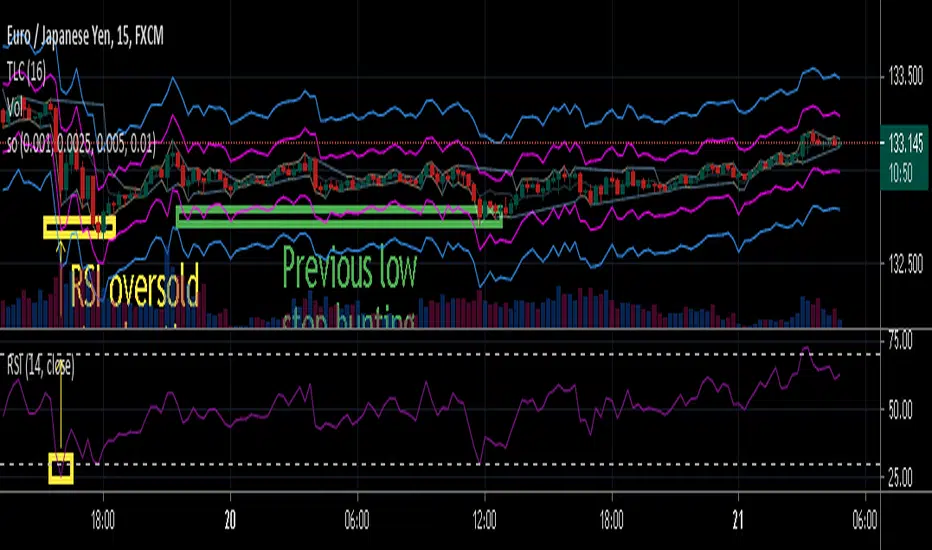

stop out or margin call price levels

Abstract

This script finds the potential stop out or margin call price levels without considering timeframe.

This script computes stop out or margin call price levels that over leveraged positions buy cheap enough.

You can use this indicator to follow stop hunters.

Introduction

Stop hunting exists because of benefit conflict.

When most of retails traders are in the correct direction, big banks do not want to buy more expensive then retail traders.

Therefore, Big banks create sell pressure to make retail traders misunderstand their trade decisions are wrong.

When retail traders decide to cut loss, it is time big banks buy cheaper.

Many courses recommend average true range as a stop loss reference.

However, in different timeframe, average true ranges are different.

Therefore, we need to have a method to measure potential stop hunting levels which is not relative to timeframe.

There is a method because there are observable levels where over leveraged positions must cut loss.

For example, for a 100 leverage position, its margin call level is 0.005, so 0.005 drawdown is a potential stop hunting level.

Computing

For buy

potential stop out or margin call price level = low * ( 1 - ratio )

For sell

potential stop out or margin call price level = high * ( 1 + ratio )

Parameters

There are 4 levels available for adjusting.

The default values are :

(1) 0.001 : 500 leverage , 50% margin call

(2) 0.0025 : 200 leverage , 50% margin call

(3) 0.005 : 100 leverage , 50% margin call

(4) 0.010 : 50 leverage , 50% margin call

Usage

(1) Find an oversold price level. If you don't want to use an another indicator, you can use previous low.

(2) Memorize their stop out or margin call price levels of that level.

(2) Consider buy near those levels.

(3) If there are quick price rejection near those levels, better entry opportunities.

(4) Take profit and stop loss : you decide.

Conclusion

This script can find potential stop out or margin call price levels that over leveraged positions buy cheap enough.

If you are bored, you can consider find 100 signals you are interested in and share your observation.

Reference

Brokers, leverage and margin call threshold

This script finds the potential stop out or margin call price levels without considering timeframe.

This script computes stop out or margin call price levels that over leveraged positions buy cheap enough.

You can use this indicator to follow stop hunters.

Introduction

Stop hunting exists because of benefit conflict.

When most of retails traders are in the correct direction, big banks do not want to buy more expensive then retail traders.

Therefore, Big banks create sell pressure to make retail traders misunderstand their trade decisions are wrong.

When retail traders decide to cut loss, it is time big banks buy cheaper.

Many courses recommend average true range as a stop loss reference.

However, in different timeframe, average true ranges are different.

Therefore, we need to have a method to measure potential stop hunting levels which is not relative to timeframe.

There is a method because there are observable levels where over leveraged positions must cut loss.

For example, for a 100 leverage position, its margin call level is 0.005, so 0.005 drawdown is a potential stop hunting level.

Computing

For buy

potential stop out or margin call price level = low * ( 1 - ratio )

For sell

potential stop out or margin call price level = high * ( 1 + ratio )

Parameters

There are 4 levels available for adjusting.

The default values are :

(1) 0.001 : 500 leverage , 50% margin call

(2) 0.0025 : 200 leverage , 50% margin call

(3) 0.005 : 100 leverage , 50% margin call

(4) 0.010 : 50 leverage , 50% margin call

Usage

(1) Find an oversold price level. If you don't want to use an another indicator, you can use previous low.

(2) Memorize their stop out or margin call price levels of that level.

(2) Consider buy near those levels.

(3) If there are quick price rejection near those levels, better entry opportunities.

(4) Take profit and stop loss : you decide.

Conclusion

This script can find potential stop out or margin call price levels that over leveraged positions buy cheap enough.

If you are bored, you can consider find 100 signals you are interested in and share your observation.

Reference

Brokers, leverage and margin call threshold

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。