PROTECTED SOURCE SCRIPT

volume.riiin

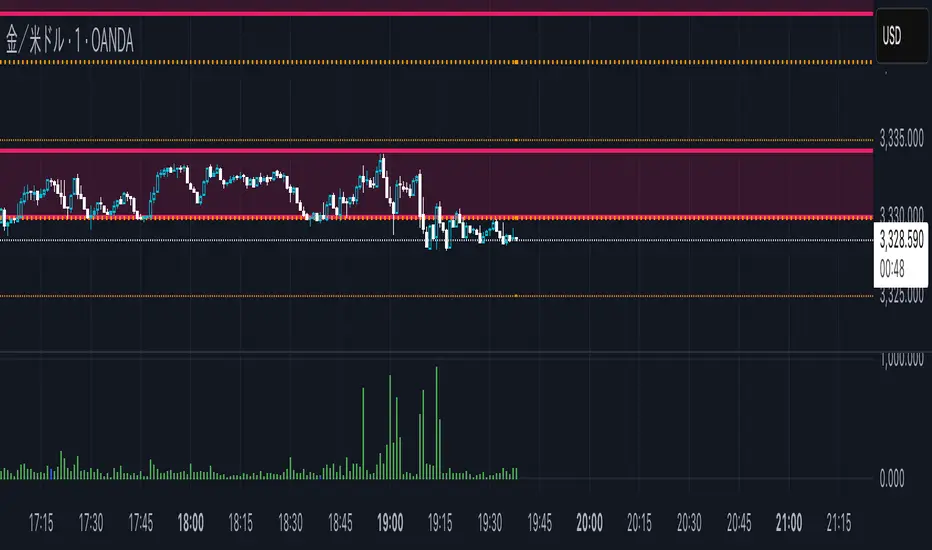

Futures Volume – Real Institutional Activity Insight

This indicator visualizes futures market volume, which reflects the actual number of contracts traded on centralized exchanges like CME. Unlike spot volume (often broker-specific or tick-based), futures volume shows true institutional participation and market conviction.

Key Features:

📈 Reliable Volume Data from real futures markets (e.g., CME Gold, Crude Oil, S&P 500)

🔍 Anticipate Trend Reversals by spotting sudden volume spikes

💥 Confirm Breakouts: Price moves with volume = higher reliability

🧠 Identify Key Battle Zones: High volume price levels often become strong support/resistance

🔗 Can be combined with spot chart for better decision-making

Why Use Futures Volume?

Futures volume often acts as a leading indicator, revealing shifts in market sentiment before price follows. For assets like XAUUSD (Gold), tracking the futures market can give you a real edge, especially when spotting fakeouts or validating big moves.

Let volume tell the real story behind the chart.

Use this indicator to trade with the institutions, not against them.

This indicator visualizes futures market volume, which reflects the actual number of contracts traded on centralized exchanges like CME. Unlike spot volume (often broker-specific or tick-based), futures volume shows true institutional participation and market conviction.

Key Features:

📈 Reliable Volume Data from real futures markets (e.g., CME Gold, Crude Oil, S&P 500)

🔍 Anticipate Trend Reversals by spotting sudden volume spikes

💥 Confirm Breakouts: Price moves with volume = higher reliability

🧠 Identify Key Battle Zones: High volume price levels often become strong support/resistance

🔗 Can be combined with spot chart for better decision-making

Why Use Futures Volume?

Futures volume often acts as a leading indicator, revealing shifts in market sentiment before price follows. For assets like XAUUSD (Gold), tracking the futures market can give you a real edge, especially when spotting fakeouts or validating big moves.

Let volume tell the real story behind the chart.

Use this indicator to trade with the institutions, not against them.

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。