OPEN-SOURCE SCRIPT

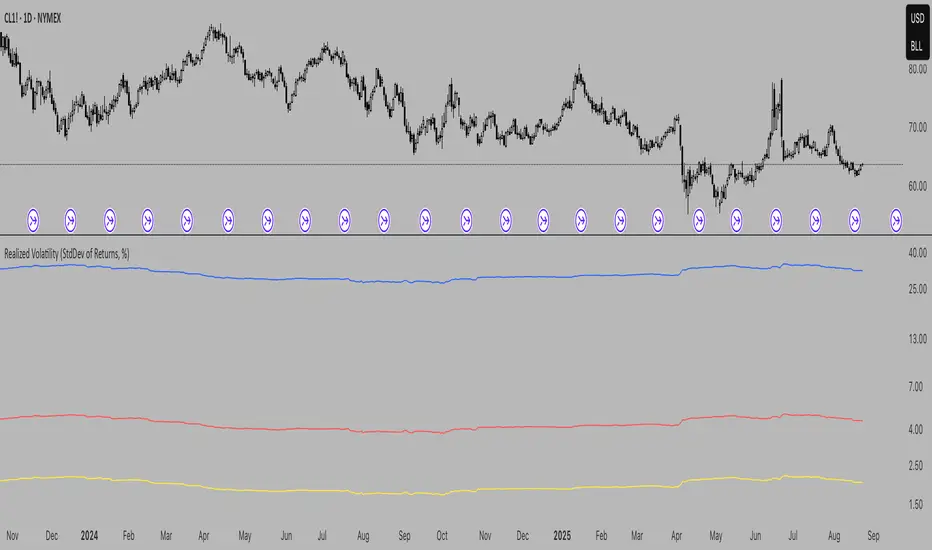

Realized Volatility (StdDev of Returns, %)

Realized Volatility (StdDev of Returns, %)

This indicator measures realized (historical) volatility by calculating the standard deviation of log returns over a user-defined lookback period. It helps traders and analysts observe how much the price has varied in the past, expressed as a percentage.

How it works:

Provides three volatility measures:

Inputs:

Notes:

This indicator measures realized (historical) volatility by calculating the standard deviation of log returns over a user-defined lookback period. It helps traders and analysts observe how much the price has varied in the past, expressed as a percentage.

How it works:

- Computes close-to-close logarithmic returns.

- Calculates the standard deviation of these returns over the selected lookback window.

Provides three volatility measures:

- Daily Volatility (%): Standard deviation over the chosen period.

- Annualized Volatility (%): Scaled using the square root of the number of trading days per year (default = 250).

- Horizon Volatility (%): Scaled to a custom horizon (default = 5 days, useful for short-term views).

Inputs:

- Lookback Period: Number of bars used for volatility calculation.

- Trading Days per Year: Used for annualizing volatility.

- Horizon (days): Adjusts volatility to a shorter or longer time frame.

Notes:

- This is a statistical measure of past volatility, not a forecasting tool.

- If you change the scale to logarithmic, the indicator readibility improves.

- It should be used for analysis in combination with other tools and not as a standalone signal.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。