OPEN-SOURCE SCRIPT

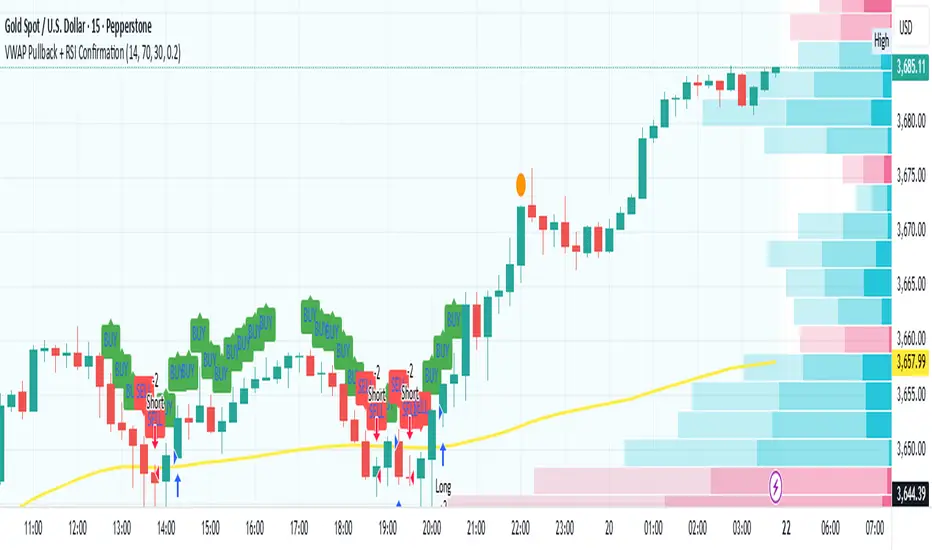

VWAP Pullback + RSI Confirmation

This strategy focuses on trend continuation entries. Instead of betting on reversions, it looks for opportunities when price pulls back to VWAP but the dominant trend remains intact.

Trend Bias:

Price above VWAP = bullish environment → look for BUY pullbacks.

Price below VWAP = bearish environment → look for SELL pullbacks.

Entry Logic:

BUY: Price pulls back near VWAP, RSI stays above oversold (momentum intact).

SELL: Price pulls back near VWAP, RSI stays below overbought (momentum intact).

Exit Rule:

Stop-loss just below/above VWAP.

Take-profit at 1.5–2x risk (default script uses ~2%).

Best Timeframes:

15m–1H → good for intraday trend-following setups.

Daily → captures stronger, longer trends.

⚡ This strategy is powerful in trending markets because VWAP acts as a "magnet" for pullbacks, while RSI prevents overbought/oversold traps.

Trend Bias:

Price above VWAP = bullish environment → look for BUY pullbacks.

Price below VWAP = bearish environment → look for SELL pullbacks.

Entry Logic:

BUY: Price pulls back near VWAP, RSI stays above oversold (momentum intact).

SELL: Price pulls back near VWAP, RSI stays below overbought (momentum intact).

Exit Rule:

Stop-loss just below/above VWAP.

Take-profit at 1.5–2x risk (default script uses ~2%).

Best Timeframes:

15m–1H → good for intraday trend-following setups.

Daily → captures stronger, longer trends.

⚡ This strategy is powerful in trending markets because VWAP acts as a "magnet" for pullbacks, while RSI prevents overbought/oversold traps.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。