INVITE-ONLY SCRIPT

已更新 SPX ORB 60m → 0DTE Credit Spreads (Signals & Webhooks)

SPX ORB 60m → 0DTE Credit Spreads (Signals & Webhooks)

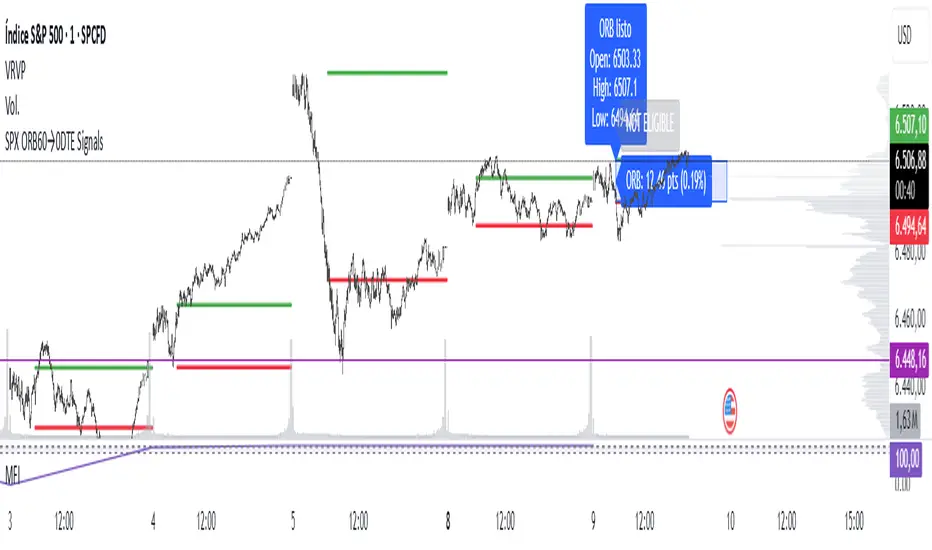

This indicator implements a 60-minute Opening Range Breakout (ORB) workflow for SPX and maps the first breakout during a monitoring window to a same-day options credit-spread idea. It’s signal-only (no backtesting) and includes both visual planning tools and automation hooks (webhooks/alerts).

How it works

ORB window: 09:30–10:30 New York. The script builds ORB High/Low and fixes them at 10:30.

Monitoring window: 10:31–12:00 New York.

The first wick break picks direction:

Break above ORB High → bullish bias → PUT credit spread idea (short strike below ORB Low − offset).

Break below ORB Low → bearish bias → CALL credit spread idea (short strike above ORB High + offset).

One signal per day. The bar is tagged “Fired PUT/CALL”.

Key inputs

Spread width ($), strike step ($), and independent short-strike offsets for PUT/CALL.

Eligibility thresholds by % of 09:30 open or points (separate minima for PUT vs CALL), plus an “ignore thresholds” test mode.

Day-of-week filters per side.

Preview before fire: show gray dotted “hypothetical” strikes only when eligible (or always), or hide until the actual trigger.

If the chosen side is blocked by weekday filter, you can still display it disabled (gray).

Visuals

ORB Rectangle: from 10:30 to 16:00 NY spanning ORB High/Low; updates intraday and then stays fixed. Optional label shows the range in pts and %.

Executed lines & labels: customizable style and width; colorized after the first trigger.

“NOT ELIGIBLE” gray label (optional) when thresholds/day filters are not met.

Outcome tag at session close (informational): WIN/LOSE relative to the short strike.

ORB High/Low plotted with plot.style_linebr for clean session edges.

Probability box (informational)

Optional box displayed at the breakout with a 0–100% composite score from:

ORB/ATR size (capped),

ADX (Wilder calculation inside the script),

ATR regime vs a long SMA baseline.

All lengths, caps, weights, colors and opacity are configurable, including a time offset to place the box.

Automation

Two backends supported: DigitalOcean server.js or SignalStack (Tastytrade).

Optional limit_price per leg and time_in_force (day/gtc) for SignalStack.

Alertconditions provided for PUT / CALL signals so you can create alerts from the TradingView dialog.

Additionally, the script can emit alert() payloads on trigger (enable in settings) to drive your webhook.

Notes

Designed for intraday NY session; 1–15m charts are typical.

Signals are for automation/planning, not recommendations. Validate risk, fills, and routing.

Disclaimer

For educational/informational purposes only. Not financial advice. Options trading involves substantial risk.

This indicator implements a 60-minute Opening Range Breakout (ORB) workflow for SPX and maps the first breakout during a monitoring window to a same-day options credit-spread idea. It’s signal-only (no backtesting) and includes both visual planning tools and automation hooks (webhooks/alerts).

How it works

ORB window: 09:30–10:30 New York. The script builds ORB High/Low and fixes them at 10:30.

Monitoring window: 10:31–12:00 New York.

The first wick break picks direction:

Break above ORB High → bullish bias → PUT credit spread idea (short strike below ORB Low − offset).

Break below ORB Low → bearish bias → CALL credit spread idea (short strike above ORB High + offset).

One signal per day. The bar is tagged “Fired PUT/CALL”.

Key inputs

Spread width ($), strike step ($), and independent short-strike offsets for PUT/CALL.

Eligibility thresholds by % of 09:30 open or points (separate minima for PUT vs CALL), plus an “ignore thresholds” test mode.

Day-of-week filters per side.

Preview before fire: show gray dotted “hypothetical” strikes only when eligible (or always), or hide until the actual trigger.

If the chosen side is blocked by weekday filter, you can still display it disabled (gray).

Visuals

ORB Rectangle: from 10:30 to 16:00 NY spanning ORB High/Low; updates intraday and then stays fixed. Optional label shows the range in pts and %.

Executed lines & labels: customizable style and width; colorized after the first trigger.

“NOT ELIGIBLE” gray label (optional) when thresholds/day filters are not met.

Outcome tag at session close (informational): WIN/LOSE relative to the short strike.

ORB High/Low plotted with plot.style_linebr for clean session edges.

Probability box (informational)

Optional box displayed at the breakout with a 0–100% composite score from:

ORB/ATR size (capped),

ADX (Wilder calculation inside the script),

ATR regime vs a long SMA baseline.

All lengths, caps, weights, colors and opacity are configurable, including a time offset to place the box.

Automation

Two backends supported: DigitalOcean server.js or SignalStack (Tastytrade).

Optional limit_price per leg and time_in_force (day/gtc) for SignalStack.

Alertconditions provided for PUT / CALL signals so you can create alerts from the TradingView dialog.

Additionally, the script can emit alert() payloads on trigger (enable in settings) to drive your webhook.

Notes

Designed for intraday NY session; 1–15m charts are typical.

Signals are for automation/planning, not recommendations. Validate risk, fills, and routing.

Disclaimer

For educational/informational purposes only. Not financial advice. Options trading involves substantial risk.

仅限邀请脚本

只有经作者批准的用户才能访问此脚本。您需要申请并获得使用权限。该权限通常在付款后授予。如需了解更多详情,请按照以下作者的说明操作,或直接联系mauricio_a_morales。

除非您完全信任其作者并了解脚本的工作原理,否則TradingView不建议您付费或使用脚本。您还可以在我们的社区脚本中找到免费的开源替代方案。

作者的说明

Just DM for access request

提醒:在请求访问权限之前,请阅读仅限邀请脚本指南。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

仅限邀请脚本

只有经作者批准的用户才能访问此脚本。您需要申请并获得使用权限。该权限通常在付款后授予。如需了解更多详情,请按照以下作者的说明操作,或直接联系mauricio_a_morales。

除非您完全信任其作者并了解脚本的工作原理,否則TradingView不建议您付费或使用脚本。您还可以在我们的社区脚本中找到免费的开源替代方案。

作者的说明

Just DM for access request

提醒:在请求访问权限之前,请阅读仅限邀请脚本指南。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。