INVITE-ONLY SCRIPT

已更新 RSI-2

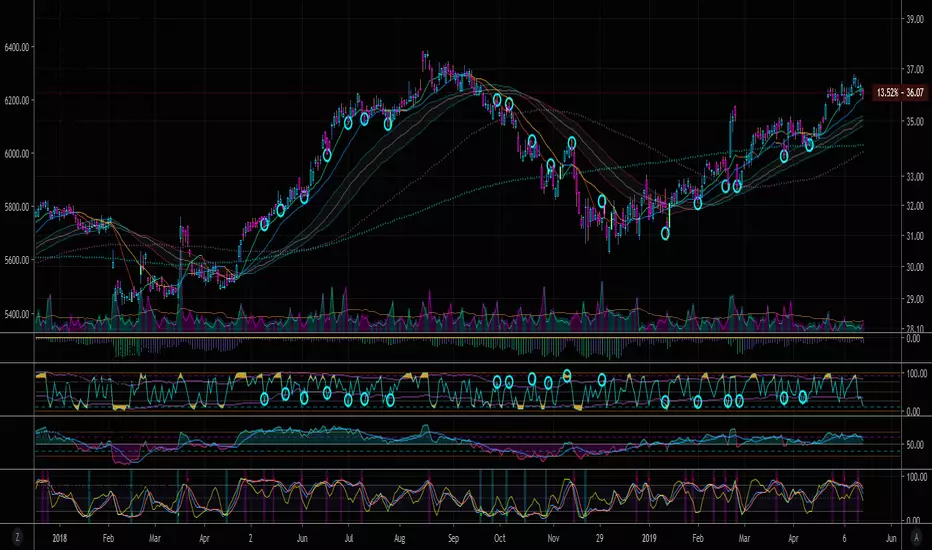

RSI-2 is an RSI indicator based on 2 periods.

It is used to locate pull back points within a major trend.

These points will generally offer the best risk/reward entry areas.

OB is >90

OS is <10

In an uptrend, long, when RSI-2 is OS

In a downtrend, short, when RSI-2 is OB

Start with 1D chart,

If RSI-2 gives too many signals (false signals) then use higher time frame, such as 3D

If RSi-2 gives not enough signals, then use a lower time frame, such as 3HR

For more information on RSI-2, read "Short term trading strategies that work"-by larry connors, chapter 9

It is used to locate pull back points within a major trend.

These points will generally offer the best risk/reward entry areas.

OB is >90

OS is <10

In an uptrend, long, when RSI-2 is OS

In a downtrend, short, when RSI-2 is OB

Start with 1D chart,

If RSI-2 gives too many signals (false signals) then use higher time frame, such as 3D

If RSi-2 gives not enough signals, then use a lower time frame, such as 3HR

For more information on RSI-2, read "Short term trading strategies that work"-by larry connors, chapter 9

版本注释

Updated version.Bollinger bands activated, to fix the prior issue where RSI-2 indicator was not sensitive enough on the current time frame to reach OS (<10) & OB (>90) areas.

With the bolinger bands, it effectively creates a corridor channel to use as OB & OS.

Bolinger band for RSI-2 uses 1 std dev over 31 periods.

traditional bolinger bands are based on: 2 std dev over 20 period ,

tradition TDI is based on: 1.618 std dev over 31 peroids

版本注释

update版本注释

update版本注释

update版本注释

update版本注释

update仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系provalesco。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系provalesco。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。