OPEN-SOURCE SCRIPT

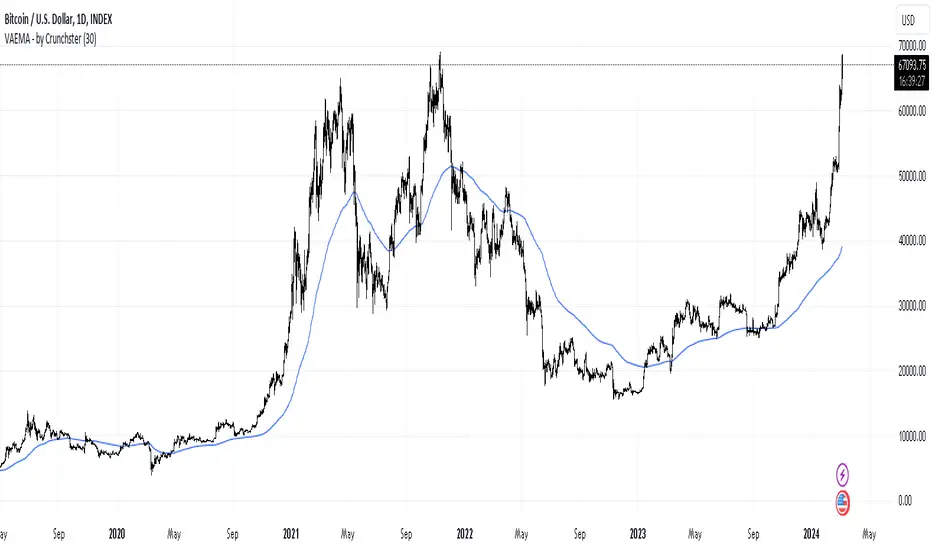

已更新 Volatility Adjusted EMA - by Crunchster

Applies recent volatility adjustment to the exponential moving average, where the smoothing factor is 2/(N + 1) - N being the lookback period or span

Volatility of recent 30 days returns is calculated using standard deviation with a thirty day lookback.

Increased smoothing compared to a standard EMA, which also adjusts to market conditions, as first described by Chande in 1991.

Volatility of recent 30 days returns is calculated using standard deviation with a thirty day lookback.

Increased smoothing compared to a standard EMA, which also adjusts to market conditions, as first described by Chande in 1991.

版本注释

Minor code update开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Join me on Mizar.com and trade my strategies

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

Join me on Mizar.com and trade my strategies

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。