INVITE-ONLY SCRIPT

已更新 Cyatophilum VWAP Strategy

An indicator to backtest and automate VWAP custom strategies.

Use the Trend Mode to create Swing Trading strategies or Rotation Mode for Intraday Trading.

Configure your strategy using the Entry Condition Builder and Risk Management features, such as Trailing Stop & Take Profits, Safety Orders, and VWAP Exit conditions.

═════════════════════════════════════════════════════════════════════════

█ HOW IT WORKS

VWAP stands for Volume Weighted Average Price.

It is like a simple moving average that takes volume into account.

It is used by a lot of traders since it has everything one needs to know: price and volume.

The cummulated volume calculation resets every session, which interval can be configured.

From that we can calculate the MVWAP and the Standard Deviation Bands and create strategies around that.

█ HOW TO USE

Trend Mode

Trend Mode is the name for strategies built upon VWAP and price/MVWAP cross, most often for Swing Trading on high timeframes trending markets.

The side traded is often long and trying to beat Buy & Hold.

The trade exit can be triggered by a reversal signal (top chart), or a trailing stop (bottom chart) and take profit.

Rotation Mode

This is the mode for Intraday on low timeframes. It will work best on ranging markets.

We use the Standard Deviation Bands to buy/sell the price at overbougth/oversold levels.

The indicator allows to create complex entry conditions such as "Break out of 3rd bands AND break back in 2nd bands" within a certain amount of time.

We will use either the exit options to close the trade when prices reach an opposite band, or the risk management features explained below.

█ FEATURES

• VWAP settings

Configure the VWAP.

• Entry settings

Choose to go long, short, and if the strategy should reverse or not.

• Trend Mode

Choose to create entries from VWAP cross with price or MVWAP.

• Rotation Mode

Configure the 3 bands and build a condition for entry. The multiple inputs allow to add up different events required to trigger an entry, using 3 logical gates that can be linked together using a AND or OR condition. The events being: "break out", "Break back in" or "Just touches" any of the 3 bands. The condition must be met within a certain period of time to be valid.

• Exit settings

Options to exit trades at the end of every session or when the price reaches an opposite band.

• Stop Loss & Take Profit

Configure your stop loss and take profit for long and short trades.

You can also make a trailing stoploss and a trailing take profit.

• Safety Orders (DCA)

Create a strategy with up to 100 safety orders.

Configure their placement and order size using the price deviation, step scale, take profit type (from base order or total volume), and volume scale settings.

Graphics

A Configuration panel with all the indicator settings, useful for sharing a strategy.

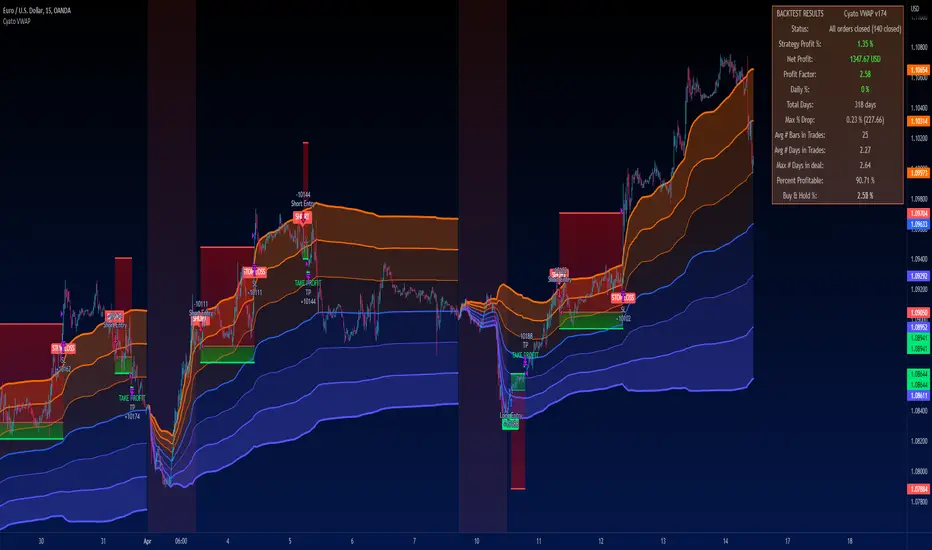

A Backtest Results panel with buy & Hold Comparator.

█ ALERTS

Configure your alert messages for all events in the indicator settings.

Then click "Add Alert". In the popup window, select the option "alert() function calls only", give the alert a name and you are good to go!

█ BACKTEST RESULTS

The backtest settings used in this snapshot are the following:

Please read the author instructions below for access.

Use the Trend Mode to create Swing Trading strategies or Rotation Mode for Intraday Trading.

Configure your strategy using the Entry Condition Builder and Risk Management features, such as Trailing Stop & Take Profits, Safety Orders, and VWAP Exit conditions.

═════════════════════════════════════════════════════════════════════════

█ HOW IT WORKS

VWAP stands for Volume Weighted Average Price.

It is like a simple moving average that takes volume into account.

It is used by a lot of traders since it has everything one needs to know: price and volume.

The cummulated volume calculation resets every session, which interval can be configured.

From that we can calculate the MVWAP and the Standard Deviation Bands and create strategies around that.

█ HOW TO USE

Trend Mode

Trend Mode is the name for strategies built upon VWAP and price/MVWAP cross, most often for Swing Trading on high timeframes trending markets.

The side traded is often long and trying to beat Buy & Hold.

The trade exit can be triggered by a reversal signal (top chart), or a trailing stop (bottom chart) and take profit.

Rotation Mode

This is the mode for Intraday on low timeframes. It will work best on ranging markets.

We use the Standard Deviation Bands to buy/sell the price at overbougth/oversold levels.

The indicator allows to create complex entry conditions such as "Break out of 3rd bands AND break back in 2nd bands" within a certain amount of time.

We will use either the exit options to close the trade when prices reach an opposite band, or the risk management features explained below.

█ FEATURES

• VWAP settings

Configure the VWAP.

• Entry settings

Choose to go long, short, and if the strategy should reverse or not.

• Trend Mode

Choose to create entries from VWAP cross with price or MVWAP.

• Rotation Mode

Configure the 3 bands and build a condition for entry. The multiple inputs allow to add up different events required to trigger an entry, using 3 logical gates that can be linked together using a AND or OR condition. The events being: "break out", "Break back in" or "Just touches" any of the 3 bands. The condition must be met within a certain period of time to be valid.

• Exit settings

Options to exit trades at the end of every session or when the price reaches an opposite band.

• Stop Loss & Take Profit

Configure your stop loss and take profit for long and short trades.

You can also make a trailing stoploss and a trailing take profit.

• Safety Orders (DCA)

Create a strategy with up to 100 safety orders.

Configure their placement and order size using the price deviation, step scale, take profit type (from base order or total volume), and volume scale settings.

Graphics

A Configuration panel with all the indicator settings, useful for sharing a strategy.

A Backtest Results panel with buy & Hold Comparator.

█ ALERTS

Configure your alert messages for all events in the indicator settings.

Then click "Add Alert". In the popup window, select the option "alert() function calls only", give the alert a name and you are good to go!

█ BACKTEST RESULTS

The backtest settings used in this snapshot are the following:

- Initial Capital: 10 000€

- Order size: 10% equity

- Commission: 0.1€ per order

- Slippage : 10 ticks

Please read the author instructions below for access.

版本注释

Added information in the backtest panel: required initial capital, amount of SO used, max days in a deal.版本注释

Added 'contracts' option to the safety order size type版本注释

Updated alert inputs版本注释

Updated inputs, added stop loss types, added alert placeholders, updated backtest panel, updated graphics.仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系cyatophilum。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

This indicator access can be purchased through a subscription on my website: https://blockchainfiesta.com/strategy/Cyatophilum-VWAP-Strategy/41/

🔥Get the Cyatophilum Indicators today and automate them on Binance! => blockchainfiesta.com/strategies/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系cyatophilum。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

This indicator access can be purchased through a subscription on my website: https://blockchainfiesta.com/strategy/Cyatophilum-VWAP-Strategy/41/

🔥Get the Cyatophilum Indicators today and automate them on Binance! => blockchainfiesta.com/strategies/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

Discord Server: discord.gg/RVwBkpnQzm

I am taking PineScript Commissions ✔

=> blockchainfiesta.com/contact/

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。