OPEN-SOURCE SCRIPT

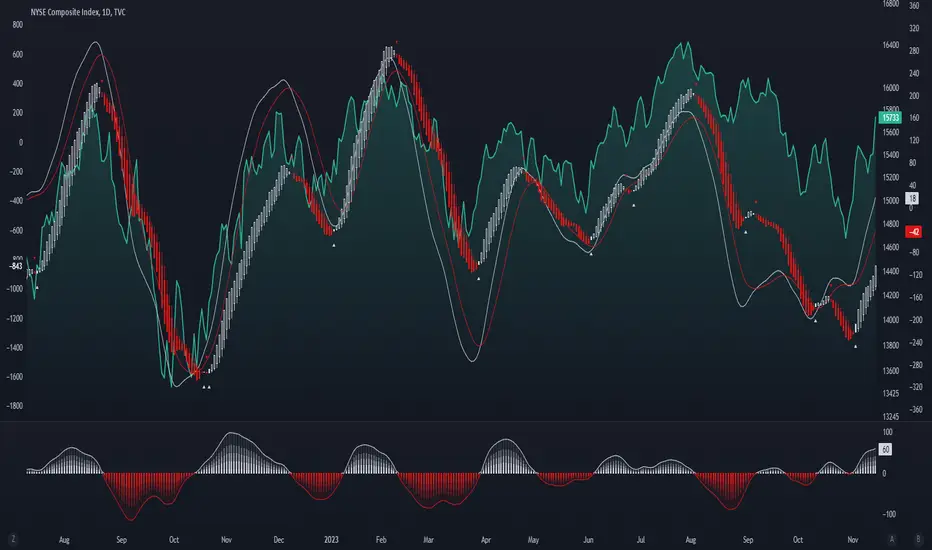

已更新 Enhanced McClellan Summation Index

The Enhanced McClellan Summation Index (MSI) is a comprehensive tool that transforms the MSI indicator with Heikin-Ashi visualization, offering improved trend analysis and momentum insights. This indicator includes MACD and it's histogram calculations to refine trend signals, minimize false positives and offer additional momentum analysis.

Methodology:

McClellan Summation Index (MSI) -

The MSI begins by calculating the ratio between advancing and declining issues in the specified index.

float decl = 𝘐𝘯𝘥𝘪𝘤𝘦 𝘥𝘦𝘤𝘭𝘪𝘯𝘪𝘯𝘨 𝘪𝘴𝘴𝘶𝘦𝘴

float adv = 𝘐𝘯𝘥𝘪𝘤𝘦 𝘢𝘥𝘷𝘢𝘯𝘤𝘪𝘯𝘨 𝘪𝘴𝘴𝘶𝘦𝘴

float ratio = (adv - decl) / (adv + decl)

It then computes a cumulative sum of the MACD (the difference between a 19-period EMA and a 39-period EMA) of this ratio. The result is a smoothed indicator reflecting market breadth and momentum.

macd(float r) =>

ta.ema(r, 19) - ta.ema(r, 39)

float msi = ta.cum(macd(ratio))

Heikin-Ashi Transformation -

Heikin-Ashi is a technique that uses a modified candlestick formula to create a smoother representation of price action. It averages the open, close, high, and low prices of the current and previous periods. This transformation reduces noise and provides a clearer view of trends.

type bar

float o = open

float h = high

float l = low

float c = close

bar b = bar.new()

float ha_close = math.avg(b.o, b.h, b.l, b.c)

MACD and Histogram -

The Enhanced MSI incorporates MACD and histogram calculations to provide additional momentum analysis and refine trend signals. The MACD represents the difference between the 12-period EMA and the 26-period EMA of the MSI. The histogram is the visual representation of the difference between the MACD and its signal line.

Options:

- Index Selection - Choose from

NYA,

NDX, or

XAX to tailor the MSI-HA to the desired market index.

- MACD Settings - Adjust the parameters for the MACD calculation to fine-tune the indicator's responsiveness.

- Ratio Multiplier - Apply scaling to the MSI to suit different market conditions and indices.

Benefits of Heikin-Ashi -

- Smoothed Trends - Heikin-Ashi reduces market noise, providing a more apparent and smoothed representation of trends.

- Clearer Patterns - Candlestick patterns are more distinct, aiding in the identification of trend reversals and continuations.

Utility and Use Cases:

- Trend & Momentum Analysis - Utilize the tool's Heikin-Ashi visualization for clearer trend identification in confluence with it's MACD and histogram to gain additional insights into the strength and direction of trends, while filtering out potential false positives.

- Breadth Analysis - Explore market breadth through the MSI's cumulative breadth indicator, gauging the overall health and strength of the underlying market.

- Alerts Setup Guide -

The Enhanced MSI is a robust indicator that combines the breadth analysis of the McClellan Summation Index with the clarity of Heikin-Ashi visualization and additional momentum insights from MACD and histogram calculations. Its customization options make it adaptable to various indices and market conditions, offering traders a comprehensive tool for trend and momentum analysis.

版本注释

improved methodology, added support for plot export to new SuperTrend ToolKit版本注释

Added alerts, improved methodology.版本注释

Added option for any alert call.开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。