OPEN-SOURCE SCRIPT

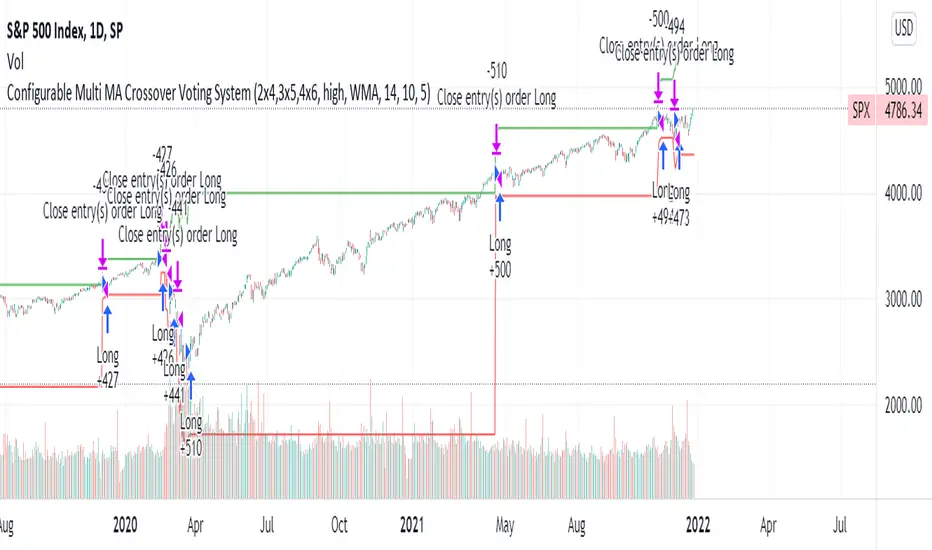

Configurable Multi MA Crossover Voting System

This strategy goes long when all fast moving averages that you have defined are above their counterpart slow moving averages.

Long position is closed when profit or loss target is hit and at least one of the fast moving averages is below its counterpart slow moving average.

The format of the config is simple. The format is : FASTxSLOW,FASTxSLOW,...

Example : If you want 2 moving averages fast=9,slow=14 and fast=20,slow=50 you define it like this : 9x14,20x50

Another example : 5x10,10x15,15x20 => means 3 moving average setups : first wih fast=5/slow=10, second with fast=10/slow=15, last with fast=15/slow=20

You can chose the type of moving average : SMA, WMA, VWMA (i got issues with EMA/RMA so i removed them)

You can chose the source of the moving average : high, close, hl2 etc.

You can chose the period on which ATR is calculated and ATR profit/loss factors.

Profit is calculated like : buy_price + atr_factor*atr

Loss is calculated like : buy_price - atr_factor*atr

Performance in backtest is variable depending on the timeframe, the options and the market.

Performance in backtest suggests it works better for higher timeframes like 1d, 4h etc.

Disclaimer

Please remember that past performance may not be indicative of future results.

Due to various factors, including changing market conditions, the strategy may no longer perform as well as in historical backtesting.

This post and the script don’t provide any financial advice.

Long position is closed when profit or loss target is hit and at least one of the fast moving averages is below its counterpart slow moving average.

The format of the config is simple. The format is : FASTxSLOW,FASTxSLOW,...

Example : If you want 2 moving averages fast=9,slow=14 and fast=20,slow=50 you define it like this : 9x14,20x50

Another example : 5x10,10x15,15x20 => means 3 moving average setups : first wih fast=5/slow=10, second with fast=10/slow=15, last with fast=15/slow=20

You can chose the type of moving average : SMA, WMA, VWMA (i got issues with EMA/RMA so i removed them)

You can chose the source of the moving average : high, close, hl2 etc.

You can chose the period on which ATR is calculated and ATR profit/loss factors.

Profit is calculated like : buy_price + atr_factor*atr

Loss is calculated like : buy_price - atr_factor*atr

Performance in backtest is variable depending on the timeframe, the options and the market.

Performance in backtest suggests it works better for higher timeframes like 1d, 4h etc.

Disclaimer

Please remember that past performance may not be indicative of future results.

Due to various factors, including changing market conditions, the strategy may no longer perform as well as in historical backtesting.

This post and the script don’t provide any financial advice.

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。