PROTECTED SOURCE SCRIPT

BB Squeeze + SuperTrend + Keltner Channel

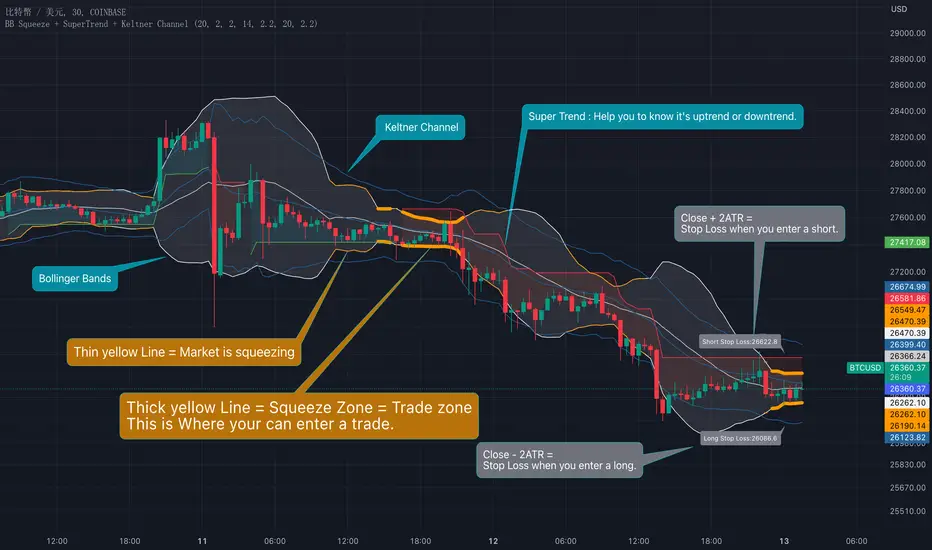

Bollinger Bands and Keltner Channel are two of my favorite channels. When you use them correctly, they can bring great help to your trading.

I like to use Bollinger Bands and Keltner Channels to identify when you can trade and when you can not trade, which is also known as the "squeeze".

When the opening of the Bollinger Bands is very small, it is a range that you can enter a trade, the range is called "Squeeze Zone" or "Trade zone".

When the opening of the Bollinger Bands is very large, it is a range that you cannot enter a trade, because the market fluctuates big when BB's opening is large.

I use two ways to identify when the Bollinger Bands's opening is very small or large, one is the Bollinger Bands entering Keltner Bands and one is using specific ATR ranges,. The first one allows you to identify when the market is squeezing and the second one allows you to identify when the market has entered Squeeze zone, that is, the market is already in a trading range suitable for entering a trade.(see chart.)

When the market is squeezed and you enter the trade, you can also use ATR as the stop loss price of the trade, I recommend using 2 ATR as your stop loss, and I also display them on the chart (see chart).

In addition, I also added SuperTrend to this indicator. SuperTrend is a very suitable for identifying trends. You can use SuperTrend to help you identify whether to go long or short.

This is how I use this indicator(See chart):

1.Only trade when market is in Squeeze Zone. (Thick yellow line in chart)

2.When entry a trade, use 2 ATR as stop loss. (Label in Chart)

3.Use Super trend to know to go long or short.

4.Keltner Channel helps to know when the market is squeezing. (Thin yellow line in chart.)

======== 中文說明 (Chinese Explanation) ========

Bollinger Bands(布林帶)跟 Keltner Channel(肯特納通道)是我最喜歡的兩個通道,當你正確使用它們時,它們可以替你的交易帶來非常大的幫助。

我喜歡用 Bollinger Bands 跟 Keltner Channel 來識別何時可以交易,何時不能交易,這個又稱做“擠壓操作”。當布林帶的開口很小時,便是可以交易的區間,而當布林帶的開口很大時,對我來說此時就是不可以交易的區間,因為此時市場的波動很大。

我使用兩種方式來識別當布林帶開口很小的時候,一種是布林帶進入肯特納通道,一種則使用特定的ATR範圍,前者可以讓你識別市場正在擠壓,後者則可以識別市場已經進入擠壓區間,也就是市場已經處於適合進入交易的交易區間。

當市場進入擠壓之後,而你也進入了交易,你還可以使用ATR來作為交易的止損價格,我建議使用2個ATR 來當作你的止損,而我也將他們顯示在圖表上了(見圖表)。

另外,我還在這個指標中加入了 SuperTrend(超級趨勢),SuperTrend 是一個非常適合用來辨別趨勢的指標,你可以使用 SuperTrend 來幫助你識別要做多還是做空。

這是我使用該指標的方式(見圖表):

1.僅在市場處於交易區間時進行交易。 (圖中黃色粗線)

2.入場時,使用2個ATR作為止損。 (圖表中的標籤)

3.使用超級趨勢知道做多或做空。

4.Keltner Channel 有助於了解市場何時擠壓。 (圖表中的黃色細線。)

I like to use Bollinger Bands and Keltner Channels to identify when you can trade and when you can not trade, which is also known as the "squeeze".

When the opening of the Bollinger Bands is very small, it is a range that you can enter a trade, the range is called "Squeeze Zone" or "Trade zone".

When the opening of the Bollinger Bands is very large, it is a range that you cannot enter a trade, because the market fluctuates big when BB's opening is large.

I use two ways to identify when the Bollinger Bands's opening is very small or large, one is the Bollinger Bands entering Keltner Bands and one is using specific ATR ranges,. The first one allows you to identify when the market is squeezing and the second one allows you to identify when the market has entered Squeeze zone, that is, the market is already in a trading range suitable for entering a trade.(see chart.)

When the market is squeezed and you enter the trade, you can also use ATR as the stop loss price of the trade, I recommend using 2 ATR as your stop loss, and I also display them on the chart (see chart).

In addition, I also added SuperTrend to this indicator. SuperTrend is a very suitable for identifying trends. You can use SuperTrend to help you identify whether to go long or short.

This is how I use this indicator(See chart):

1.Only trade when market is in Squeeze Zone. (Thick yellow line in chart)

2.When entry a trade, use 2 ATR as stop loss. (Label in Chart)

3.Use Super trend to know to go long or short.

4.Keltner Channel helps to know when the market is squeezing. (Thin yellow line in chart.)

======== 中文說明 (Chinese Explanation) ========

Bollinger Bands(布林帶)跟 Keltner Channel(肯特納通道)是我最喜歡的兩個通道,當你正確使用它們時,它們可以替你的交易帶來非常大的幫助。

我喜歡用 Bollinger Bands 跟 Keltner Channel 來識別何時可以交易,何時不能交易,這個又稱做“擠壓操作”。當布林帶的開口很小時,便是可以交易的區間,而當布林帶的開口很大時,對我來說此時就是不可以交易的區間,因為此時市場的波動很大。

我使用兩種方式來識別當布林帶開口很小的時候,一種是布林帶進入肯特納通道,一種則使用特定的ATR範圍,前者可以讓你識別市場正在擠壓,後者則可以識別市場已經進入擠壓區間,也就是市場已經處於適合進入交易的交易區間。

當市場進入擠壓之後,而你也進入了交易,你還可以使用ATR來作為交易的止損價格,我建議使用2個ATR 來當作你的止損,而我也將他們顯示在圖表上了(見圖表)。

另外,我還在這個指標中加入了 SuperTrend(超級趨勢),SuperTrend 是一個非常適合用來辨別趨勢的指標,你可以使用 SuperTrend 來幫助你識別要做多還是做空。

這是我使用該指標的方式(見圖表):

1.僅在市場處於交易區間時進行交易。 (圖中黃色粗線)

2.入場時,使用2個ATR作為止損。 (圖表中的標籤)

3.使用超級趨勢知道做多或做空。

4.Keltner Channel 有助於了解市場何時擠壓。 (圖表中的黃色細線。)

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

受保护脚本

此脚本以闭源形式发布。 但是,您可以自由使用,没有任何限制 — 了解更多信息这里。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。