OPEN-SOURCE SCRIPT

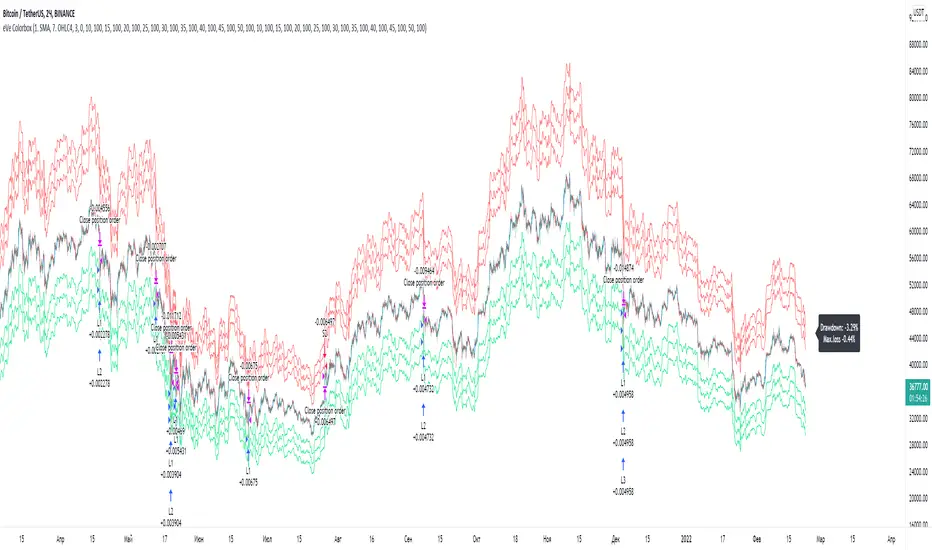

Robot eVe Colorbox

A script to test the Colorbox strategy of the trading robot eVe.

Lines

The blue line is the moving average and the reference point for the other lines.

Lime lines - a shifted moving average for opening a long position using a limit order.

Red lines - a shifted moving average for opening a short position using a limit order.

Strategy

Long positions are opened by a limit order at the price of the lime line.

Short positions shall be opened by a limit order at the price of the red line.

Any positions shall be closed by a market order.

If a long position is open, the position shall be exited upon the occurrence of any rising bar (green bar).

If a position is short, the position is exited on any falling bar (red bar).

This is a counter-trend strategy.

Exchange fees

A maker is used to enter.

A taker is used to exit.

The amounts for a maker and a taker are always equal.

For the backtest, the average commission = (maker_fee + taker_fee) / 2

Symbols

This is a very versatile strategy. It can be profitable on any trading pairs, on any asset class, and on any timeframe. But it requires the right parameters to perform well (see recommendations below).

Recommendations

The more volatile the asset, the better the strategy will work.

The more volatility , the more you need to set a slider for your orders.

The larger the time frame, the greater the number of slots required for orders.

Short positions are less profitable and more risky.

Short positions can be disabled altogether, it can be useful.

The strategy works very well for Crypto/Crypto trading pairs (e.g. ETH/BTC , DOGE/ETH, etc)

Lines

The blue line is the moving average and the reference point for the other lines.

Lime lines - a shifted moving average for opening a long position using a limit order.

Red lines - a shifted moving average for opening a short position using a limit order.

Strategy

Long positions are opened by a limit order at the price of the lime line.

Short positions shall be opened by a limit order at the price of the red line.

Any positions shall be closed by a market order.

If a long position is open, the position shall be exited upon the occurrence of any rising bar (green bar).

If a position is short, the position is exited on any falling bar (red bar).

This is a counter-trend strategy.

Exchange fees

A maker is used to enter.

A taker is used to exit.

The amounts for a maker and a taker are always equal.

For the backtest, the average commission = (maker_fee + taker_fee) / 2

Symbols

This is a very versatile strategy. It can be profitable on any trading pairs, on any asset class, and on any timeframe. But it requires the right parameters to perform well (see recommendations below).

Recommendations

The more volatile the asset, the better the strategy will work.

The more volatility , the more you need to set a slider for your orders.

The larger the time frame, the greater the number of slots required for orders.

Short positions are less profitable and more risky.

Short positions can be disabled altogether, it can be useful.

The strategy works very well for Crypto/Crypto trading pairs (e.g. ETH/BTC , DOGE/ETH, etc)

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。