OPEN-SOURCE SCRIPT

已更新 Volume Share - Bitcoin Retail % [cryptorae]

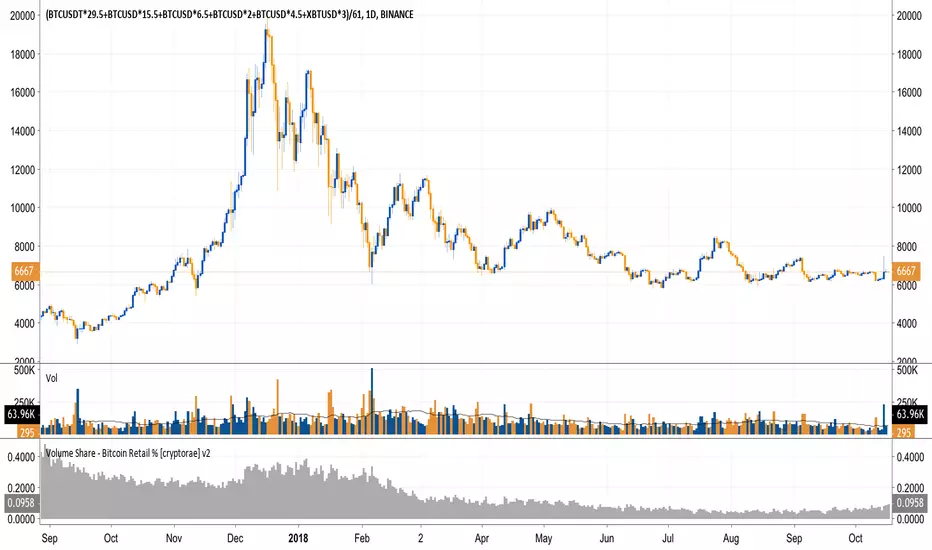

I've been keeping my eyes on retail BTC trading volume as a % of total BTC trading volume (charted).

It's the single best chart showing the death of sentiment in this bear market. Retail fell to as low as 5.6% on 6/8. The good news is that the % has stabilized at these levels.

I think retail interest will need to trend higher in tandem with higher price moves for us to break through key resistance levels.

To know why, let's look closer at the anatomy of the recent bull and bear market.

In the 2017 bull market:

- Retail interest trended higher or sideways with each drive up

- Average retail volume share was ~46%

In other words, price movements were dominated by infusions of new money.

In the 2018 bear market:

- Retail interest trended LOWER with each recovery in price

- Average retail volume share was ~15%

In other words, price movements were dominated by money exchanging through the hands of traders.

Open thoughts:

- If the bear market persists and prices reach critical levels, I think that retail % would spike as some finally rush for the exit and new investors happily jump in

- If prices recover w/o a sustained increase in retail %, I'd not be so quick to call a bull market

Things I classify as "retail":

- Bitflyer

- Bithumb

- Coinbase

- Bistamp

- Kraken

Things classified as "non-retail"

- Bitmex

- Bitfinex

The formula is retail / (retail + non-retail)

The script is open for you to modify if you disagree. Let me know your thoughts/tweaks.

It's the single best chart showing the death of sentiment in this bear market. Retail fell to as low as 5.6% on 6/8. The good news is that the % has stabilized at these levels.

I think retail interest will need to trend higher in tandem with higher price moves for us to break through key resistance levels.

To know why, let's look closer at the anatomy of the recent bull and bear market.

In the 2017 bull market:

- Retail interest trended higher or sideways with each drive up

- Average retail volume share was ~46%

In other words, price movements were dominated by infusions of new money.

In the 2018 bear market:

- Retail interest trended LOWER with each recovery in price

- Average retail volume share was ~15%

In other words, price movements were dominated by money exchanging through the hands of traders.

Open thoughts:

- If the bear market persists and prices reach critical levels, I think that retail % would spike as some finally rush for the exit and new investors happily jump in

- If prices recover w/o a sustained increase in retail %, I'd not be so quick to call a bull market

Things I classify as "retail":

- Bitflyer

- Bithumb

- Coinbase

- Bistamp

- Kraken

Things classified as "non-retail"

- Bitmex

- Bitfinex

The formula is retail / (retail + non-retail)

The script is open for you to modify if you disagree. Let me know your thoughts/tweaks.

版本注释

I updated my original volume share script .Changes:

1. Removed Bithumb data due their distortive wash trading event.

2. Added Gemini data now that they have backfilled their volume data on TradingView.

NOTE: Intra-period volume-share levels can greatly fluctuate. You must wait for a candle before interpreting the most recent data point of the indicator.

Comparison of v1 and v2

Observations

The retail segment of the market is slowly creeping back up. This development can largely be attributed to the decline of volume on BitMEX, which is currently a graveyard of degen-class of traders who are the collateral damage of the pro vs. pro wars.

BitMEX volume declining:

Fiat onramp volume flat:

Thoughts

Don't get too excited. The slight upward drift of retail volume share is not due to positive retail sentiment, but due to degen exhaustion. I view this as a positive (not necessarily bullish) development. While this may not represent an improvement of sentiment, the activity does represent a sort of trader capitulation. Traders must learn to cope with boredom and effectively allocate their time. If these markets bore you, walk away form it. Allocate a % of capital to Bitcoin and forget about it. Your mind is decaying by constantly scrutinizing these charts. Go out and get some sunlight.

I continue to believe the same things asserted in my prior thread (tl;dr that increasing retail participation would confirm a break out of local highs AND lows on the chart. Decreasing retail participation would invalidate those break outs.) It remains a theory, so please treat it accordingly.

What's next?

The R/R of short selling BTC is incredibly poor right now as we have appear to have bottomed. That said, you should remember that retail volume share is not a one way measure of bullishness. Volume share should also rise if we are to see a true, sell-it-all-to-cash capitulation.

This indicator continues to be my favorite macro indicator for crypto markets and the best real-time gauge of sentiment, which is the single most important driver of prices. I leave it on every crypto chart. I hope you find it equally useful and I always appreciate feedback and additional interpretation.

Cheers,

Rae

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

开源脚本

秉承TradingView的精神,该脚本的作者将其开源,以便交易者可以查看和验证其功能。向作者致敬!您可以免费使用该脚本,但请记住,重新发布代码须遵守我们的网站规则。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。