⊣

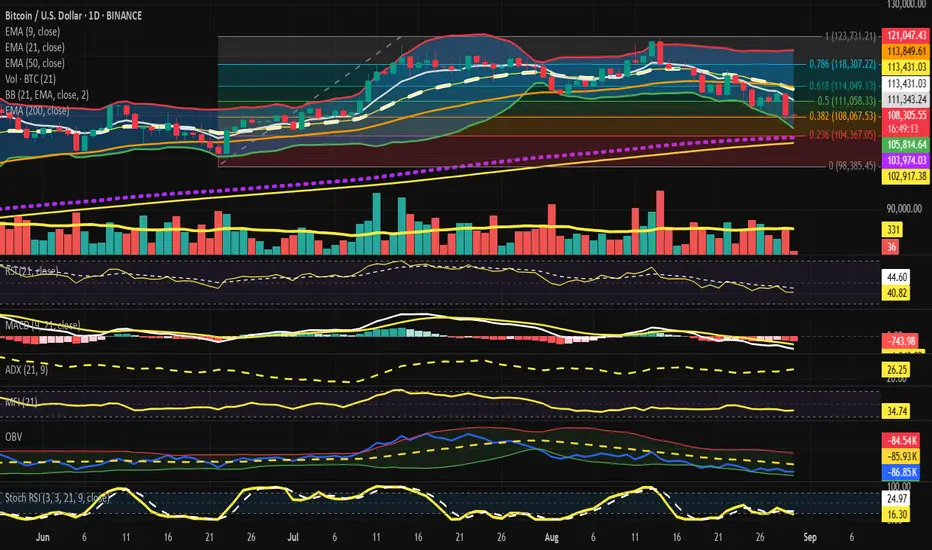

⟁ BTC/USD – BINANCE – (CHART: 1D) – (Aug 30, 2025).

◇ Analysis Price: $108,377.41.

⊣

⨀ I. Temporal Axis – Strategic Interval – (1D):

▦ EMA9 – $111,357.61:

∴ Price remains below EMA9, confirming immediate bearish control;

∴ EMA9 has flipped into dynamic resistance after multiple failed retests;

∴ Short-term recovery requires a clean daily close above EMA9.

✴️ Conclusion: EMA9 acts as near-term resistance, bearish short bias intact. Logic sealed.

⊢

▦ EMA21 – $113,437.56:

∴ EMA21 aligns with Fib 0.618 ($114,049), forming a resistance cluster;

∴ Persistent rejection since Aug 21 emphasizes mid-term weakness;

∴ Reclaiming EMA21 is the first real bullish trigger.

✴️ Conclusion: EMA21 = critical pivot to shift from bearish to neutral. Logic sealed.

⊢

▦ EMA50 – $113,852.43:

∴ Slightly above EMA21, adding weight to the $113.4 / 113.9k resistance zone;

∴ Until broken, this confluence acts as a bearish supply wall;

∴ A reclaim here reopens upside toward Fib 0.786 ($118.3k).

✴️ Conclusion: EMA50 reinforces resistance cluster. Logic sealed.

⊢

▦ EMA200 – $102,917.45:

∴ Long-term fortress, still untested in this cycle;

∴ Confluence with Fib 0.236 ($104,367) = macro defense zone;

∴ Bears’ ultimate target if current supports give way.

✴️ Conclusion: EMA200 stands as macro citadel. Logic sealed.

⊢

▦ Bollinger Bands (21, 2) – $121,042 / $113,437 / $105,833:

∴ Price riding lower band at $105.8k;

∴ Bands widening = volatility expansion with bearish tilt;

∴ Failure to revert to midline confirms continuation risk.

✴️ Conclusion: Bands highlight bearish volatility regime. Logic sealed.

⊢

▦ RSI (21, 9) – 40.90 / 44.62:

∴ RSI below neutral 50, momentum bearish;

∴ Not oversold (<30), leaving room for more downside;

∴ No bullish divergence present.

✴️ Conclusion: RSI validates sellers’ momentum. Logic sealed.

⊢

▦ MACD (9, 21, 9) – Line: –2,079.96 / Signal: –1,342.25 / Histogram: –737.71:

∴ Bearish cross intact below zero-line;

∴ Histogram remains deeply negative, no sign of contraction;

∴ Momentum acceleration still favors bears;

✴️ Conclusion: MACD entrenched in bearish phase. Logic sealed.

⊢

▦ ADX (21, 9) – 26.25:

∴ Above 25 confirms trend strength;

∴ With DI– dominance, direction is bearish;

∴ Indicates continuation rather than reversal.

✴️ Conclusion: ADX confirms strengthening bearish trend. Logic sealed.

⊢

▦ MFI (21) – 34.75:

∴ Below 50 = capital outflows dominate;

∴ No oversold signal (<20) yet;

∴ Market still has selling pressure capacity.

✴️ Conclusion: MFI aligns with distribution bias. Logic sealed.

⊢

▦ OBV (21, BB2) – (–86.84K):

∴ OBV trending lower, confirming distribution;

∴ Volume does not show accumulation footprint;

∴ Confirms sellers dominate liquidity.

✴️ Conclusion: OBV validates distribution regime. Logic sealed.

⊢

▦ Stoch RSI (3, 3, 21, 9) – K: 16.30 / D: 24.97:

∴ In oversold territory (<20);

∴ No confirmed bullish crossover yet;

∴ Relief bounce possible if crossover occurs.

✴️ Conclusion: Oversold condition may allow relief, but not structural reversal. Logic sealed.

⊢

▦ Fibonacci Retracements (0 = $98,385 -> 1 = $123,731):

✴️ Conclusion: Market clings to 0.382; Loss exposes 0.236 + EMA200 fortress; Logic sealed.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ Short-term structure: price pinned under EMA9 and EMA21/50 cluster, bearish dominance confirmed;

∴ Momentum: RSI below 50, MACD negative, ADX >25 = sellers in control;

∴ Capital flows: MFI <50, OBV falling = distribution not yet exhausted;

∴ Only counterpoint: Stoch RSI oversold; potential for technical bounce, not structural reversal.

✴️ Conclusion: The battlefield is 0.382 Fib ($108k). Bulls must reclaim $111k -> $113.4k to neutralize; failure drags price toward ($104 / 103k). Logic sealed.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + EMA9 - (All Exchanges):

∴ Current inflow readings remain low-to-moderate, no spikes comparable to 2022 capitulation phases (>200K BTC);

∴ EMA9 of inflows trending stable/declining since Q2 2025;

∴ Lack of exchange deposits suggests no broad panic selling.

✴️ Conclusion: Inflows do not confirm capitulation; sellers are present but not aggressive. Logic sealed.

⊢

▦ Historical Context:

∴ Spikes above ~150K BTC inflow (e.g. 2022–2023) correlated with sharp price drawdowns;

∴ 2024–2025 shows inflows mostly <50K BTC/day, even during corrections;

∴ Current cycle corrections appear orderly rather than panic-driven.

✴️ Conclusion: Current inflow regime supports controlled distribution, not mass liquidation. Logic sealed.

⊢

▦ Liquidity Implications:

∴ Absence of exchange inflow surges implies supply pressure limited to tactical sellers;

∴ On-chain wallets continue holding, whales not rushing coins into exchanges;

∴ Technical breakdowns (EMA clusters, Fib 0.382) would require derivative/liquidation cascades rather than spot-led panic.

✴️ Conclusion: Structural downside must be driven by futures leverage, not spot panic flows. Logic sealed.

⊢

𓂀 Stoic-Structural Interpretation and On-Chain Oracle:

∴ Structure: EMA stack inverted; Fib 0.382 ($108k) = present bastion; EMA200 ($103k) = macro citadel;

∴ Momentum: RSI, MACD, ADX in alignment with descent, affirming stoic acceptance of downward will;

∴ Capital Flow: OBV and MFI declare liquidity leaving, distribution sealing bearish fate;

∴ Oracle: Oversold Stoch RSI whispers of fleeting respite, not salvation;

∴ Structure of Flow: Unlike past cycles, inflow discipline holds; coins remain largely in cold storage;

∴ Momentum of Will: Market decline is technical, not yet forced by whales. Bears act by structure, not by panic;

∴ Fate of Distribution: Without inflow surges, spot-driven capitulation remains unlikely; path to $103K relies on derivative liquidation.

⊢

✦ Structure Thus:

∴ The market embodies stoic compression;

∴ Only a reclaim >$113.4k reopens neutrality;

∴ Loss of $108k pulls destiny to ($104 / 103k);

∴ Fate sealed in bearish compression, awaiting expansion - logic sealed;

∴ On-chain inflows confirm the absence of mass panic;

∴ Technical charts dominate destiny;

∴ Bears have structure, but not yet blood;

∴ Bulls retain a chance if they defend $108K with low inflows sustained.

⊢

⚚ Unified Insight (Technical + On-Chain):

∴ Technical: Bitcoin clings to Fib 0.382 ($108K); failure = ($104 / 103K). Momentum + OBV favor bears.

∴ On-Chain: No whale capitulation; inflows remain muted, meaning downside is not spot-led.

✴️ Consequence: If inflows stay low, bulls may engineer a bounce at $108K -> $111K. If derivatives trigger cascade, EMA200 ($103K) becomes the stoic fortress.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

⟁ BTC/USD – BINANCE – (CHART: 1D) – (Aug 30, 2025).

◇ Analysis Price: $108,377.41.

⊣

⨀ I. Temporal Axis – Strategic Interval – (1D):

▦ EMA9 – $111,357.61:

∴ Price remains below EMA9, confirming immediate bearish control;

∴ EMA9 has flipped into dynamic resistance after multiple failed retests;

∴ Short-term recovery requires a clean daily close above EMA9.

✴️ Conclusion: EMA9 acts as near-term resistance, bearish short bias intact. Logic sealed.

⊢

▦ EMA21 – $113,437.56:

∴ EMA21 aligns with Fib 0.618 ($114,049), forming a resistance cluster;

∴ Persistent rejection since Aug 21 emphasizes mid-term weakness;

∴ Reclaiming EMA21 is the first real bullish trigger.

✴️ Conclusion: EMA21 = critical pivot to shift from bearish to neutral. Logic sealed.

⊢

▦ EMA50 – $113,852.43:

∴ Slightly above EMA21, adding weight to the $113.4 / 113.9k resistance zone;

∴ Until broken, this confluence acts as a bearish supply wall;

∴ A reclaim here reopens upside toward Fib 0.786 ($118.3k).

✴️ Conclusion: EMA50 reinforces resistance cluster. Logic sealed.

⊢

▦ EMA200 – $102,917.45:

∴ Long-term fortress, still untested in this cycle;

∴ Confluence with Fib 0.236 ($104,367) = macro defense zone;

∴ Bears’ ultimate target if current supports give way.

✴️ Conclusion: EMA200 stands as macro citadel. Logic sealed.

⊢

▦ Bollinger Bands (21, 2) – $121,042 / $113,437 / $105,833:

∴ Price riding lower band at $105.8k;

∴ Bands widening = volatility expansion with bearish tilt;

∴ Failure to revert to midline confirms continuation risk.

✴️ Conclusion: Bands highlight bearish volatility regime. Logic sealed.

⊢

▦ RSI (21, 9) – 40.90 / 44.62:

∴ RSI below neutral 50, momentum bearish;

∴ Not oversold (<30), leaving room for more downside;

∴ No bullish divergence present.

✴️ Conclusion: RSI validates sellers’ momentum. Logic sealed.

⊢

▦ MACD (9, 21, 9) – Line: –2,079.96 / Signal: –1,342.25 / Histogram: –737.71:

∴ Bearish cross intact below zero-line;

∴ Histogram remains deeply negative, no sign of contraction;

∴ Momentum acceleration still favors bears;

✴️ Conclusion: MACD entrenched in bearish phase. Logic sealed.

⊢

▦ ADX (21, 9) – 26.25:

∴ Above 25 confirms trend strength;

∴ With DI– dominance, direction is bearish;

∴ Indicates continuation rather than reversal.

✴️ Conclusion: ADX confirms strengthening bearish trend. Logic sealed.

⊢

▦ MFI (21) – 34.75:

∴ Below 50 = capital outflows dominate;

∴ No oversold signal (<20) yet;

∴ Market still has selling pressure capacity.

✴️ Conclusion: MFI aligns with distribution bias. Logic sealed.

⊢

▦ OBV (21, BB2) – (–86.84K):

∴ OBV trending lower, confirming distribution;

∴ Volume does not show accumulation footprint;

∴ Confirms sellers dominate liquidity.

✴️ Conclusion: OBV validates distribution regime. Logic sealed.

⊢

▦ Stoch RSI (3, 3, 21, 9) – K: 16.30 / D: 24.97:

∴ In oversold territory (<20);

∴ No confirmed bullish crossover yet;

∴ Relief bounce possible if crossover occurs.

✴️ Conclusion: Oversold condition may allow relief, but not structural reversal. Logic sealed.

⊢

▦ Fibonacci Retracements (0 = $98,385 -> 1 = $123,731):

- 0.786 -> $118,307 – (upper resistance);

- 0.618 -> $114,049 – (current battlefield, confluence EMA21/50);

- 0.500 -> $111,058 – (reclaim point for neutralization);

- 0.382 -> $108,067 – (current support pivot);

- 0.236 -> $104,367 – (deeper target, near EMA200).

✴️ Conclusion: Market clings to 0.382; Loss exposes 0.236 + EMA200 fortress; Logic sealed.

⊢

🜎 Strategic Insight - Technical Oracle:

∴ Short-term structure: price pinned under EMA9 and EMA21/50 cluster, bearish dominance confirmed;

∴ Momentum: RSI below 50, MACD negative, ADX >25 = sellers in control;

∴ Capital flows: MFI <50, OBV falling = distribution not yet exhausted;

∴ Only counterpoint: Stoch RSI oversold; potential for technical bounce, not structural reversal.

✴️ Conclusion: The battlefield is 0.382 Fib ($108k). Bulls must reclaim $111k -> $113.4k to neutralize; failure drags price toward ($104 / 103k). Logic sealed.

⊢

∫ II. On-Chain Intelligence - (Source: CryptoQuant):

▦ Exchange Inflow Total + EMA9 - (All Exchanges):

∴ Current inflow readings remain low-to-moderate, no spikes comparable to 2022 capitulation phases (>200K BTC);

∴ EMA9 of inflows trending stable/declining since Q2 2025;

∴ Lack of exchange deposits suggests no broad panic selling.

✴️ Conclusion: Inflows do not confirm capitulation; sellers are present but not aggressive. Logic sealed.

⊢

▦ Historical Context:

∴ Spikes above ~150K BTC inflow (e.g. 2022–2023) correlated with sharp price drawdowns;

∴ 2024–2025 shows inflows mostly <50K BTC/day, even during corrections;

∴ Current cycle corrections appear orderly rather than panic-driven.

✴️ Conclusion: Current inflow regime supports controlled distribution, not mass liquidation. Logic sealed.

⊢

▦ Liquidity Implications:

∴ Absence of exchange inflow surges implies supply pressure limited to tactical sellers;

∴ On-chain wallets continue holding, whales not rushing coins into exchanges;

∴ Technical breakdowns (EMA clusters, Fib 0.382) would require derivative/liquidation cascades rather than spot-led panic.

✴️ Conclusion: Structural downside must be driven by futures leverage, not spot panic flows. Logic sealed.

⊢

𓂀 Stoic-Structural Interpretation and On-Chain Oracle:

∴ Structure: EMA stack inverted; Fib 0.382 ($108k) = present bastion; EMA200 ($103k) = macro citadel;

∴ Momentum: RSI, MACD, ADX in alignment with descent, affirming stoic acceptance of downward will;

∴ Capital Flow: OBV and MFI declare liquidity leaving, distribution sealing bearish fate;

∴ Oracle: Oversold Stoch RSI whispers of fleeting respite, not salvation;

∴ Structure of Flow: Unlike past cycles, inflow discipline holds; coins remain largely in cold storage;

∴ Momentum of Will: Market decline is technical, not yet forced by whales. Bears act by structure, not by panic;

∴ Fate of Distribution: Without inflow surges, spot-driven capitulation remains unlikely; path to $103K relies on derivative liquidation.

⊢

✦ Structure Thus:

∴ The market embodies stoic compression;

∴ Only a reclaim >$113.4k reopens neutrality;

∴ Loss of $108k pulls destiny to ($104 / 103k);

∴ Fate sealed in bearish compression, awaiting expansion - logic sealed;

∴ On-chain inflows confirm the absence of mass panic;

∴ Technical charts dominate destiny;

∴ Bears have structure, but not yet blood;

∴ Bulls retain a chance if they defend $108K with low inflows sustained.

⊢

⚚ Unified Insight (Technical + On-Chain):

∴ Technical: Bitcoin clings to Fib 0.382 ($108K); failure = ($104 / 103K). Momentum + OBV favor bears.

∴ On-Chain: No whale capitulation; inflows remain muted, meaning downside is not spot-led.

✴️ Consequence: If inflows stay low, bulls may engineer a bounce at $108K -> $111K. If derivatives trigger cascade, EMA200 ($103K) becomes the stoic fortress.

⊢

· Cryptorvm Dominvs · MAGISTER ARCANVM · Vox Primordialis ·

· Dominivm Cardo Gyratio Omnivm · Silence precedes the next force. Structure is sacred ·

⊢

交易开始

⊣⟁ BTC Derivatives Layer – Amberdata – Market Gamma (Calls) – (Aug 30, 2025).

⊣

⨀ III. Options Gamma Exposure (Call Side):

▦ Gamma Concentration – Current (Aug 30):

∴ Peak gamma clustered tightly around strikes (107.5K / 108K);

∴ This creates a strong “pinning” effect near spot ($108.3K);

∴ Market-makers likely hedge aggressively around this level.

✴️ Conclusion: Spot is magnetized at 108K by call gamma exposure. Logic sealed.

⊢

▦ Short-Term Expiries (Aug 31 – Sep 02):

∴ Gamma surface shows immediate expiry crowding near 108K;

∴ Implies high sensitivity to small spot moves into month-end;

∴ Elevated hedging flows may suppress volatility near 108K.

✴️ Conclusion: Short-term expiries reinforce pinning pressure.

⊢

▦ Medium-Term Expiries (Sep 19 – Sep 26):

∴ Broader gamma curve flattens across (110K / 115K strikes;

∴ Suggests dealers less exposed further up the curve;

∴ If price escapes (111K / 113K) resistance cluster, gamma exposure thins, allowing volatility release.

✴️ Conclusion: Above 113K, dealer hedging impact fades, enabling breakout potential.

⊢

𓂀 Stoic-Structural Interpretation – Gamma Oracle:

∴ Structure: Market pinned by dealer gamma around $108K, enforcing stagnation;

∴ Momentum: As expiries roll off, gamma grip weakens, restoring directional freedom;

∴ Fate: Bulls require reclaim >$113K to escape gamma gravity; bears require <105K to ignite downside flows.

✦ Thus: Gamma acts as invisible fetters - binding Bitcoin to the $108K axis until expiration releases volatility.

✴️ Conclusion: Gamma discipline enforces equilibrium at $108K; volatility resumes only beyond hedging bands. Logic sealed.

⊢

相关出版物

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。