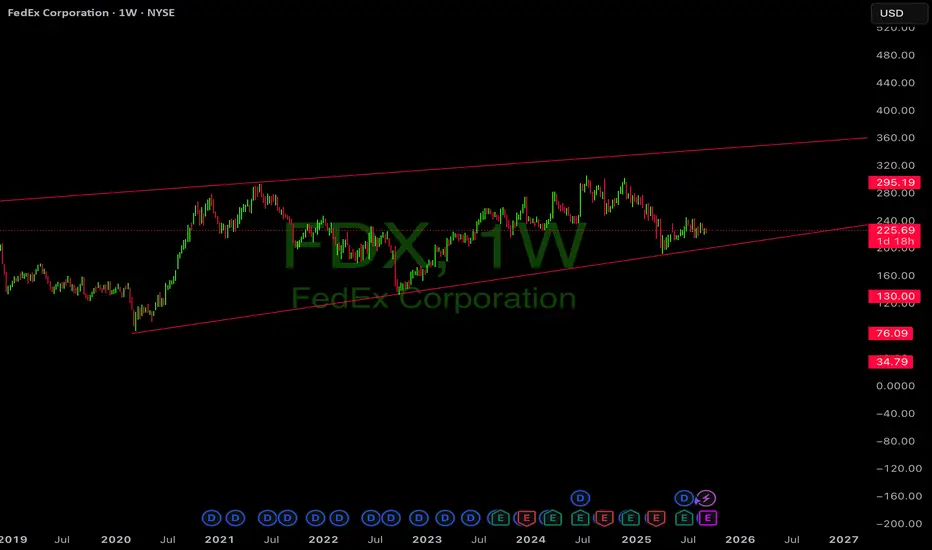

FedEx is sitting right on long-term channel support around $220 with RSI neutral, giving a favorable risk/reward setup. On the fundamental side, global trade volumes are recovering, e-commerce tailwinds remain intact, and management’s DRIVE program is cutting billions in costs through automation + AI-driven logistics. Add in shareholder returns via a ~2% dividend + buybacks, and the stock is cheap at just ~10x forward earnings vs its 5-yr avg ~13x. Risk is limited below $200, while upside back toward $300–350 over the next 12–18 months is very realistic.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。