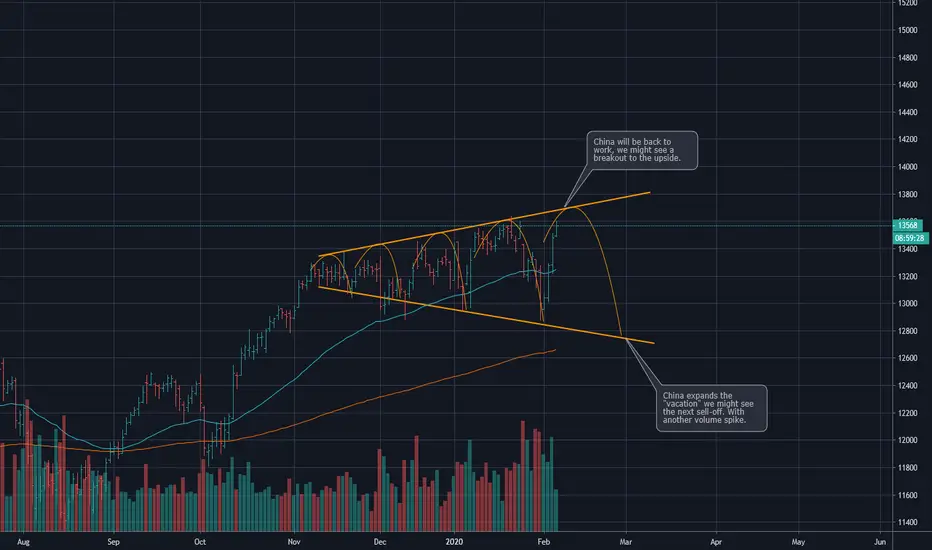

Right now, we have a broadening formation in the DAX; this usually happens, when the market in disagreement. On the upside this lead us to 13,720, but what would happen if China is going to extend the "vacations" by another two/four weeks. For German manufacturers this would lead to an demand shock, since a lot of German manufacturers are heavily involved in the supply chain of Chinese companies (via JV).

So, what do we see:

My trading plan depends this time on the news which we will get within the next couple of days.

If we see an extend of the "vacation", I expect another sell-off, which could lead us to the EMA 200 daily.

So, what do we see:

- Higher volumes: Cash-Market and Future volumes (Source: deutsche-boerse-cash-market)

- Trumpet (starting in Nov. 2019 - Feb. 2020); disagreement in the market

- Short signal: Hindenburg-Indicator

- Short Signal: MACD weekly

- Upper end of the trend channel

- Event would affect the cashflows of German companies (for at least this year)

My trading plan depends this time on the news which we will get within the next couple of days.

If we see an extend of the "vacation", I expect another sell-off, which could lead us to the EMA 200 daily.

交易开始

注释

It seems that we Start moving. Be patient...注释

Be patient, be patient, be patient注释

I am closing some positions around 13300. The remaining part with TP 13200/12900.注释

TP 1 reached交易结束:到达目标

We have just reached the 12,900. Hence we have made between 600 - 820 points. I really hope you enjoyed the trade. It was the largest "central bank driven bull trap" in the last two years.免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。