Hello Traders!

We’ve all seen those days when the market opens with a big gap-up or gives a strong rally – and most traders start panicking. But if you’ve been into option writing, you know that’s exactly when opportunity shows up.

High IV + inflated premiums = perfect setup to sell Calls (CE) and let Theta (time decay) do all the work for you.

Why this works so well after a big move:

Some ground rules for this strategy:

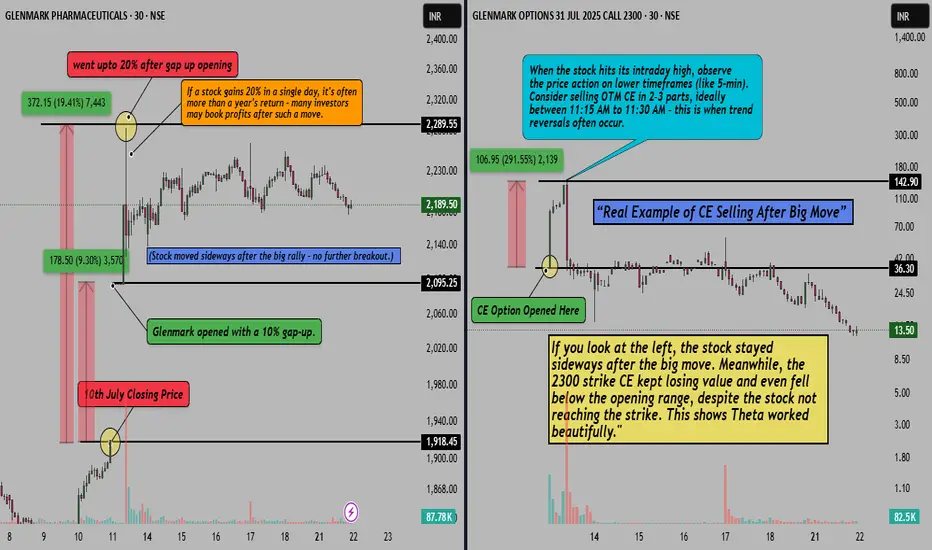

Let’s Talk Real Example – Glenmark 2300 CE Sell

Check the chart above 👆

Glenmark gave a huge 10% gap-up and rallied up to 20% intraday. That’s a crazy move – and we know what that means: CEs were loaded with premium.

So around 11:15 AM (when the stock hit the top), we started selling the 2300 strike OTM CE.

What happened next?

Price went sideways. No breakout. But the premium kept falling hard. Even though price didn’t hit 2300, CE collapsed – pure Theta magic!

Rahul’s Tip

When premiums are juicy after a big move, you don’t need to do much. Just sell smart, manage your risk, and let Theta take care of the rest.

Final Thoughts:

CE selling isn’t about catching reversals. It’s about taking advantage of overpriced options and letting time work for you.

So next time the market gives a big rally, don’t chase it. Just chill, sell smart, and let Theta kill the premium!

Do you sell options after big moves too? Share your views or setups in comments!

We’ve all seen those days when the market opens with a big gap-up or gives a strong rally – and most traders start panicking. But if you’ve been into option writing, you know that’s exactly when opportunity shows up.

High IV + inflated premiums = perfect setup to sell Calls (CE) and let Theta (time decay) do all the work for you.

Why this works so well after a big move:

- CEs become expensive:

After a sharp rally, call options are overpriced. That’s your edge as a seller. - Theta kicks in fast:

If price starts to cool off or even just go sideways, the time decay starts eating the premium quickly. - Price usually settles down:

Markets don’t rally forever. After a big move, some pause or pullback is very common. - You don’t need to be 100% right:

Even if the price doesn’t fall, you still make money as long as it doesn’t fly through your strike.

Some ground rules for this strategy:

- Sell Out-of-the-Money (OTM) Calls:

Pick a strike that’s at least 1–2% away from current price with decent premium. - Find nearby resistance:

Sell near technical resistance zones where price usually slows down. - Don’t sell into crashing IV:

Make sure IV is still high. If it's already falling, your edge is gone. - Always use a stop loss:

Set a level where you'll exit if the trade goes against you. Never hold naked without a plan.

Let’s Talk Real Example – Glenmark 2300 CE Sell

Check the chart above 👆

Glenmark gave a huge 10% gap-up and rallied up to 20% intraday. That’s a crazy move – and we know what that means: CEs were loaded with premium.

So around 11:15 AM (when the stock hit the top), we started selling the 2300 strike OTM CE.

What happened next?

Price went sideways. No breakout. But the premium kept falling hard. Even though price didn’t hit 2300, CE collapsed – pure Theta magic!

Rahul’s Tip

When premiums are juicy after a big move, you don’t need to do much. Just sell smart, manage your risk, and let Theta take care of the rest.

Final Thoughts:

CE selling isn’t about catching reversals. It’s about taking advantage of overpriced options and letting time work for you.

So next time the market gives a big rally, don’t chase it. Just chill, sell smart, and let Theta kill the premium!

Do you sell options after big moves too? Share your views or setups in comments!

Rahul Pal | BD Manager @CoinW Exchange Dubai

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

Rahul Pal | BD Manager @CoinW Exchange Dubai

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。