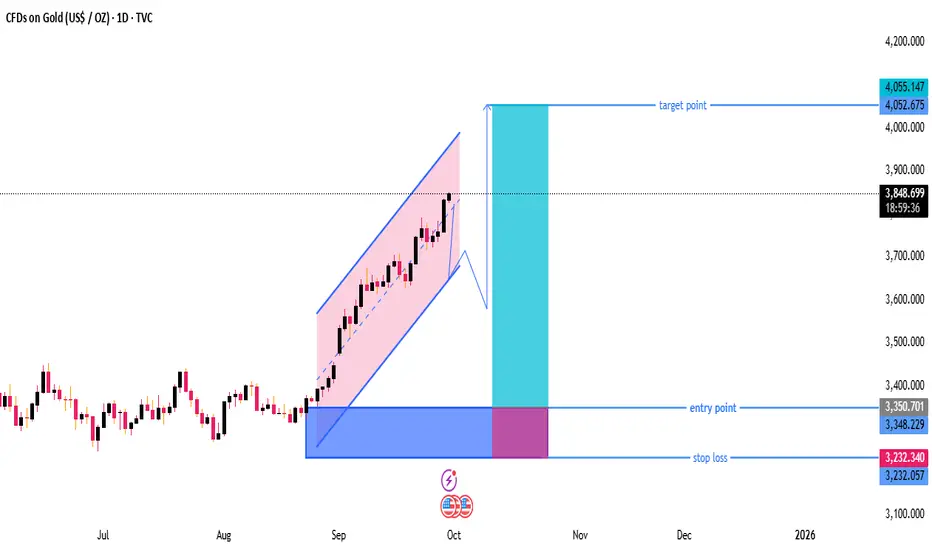

he chart shows XAU/USD (Gold) on a daily timeframe.

Price is currently trading around 3,848, within a rising parallel channel.

A possible pullback from the channel top is indicated before a move higher toward the target.

---

Key Levels & Zones

Entry Point:

Around 3,350 zone marked as the ideal buy area.

This is near the lower support region of previous consolidation.

Stop Loss:

Placed around 3,232, which is below key support.

Good for risk management — avoids staying in trade if price breaks structure.

Target Point:

Around 4,052 – 4,055, aligning with the measured move from the breakout of the channel.

This gives a strong risk-to-reward ratio (roughly 2.5:1).

---

Technical Structure

Trend: Strong uptrend – price respecting ascending channel.

Momentum: Higher highs and higher lows confirm bullish market structure.

Possible Scenario:

1. Short-term pullback expected to lower boundary or breakout retest zone.

2. Continuation move upward toward target (around 4,050).

---

Trading Plan Based on Chart

Wait for Pullback: Don’t buy at current level; price might retrace before next leg.

Enter near 3,350: Ideal long position entry point.

Stop Loss: 3,232 (safe under last swing low).

Target: 4,052–4,055 (previous high / projected channel top).

---

Summary

✅ Bias: Bullish (Buy-the-dip strategy)

📈 Entry: ~3,350

⛔ Stop Loss: ~3,232

🎯 Target: ~4,050

📊 Risk/Reward: Favorable — approx. 1:3

This setup is swing-trade friendly and follows trend continuation logic.

Price is currently trading around 3,848, within a rising parallel channel.

A possible pullback from the channel top is indicated before a move higher toward the target.

---

Key Levels & Zones

Entry Point:

Around 3,350 zone marked as the ideal buy area.

This is near the lower support region of previous consolidation.

Stop Loss:

Placed around 3,232, which is below key support.

Good for risk management — avoids staying in trade if price breaks structure.

Target Point:

Around 4,052 – 4,055, aligning with the measured move from the breakout of the channel.

This gives a strong risk-to-reward ratio (roughly 2.5:1).

---

Technical Structure

Trend: Strong uptrend – price respecting ascending channel.

Momentum: Higher highs and higher lows confirm bullish market structure.

Possible Scenario:

1. Short-term pullback expected to lower boundary or breakout retest zone.

2. Continuation move upward toward target (around 4,050).

---

Trading Plan Based on Chart

Wait for Pullback: Don’t buy at current level; price might retrace before next leg.

Enter near 3,350: Ideal long position entry point.

Stop Loss: 3,232 (safe under last swing low).

Target: 4,052–4,055 (previous high / projected channel top).

---

Summary

✅ Bias: Bullish (Buy-the-dip strategy)

📈 Entry: ~3,350

⛔ Stop Loss: ~3,232

🎯 Target: ~4,050

📊 Risk/Reward: Favorable — approx. 1:3

This setup is swing-trade friendly and follows trend continuation logic.

join my telegram channel t.me/goldmitalteamhttps://t.me/goldmitalteam

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

join my telegram channel t.me/goldmitalteamhttps://t.me/goldmitalteam

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。