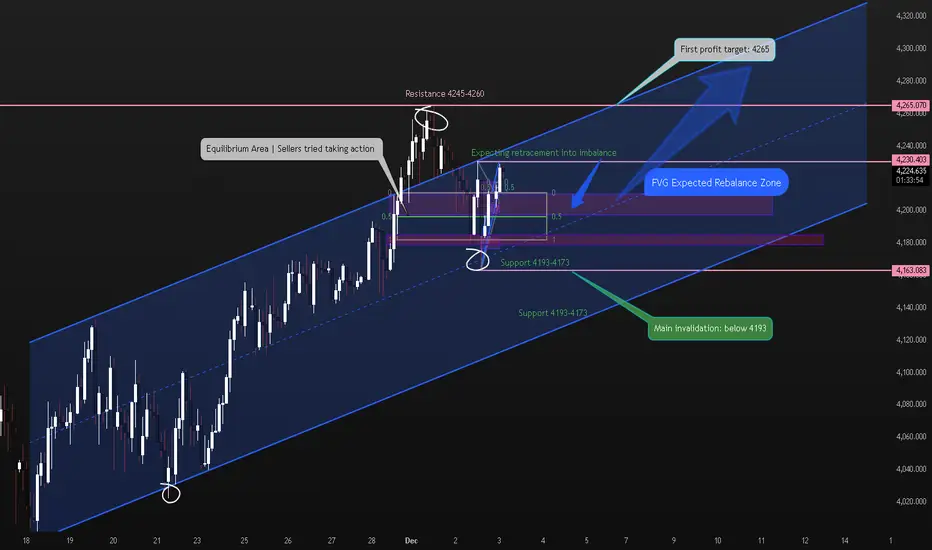

GOLD (XAUUSD) is still moving inside a clean bullish channel structure, and despite recent volatility, the trend remains firmly intact. Price is currently correcting downward and approaching a key imbalance (FVG) zone, where I expect buyers to step back in.

Even though we’ve seen a pullback from the 4,245 zone, this looks like a typical countertrend correction within bullish structure not a reversal. I’m expecting GOLD to dip slightly into the FVG layer, gather liquidity, and continue its upward movement.

📊 Macro Outlook

- Mixed US macroeconomic data continues to support a bullish scenario for gold:

- Weak US manufacturing PMI continues to signal economic slowdown.

- Higher Fed rate-cut expectations.

- Safe-haven demand remains elevated due to global uncertainty.

- Rising Treasury yields temporarily capped gold, but the bullish structure remains intact.

- With key US employment data and ISM services PMI coming this week, volatility might increase but overall momentum still favors the bulls.

Technical Breakdown

Here’s what I'm watching:

🔹 Bullish Channel Structure

Price continues to trade inside a well-defined ascending channel. Until the lower boundary breaks, bullish continuation is the higher-probability play.

🔹 FVG (Fair Value Gap) Rebalance

I expect a short-term dip into the 4205 – 4193 FVG zone.

This is a perfect area for bulls to reload positions.

🔹 Key Support Levels

- 4201 (minor reaction zone)

- 4193 – 4173 (major demand + FVG + channel midline)

- 4169 (strongest support / invalidation level)

🔹 Targets for the Upside

My bullish targets remain:

- TP1 – 4,260

- TP2 – 4,283

- TP3 – 4,300

- TP4 – 4,350

I believe GOLD can reach 4,260 fairly soon, and if momentum continues, 4,300–4,350 becomes very realistic.

My Trade Plan (Not Financial Advice)

Bias: Long

Entry:

Looking for buys inside the 4205–4193 FVG zone

or

On bullish confirmation from the channel midline

Stop-loss:

SL: 4169

or

Secondary SL: 4180

Take-profit targets:

- TP1: 4260

- TP2: 4283

- TP3: 4300

- TP4: 4350

As long as price stays above 4170 and holds the FVG, bullish continuation remains the main scenario.

Summary

Gold looks good for another bullish leg.

I expect a controlled retracement into the FVG followed by a continuation toward 4260 and above.

What's everyone's ideas??

Send them in the comments so we can chat :)

Trade safe,

– JackOfAllTrades

交易开始

Trade Still Active & Playing Out as ExpectedPrice attempted to sweep the lower FVG / demand zone but failed to achieve a full close below it. This shows buyers are still defending the zone and treating it as a short-term imbalance that needed rebalancing rather than a breakdown.

After the failed sweep, price pushed back upward and is now trading inside the mid-FVG, which is exactly the type of behavior expected in a consolidation before continuation.

At the moment:

Sweep attempt into lower FVG rejected , bullish sign

Price pulled back into mid FVG for rebalancing

Currently forming consolidation between the two FVG zones

Structure remains intact inside the ascending channel

No invalidation touched, bullish continuation still on the table

If price continues to hold above the mid-range and defend the channel, I expect accumulation and displacement as liquidity builds on both sides.

A breakout could occur quickly once this compression is complete.

I’ll keep monitoring the reaction around the FVG cluster and update again if structure changes.

#1 Full Stack AI Trading Community — jackofalltrades.vip | 2026: The Era of AI Trading Mastery📈 AI Automation • AI Trading Bots • Indicators • Strategies • Limitless Potential • Institutional Grade Products • t.me/jackofalltradesvip

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

#1 Full Stack AI Trading Community — jackofalltrades.vip | 2026: The Era of AI Trading Mastery📈 AI Automation • AI Trading Bots • Indicators • Strategies • Limitless Potential • Institutional Grade Products • t.me/jackofalltradesvip

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。