Step 1: Identify the Trend

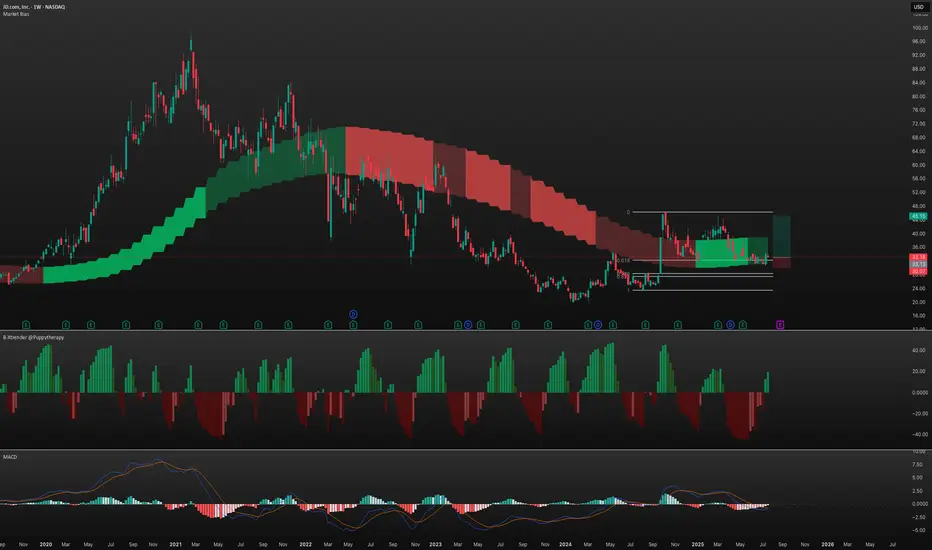

* Weekly Chart:

* Dark green, price still in the market bias zone (discount zone).

* Bullish trend but not actively expanding yet.

* Daily Chart:

* Dark red, price below the market bias zone.

* Bearish trend but not actively contracting.

Step 2: Identify the Mode

* Compression: April 25 – mid-July 2025.

* Breakout: JD closed above the recent high on July 18, indicating early expansion.

Step 3: Confirm Bullish Accumulation (BX Trender)

* Weekly Chart: Bullish accumulation confirmed, with higher highs since week of July 14.

* Daily Chart: Use for entry timing and share accumulation.

Step 4: Entry Zones

* Institutional Buy Zone: $28.5 – $32.0 (Fib retracement from swing low to high).

* Smart Money Zone: $27.5 – $28.4 (deeper liquidity zone).

Step 5: Take Profit

* 1st Target: 50% at $45(EQ high).

* 2nd Target: Let the rest ride until BX turns red.

* Point of Control (POC): Around $34.

Step 6: Stop Loss

* Below Monthly Market Bias: Around $30 (conservative protection).

JD Trade Setup

* Entry: $28.5 – $32.0

* Stop: ~$30

* 1st TP: $45

* 2nd TP: Trail with BX trender

* Bias: Bullish accumulation phase; early expansion signal confirmed.

Disclaimer: The information provided is for informational and educational purposes only and should not be considered financial advice. Always conduct your own research or consult with a licensed financial advisor before making any investment decisions.

注释

please feel free to comment, let me know what you think or if you notice any mistakes or errors.免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。