Hello Traders!

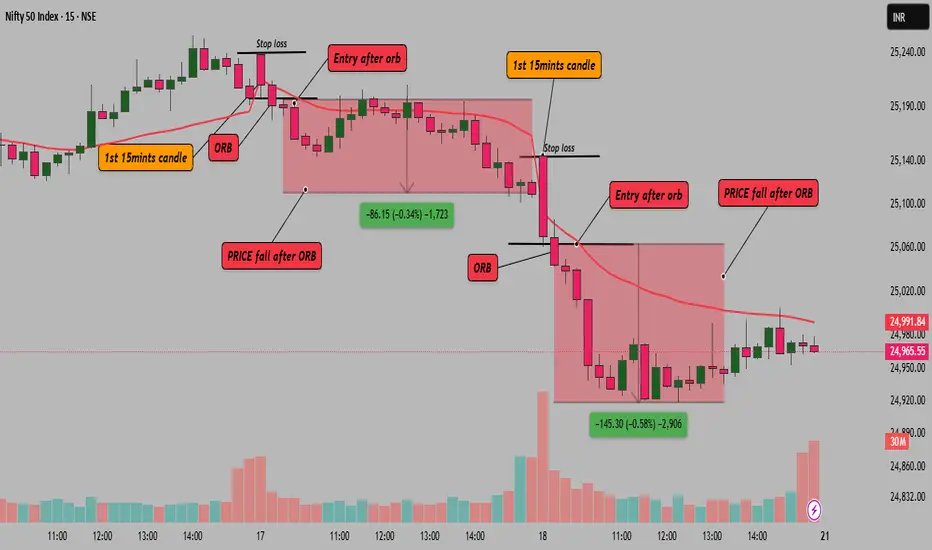

Today, let’s explore one of the most reliable setups for intraday traders – the Opening Range Breakdown (ORB). This strategy is widely used by professional traders to catch early downside momentum when the market shows weakness right after opening. If executed correctly, it offers quick profits and tight risk management. Let’s break down how it works and how to trade it with confidence.

What is Opening Range Breakdown (ORB)?

The ORB strategy focuses on the first 15 to 30 minutes of market open. The idea is to mark the high and low of this initial range and look for a breakdown below the low – which signals bearish pressure. This setup works best on volatile days or when there’s negative sentiment in global cues.

Ideal Conditions for ORB

Risk Management Tip

Keep your position size small and risk predefined. Don’t chase entries. Let the candle confirm the breakdown and only then execute.

Conclusion:

ORB is a favourite among experienced traders due to its simplicity and effectiveness. If you’re an intraday bear looking for high-probability setups, Opening Range Breakdown is something you must master.

Have you used ORB before? Let me know your experience or results in the comments!

Today, let’s explore one of the most reliable setups for intraday traders – the Opening Range Breakdown (ORB). This strategy is widely used by professional traders to catch early downside momentum when the market shows weakness right after opening. If executed correctly, it offers quick profits and tight risk management. Let’s break down how it works and how to trade it with confidence.

What is Opening Range Breakdown (ORB)?

The ORB strategy focuses on the first 15 to 30 minutes of market open. The idea is to mark the high and low of this initial range and look for a breakdown below the low – which signals bearish pressure. This setup works best on volatile days or when there’s negative sentiment in global cues.

- Mark the Opening Range:

Track the high and low of the first 15 or 30 minutes of the market open. - Wait for a Breakdown Candle:

Look for a strong bearish candle closing below the opening range low with rising volume. - Enter on Confirmation:

Take a short entry just below the breakdown candle with stop-loss above the opening range high. - Target Previous Day’s Support or VWAP:

Your exit target could be based on previous day’s support, VWAP, or risk-reward ratio like 1:2. - Volume Confirmation is Key:

Avoid low volume breakdowns. Strong volume is what separates real breakdowns from fake-outs.

Ideal Conditions for ORB

- Gap Down Open or Weak Global Cues – ORB works well when sentiment is already negative.

- High Beta Stocks or Indices like BankNifty – These respond sharply to breakdowns.

- No Major Support Below the Breakdown Level – Clean charts increase trade reliability.

Risk Management Tip

Keep your position size small and risk predefined. Don’t chase entries. Let the candle confirm the breakdown and only then execute.

Conclusion:

ORB is a favourite among experienced traders due to its simplicity and effectiveness. If you’re an intraday bear looking for high-probability setups, Opening Range Breakdown is something you must master.

Have you used ORB before? Let me know your experience or results in the comments!

Rahul Pal | BD Manager @CoinW Exchange Dubai

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

Rahul Pal | BD Manager @CoinW Exchange Dubai

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

Helping KOLs, Partners earn up to 70% rebate

Recommended Broker: tinyurl.com/RahulCoinW

Free Telegram: spf.bio/c1lkb

Website:realbullstrading.com

Signals:wa.me/919560602464

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。