Good morning,

"The best strategy with the current market is rotation" - Tim West (Not going to tag him personally but he does have a wealth of knowledge in the Key Hidden Levels chat room.

Moving on.

Its interesting I read that this morning in the chat room. I like TMF as a hedge against the potential downside risk of

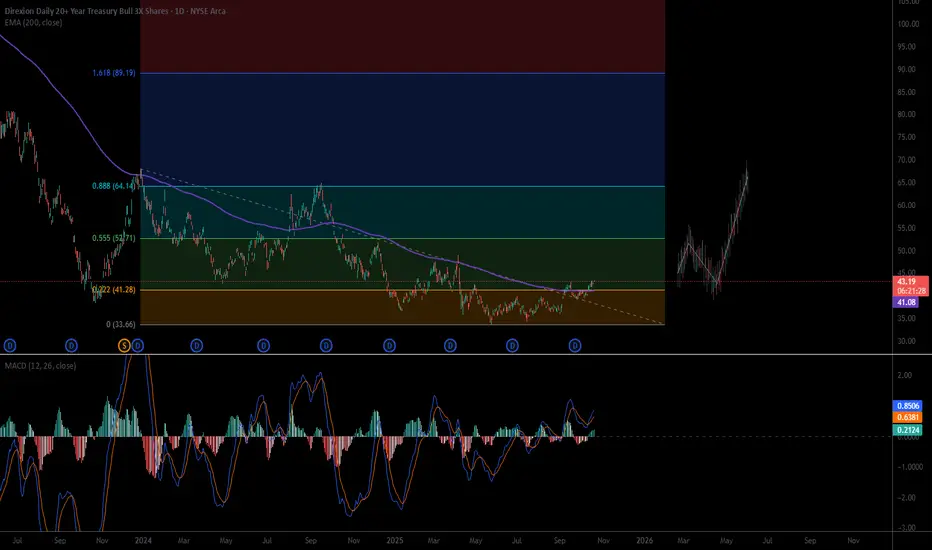

TMF as a hedge against the potential downside risk of  VOO and other large-cap ETF's. Price has retraced just under 90% since the COVID peak for $TMF. I took profits on all of my ETF's at the recent peak. Personally, I like the guaranteed 4-5% yield to park half of my portfolio, leaving the other half in cash ready to attack

VOO and other large-cap ETF's. Price has retraced just under 90% since the COVID peak for $TMF. I took profits on all of my ETF's at the recent peak. Personally, I like the guaranteed 4-5% yield to park half of my portfolio, leaving the other half in cash ready to attack  VOO on the next retracement.

VOO on the next retracement.

If we were to have another catastrophic event such as COVID, or even a major war (thinking big picture here), the upside potential is enormous. Regardless of the government shutdown, treasury bills remain one of the safest investments today. First target is the 0.888 Fibonacci.

888 = abundance

Alex

"The best strategy with the current market is rotation" - Tim West (Not going to tag him personally but he does have a wealth of knowledge in the Key Hidden Levels chat room.

Moving on.

Its interesting I read that this morning in the chat room. I like

If we were to have another catastrophic event such as COVID, or even a major war (thinking big picture here), the upside potential is enormous. Regardless of the government shutdown, treasury bills remain one of the safest investments today. First target is the 0.888 Fibonacci.

888 = abundance

Alex

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。