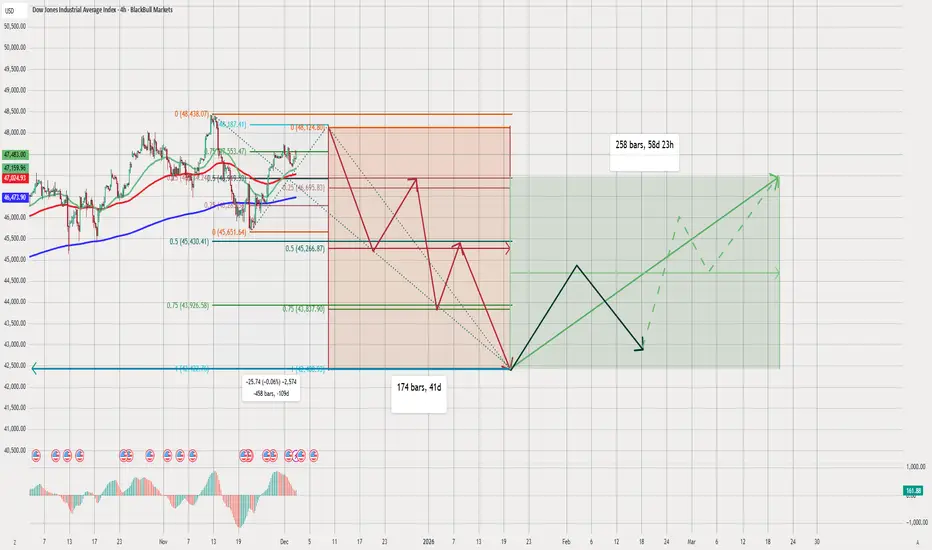

US30 (Dow Jones) Technical Analysis – 4H Chart

chart shows a well-structured bearish scenario, followed by a medium-term bullish reversal setup. combining Fibonacci retracement levels, time cycles, moving averages, and projected wave paths to map the market direction.

Below is a detailed breakdown:

1️⃣ Current Market Structure

Price recently reached a local top near 48,127.

After this, the chart suggests expect a significant downward correction.

Price is fluctuating above the:

Green MA (short-term)

Red MA (medium-term)

Blue 200 MA (long-term)

projected path shows a breakdown below these moving averages soon.

2️⃣ Fibonacci Levels (Important Zones)

From the recent high, your Fibonacci retracement levels are:

0.25 → 46,699

0.5 → 45,274

0.75 → 43,950

These levels align with your expected downward waves.

Major Support Zone

Large green zone near 41,700 – 42,200

This is where your final bearish wave ends

It also overlaps with a long-term Fibonacci cluster

This suggests it is the target bottom of the correction.

3️⃣ Bearish Projection (Red Wave Path)

chart shows multiple downward swings:

Initial drop from 48,127 → 45,274

Bounce to retest resistance

Deeper decline toward 44,000 – 43,500

Another bounce

Final capitulation to 41,700

🟥 Final Bearish Target:

~41,700

This matches the blue horizontal support line.

🔹 Duration of Bearish Cycle

174 bars (~41 days)

This suggests the decline completes around late January 2026.

4️⃣ Bullish Reversal Phase (Green + Black Path)

After reaching the bottom around 41,700, your chart shows two phases:

Phase 1 – Strong Rebound (Black Path)

A sharp rally into early February:

First rally to around 44,500 – 45,000

Short-term pullback

Then continuation higher

Phase 2 – Trend Recovery (Green Path)

Long-term green path shows:

A steady upward channel

Price aiming toward 48,000 – 49,000 again

The green dotted lines show alternative bullish scenarios

🔹 Total Recovery Time

258 bars (~58 days)

Targeting mid-March 2026 for a full recovery.

5️⃣ Interpretation of Moving Averages

Price will break below the moving averages during the correction.

Long-term recovery will push back above the:

50 MA (green)

100 MA (red)

200 MA (blue)

This confirms a trend reversal after the bottom is hit.

6️⃣ Summary of Your Outlook

📉 Short-Term Bias: Bearish

Price expected to drop from the top

Multiple lower highs / lower lows

Target bottom: 41,700

📉 Medium-Term Bias: Consolidation & Reversal

Strong bounce after the bottom

Wave structure suggests accumulation

📈 Long-Term Bias: Bullish

Recovery back toward all-time highs

Market structure returns to an uptrend by March 2026

✔️ Final Conclusion

chart suggests a full cycle:

Top formation near 48,127

Multi-wave decline (target 41,700)

41-day bearish cycle

Strong bullish reversal

Full recovery within ~58 days

This is a very clean Elliott-wave-style projection supported by Fibonacci and time cycles.

chart shows a well-structured bearish scenario, followed by a medium-term bullish reversal setup. combining Fibonacci retracement levels, time cycles, moving averages, and projected wave paths to map the market direction.

Below is a detailed breakdown:

1️⃣ Current Market Structure

Price recently reached a local top near 48,127.

After this, the chart suggests expect a significant downward correction.

Price is fluctuating above the:

Green MA (short-term)

Red MA (medium-term)

Blue 200 MA (long-term)

projected path shows a breakdown below these moving averages soon.

2️⃣ Fibonacci Levels (Important Zones)

From the recent high, your Fibonacci retracement levels are:

0.25 → 46,699

0.5 → 45,274

0.75 → 43,950

These levels align with your expected downward waves.

Major Support Zone

Large green zone near 41,700 – 42,200

This is where your final bearish wave ends

It also overlaps with a long-term Fibonacci cluster

This suggests it is the target bottom of the correction.

3️⃣ Bearish Projection (Red Wave Path)

chart shows multiple downward swings:

Initial drop from 48,127 → 45,274

Bounce to retest resistance

Deeper decline toward 44,000 – 43,500

Another bounce

Final capitulation to 41,700

🟥 Final Bearish Target:

~41,700

This matches the blue horizontal support line.

🔹 Duration of Bearish Cycle

174 bars (~41 days)

This suggests the decline completes around late January 2026.

4️⃣ Bullish Reversal Phase (Green + Black Path)

After reaching the bottom around 41,700, your chart shows two phases:

Phase 1 – Strong Rebound (Black Path)

A sharp rally into early February:

First rally to around 44,500 – 45,000

Short-term pullback

Then continuation higher

Phase 2 – Trend Recovery (Green Path)

Long-term green path shows:

A steady upward channel

Price aiming toward 48,000 – 49,000 again

The green dotted lines show alternative bullish scenarios

🔹 Total Recovery Time

258 bars (~58 days)

Targeting mid-March 2026 for a full recovery.

5️⃣ Interpretation of Moving Averages

Price will break below the moving averages during the correction.

Long-term recovery will push back above the:

50 MA (green)

100 MA (red)

200 MA (blue)

This confirms a trend reversal after the bottom is hit.

6️⃣ Summary of Your Outlook

📉 Short-Term Bias: Bearish

Price expected to drop from the top

Multiple lower highs / lower lows

Target bottom: 41,700

📉 Medium-Term Bias: Consolidation & Reversal

Strong bounce after the bottom

Wave structure suggests accumulation

📈 Long-Term Bias: Bullish

Recovery back toward all-time highs

Market structure returns to an uptrend by March 2026

✔️ Final Conclusion

chart suggests a full cycle:

Top formation near 48,127

Multi-wave decline (target 41,700)

41-day bearish cycle

Strong bullish reversal

Full recovery within ~58 days

This is a very clean Elliott-wave-style projection supported by Fibonacci and time cycles.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。