We got the SNB central bank rate decision later on today. Switzerland YoY inflation is in negative territory at -0.10%.

https://tradingeconomics.com/switzerland/inflation-cpi

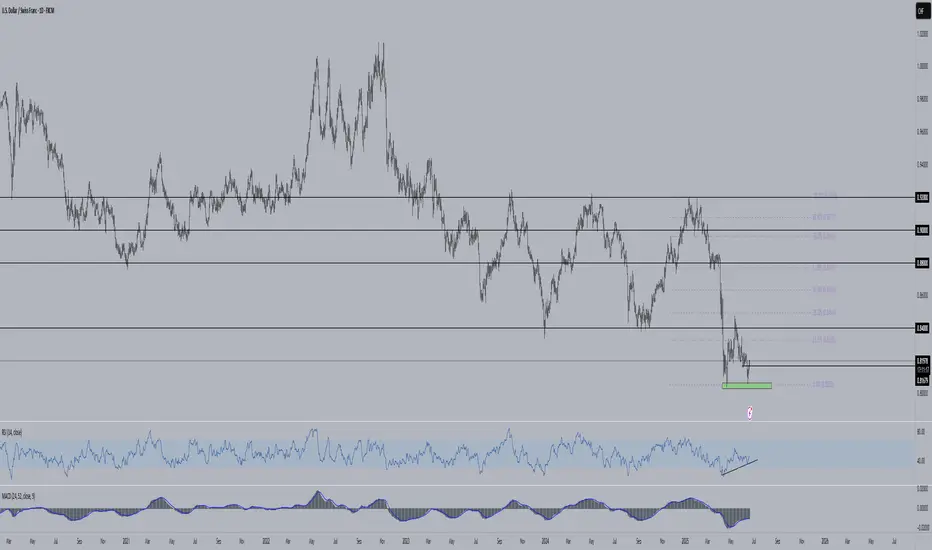

The strength of the CHF is an issue for the SNB. They are scheduled to cut rate by 25 BPS (to 0.0%) with a probability of 77% but there is 23% chance of a 50 BPS cut (to -0.25%) which would be very dovish for the Swiss Franc.

If we get a surprise 50 BPS cut, I will get into USDCHF long.

The negative is pretty much priced in for the USD. The economy is holding and the Fed is expecting a surge in inflation from tariffs.

https://ibb.co/jqKhsqC

Here is the 2Y/10Y Yield differentials on USDCHF. It is pointing to the upside.

The biggest risk for the trade is of course risk off sentiment from the war in the middle east. If US gets involve, we could see some flow in the CHF but USD could see some flow too.

Pay close attention to the SNB meeting later.

https://tradingeconomics.com/switzerland/inflation-cpi

The strength of the CHF is an issue for the SNB. They are scheduled to cut rate by 25 BPS (to 0.0%) with a probability of 77% but there is 23% chance of a 50 BPS cut (to -0.25%) which would be very dovish for the Swiss Franc.

If we get a surprise 50 BPS cut, I will get into USDCHF long.

The negative is pretty much priced in for the USD. The economy is holding and the Fed is expecting a surge in inflation from tariffs.

https://ibb.co/jqKhsqC

Here is the 2Y/10Y Yield differentials on USDCHF. It is pointing to the upside.

The biggest risk for the trade is of course risk off sentiment from the war in the middle east. If US gets involve, we could see some flow in the CHF but USD could see some flow too.

Pay close attention to the SNB meeting later.

订单已取消

SNB cut by 25 BPS and didn't mention the possibility of going into negative rate. No trade for me as I was only looking to short the CHF免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。