Market Overview

Gold (XAUUSD) has just witnessed a shocking $70+ rally, sparking intense volatility across global markets.

Rising geopolitical tensions are driving safe-haven demand to the extreme, making gold the centre of attention worldwide.

In this highly tense and unpredictable environment, every entry decision could be a make-or-break moment for traders.

🔎 Macro Outlook

🌍 Geopolitical risks → Money continues to flow into gold as a safe haven.

💵 USD & bond yields are not strong enough to halt the momentum.

📊 Upcoming PCE data & Fed policy decisions could inject even more volatility.

📊 Technical Outlook (H4)

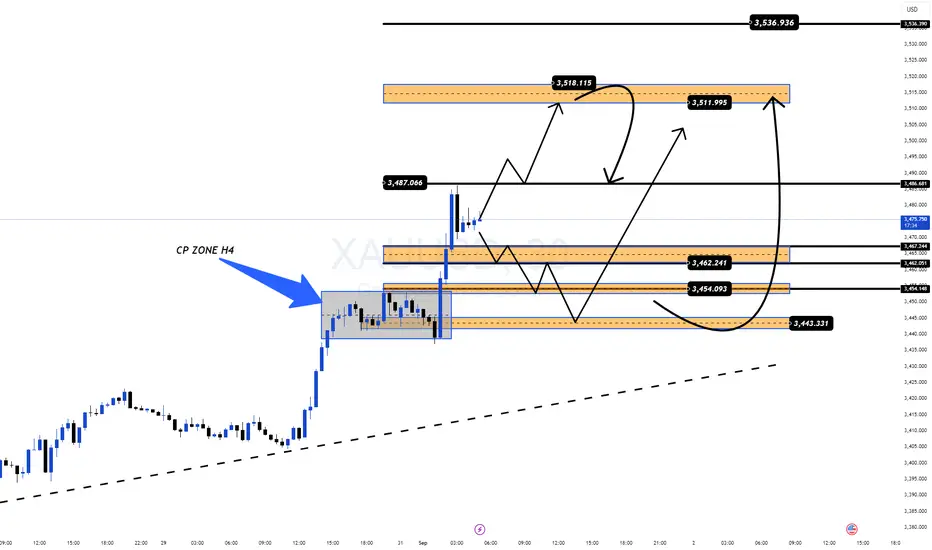

After the explosive rally, gold consolidated within CP Zone H4 before breaking out higher.

Key Support Zones

3,462 – 3,443 → Critical levels to sustain the bullish structure.

Key Resistance Zones

3,487 – 3,518 → Possible reaction area before correction.

A breakout could open the path to 3,536 and beyond.

📌 Possible Scenarios

Scenario 1 (Preferred)

✅ Price holds above 3,462 → Tests 3,511 – 3,518 and potentially breaks towards 3,536.

Scenario 2 (Deeper Pullback)

⚠️ If 3,462 fails → Price may retest 3,443 before regaining upward momentum.

🎯 Trading Plan (Reference Only)

✅ BUY ZONE 1

Entry: 3453 – 3451

SL: 3446

TP: 3460 – 3465 – 3470 – 3475 – 3480 – ???

✅ BUY ZONE 2

Entry: 3444 – 3442

SL: 3438

TP: 3450 – 3460 – 3470 – 3480 – ???

❌ SELL ZONE

Entry: 3512 – 3514

SL: 3518

TP: 3505 – 3500 – 3495 – 3490 – 3480 – 3470

💡 Final Thoughts

Gold remains in a strong uptrend, fuelled by geopolitical risk and macro flows.

Yet after such an aggressive move, a technical correction is highly likely.

Traders should carefully monitor price action around support/resistance zones for optimal entries.

❗ Most importantly: stick to risk management & Stop Loss discipline – in markets like this, survival comes before profit.

Gold (XAUUSD) has just witnessed a shocking $70+ rally, sparking intense volatility across global markets.

Rising geopolitical tensions are driving safe-haven demand to the extreme, making gold the centre of attention worldwide.

In this highly tense and unpredictable environment, every entry decision could be a make-or-break moment for traders.

🔎 Macro Outlook

🌍 Geopolitical risks → Money continues to flow into gold as a safe haven.

💵 USD & bond yields are not strong enough to halt the momentum.

📊 Upcoming PCE data & Fed policy decisions could inject even more volatility.

📊 Technical Outlook (H4)

After the explosive rally, gold consolidated within CP Zone H4 before breaking out higher.

Key Support Zones

3,462 – 3,443 → Critical levels to sustain the bullish structure.

Key Resistance Zones

3,487 – 3,518 → Possible reaction area before correction.

A breakout could open the path to 3,536 and beyond.

📌 Possible Scenarios

Scenario 1 (Preferred)

✅ Price holds above 3,462 → Tests 3,511 – 3,518 and potentially breaks towards 3,536.

Scenario 2 (Deeper Pullback)

⚠️ If 3,462 fails → Price may retest 3,443 before regaining upward momentum.

🎯 Trading Plan (Reference Only)

✅ BUY ZONE 1

Entry: 3453 – 3451

SL: 3446

TP: 3460 – 3465 – 3470 – 3475 – 3480 – ???

✅ BUY ZONE 2

Entry: 3444 – 3442

SL: 3438

TP: 3450 – 3460 – 3470 – 3480 – ???

❌ SELL ZONE

Entry: 3512 – 3514

SL: 3518

TP: 3505 – 3500 – 3495 – 3490 – 3480 – 3470

💡 Final Thoughts

Gold remains in a strong uptrend, fuelled by geopolitical risk and macro flows.

Yet after such an aggressive move, a technical correction is highly likely.

Traders should carefully monitor price action around support/resistance zones for optimal entries.

❗ Most importantly: stick to risk management & Stop Loss discipline – in markets like this, survival comes before profit.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。