Market View:

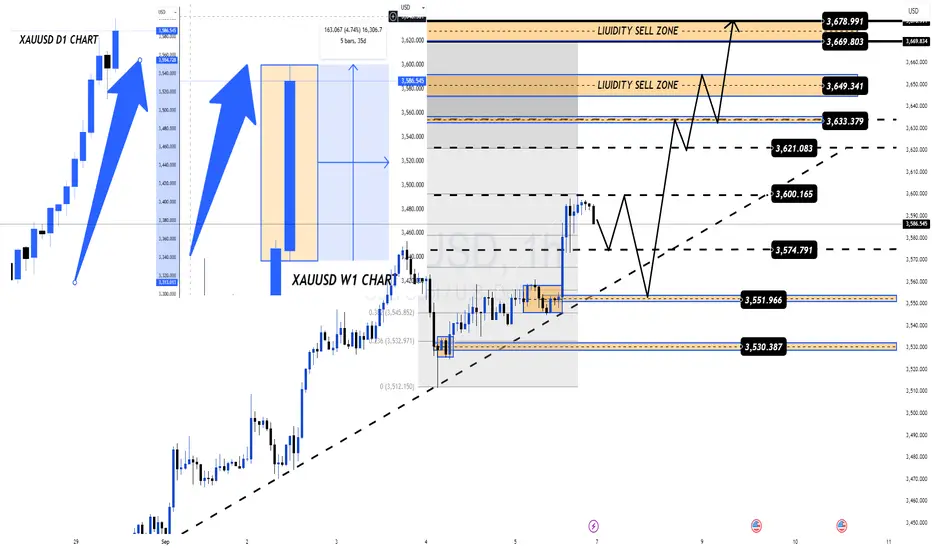

Gold (XAUUSD) finished the week with strong momentum after Nonfarm pushed price close to $3600/oz ATH. On the daily chart, the candle closed almost full body (only ~30% wick), showing no profit-taking yet. The weekly chart is also strongly bullish – confirming that buyers are in control. This signals more upside likely in the coming week and month.

Key US Events This Week:

Wed, Sep 10: Core PPI & PPI m/m → If higher than expected, USD may strengthen short-term, creating pressure on gold.

Thu, Sep 11: CPI (Core, m/m, y/y) + Jobless Claims → the most important release. Lower CPI + higher claims = bullish for gold. Higher CPI = hawkish Fed = pressure.

Fri, Sep 12: UoM Consumer Sentiment & Inflation Expectations → could shift Fed outlook further.

👉 Fundamentals may bring volatility, but overall medium-term trend remains bullish.

Technical Outlook (H1 Chart):

After the Nonfarm breakout, gold is consolidating sideways. Levels to watch:

Support: 3574 – 3551 – 3530 – 3516

Resistance: 3600 – 3621 – 3633 – 3649 – 3669 – 3678

Trading Plan:

BUY bias (preferred):

Long on dips near 3574–3550

SL: below 3530

TP: 3600 → 3621 → 3633 → 3649 → 3669 → 3678

SELL scalp (alternative):

Only if 3530 breaks with strong CPI surprise → target 3516/3527

Summary:

✅ Gold stays in a strong uptrend on Daily & Weekly charts. Macro factors support more upside if inflation keeps easing.

👉 Watch 3592 (bullish trigger) and 3575 (bearish trigger) as the key decision levels.

Follow MMFLOW TRADING for daily plans and quick updates.

Gold (XAUUSD) finished the week with strong momentum after Nonfarm pushed price close to $3600/oz ATH. On the daily chart, the candle closed almost full body (only ~30% wick), showing no profit-taking yet. The weekly chart is also strongly bullish – confirming that buyers are in control. This signals more upside likely in the coming week and month.

Key US Events This Week:

Wed, Sep 10: Core PPI & PPI m/m → If higher than expected, USD may strengthen short-term, creating pressure on gold.

Thu, Sep 11: CPI (Core, m/m, y/y) + Jobless Claims → the most important release. Lower CPI + higher claims = bullish for gold. Higher CPI = hawkish Fed = pressure.

Fri, Sep 12: UoM Consumer Sentiment & Inflation Expectations → could shift Fed outlook further.

👉 Fundamentals may bring volatility, but overall medium-term trend remains bullish.

Technical Outlook (H1 Chart):

After the Nonfarm breakout, gold is consolidating sideways. Levels to watch:

Support: 3574 – 3551 – 3530 – 3516

Resistance: 3600 – 3621 – 3633 – 3649 – 3669 – 3678

Trading Plan:

BUY bias (preferred):

Long on dips near 3574–3550

SL: below 3530

TP: 3600 → 3621 → 3633 → 3649 → 3669 → 3678

SELL scalp (alternative):

Only if 3530 breaks with strong CPI surprise → target 3516/3527

Summary:

✅ Gold stays in a strong uptrend on Daily & Weekly charts. Macro factors support more upside if inflation keeps easing.

👉 Watch 3592 (bullish trigger) and 3575 (bearish trigger) as the key decision levels.

Follow MMFLOW TRADING for daily plans and quick updates.

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

⚜️Trade with Money Market Flow, logic, Price action

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

🔥Live Market Updates-Realtime Trading Plans & Signal

t.me/+vpD6XCC9jP05ZDQ1

⚜️Risk Reward 1.3 to 2.5...

⚜️Daily 8 to 16 Signals VIP

MMFLOW gives you precision entries & BIGWIN profits

相关出版物

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。