INVITE-ONLY SCRIPT

Swing + 3-Bar Breakout(Mastersinnifty)

Overview

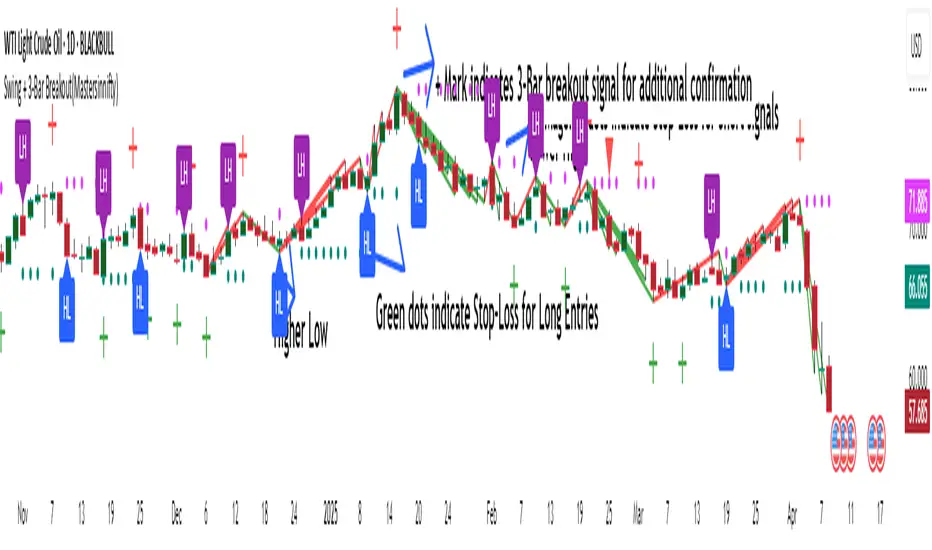

This script is a hybrid trading tool combining swing-based structural analysis, momentum filtering, and breakout validation — designed to detect early reversals and confirm trend continuations within a single unified system.

It integrates five major components:

- ZigZag Structural Detection — to identify critical swing highs and lows.

- Momentum Validation — using RSI and Rate of Change (ROC) to confirm the strength behind swings.

- Three-Bar Breakout Confirmation — spotting trend continuation beyond swing structures.

- Dynamic Trailing Stop System — managing trades adaptively via ATR-based trailing stops.

- Projected Target Levels — estimating future price destinations based on measured swings.

---

What Makes This Script Unique

Rather than using standard indicators in isolation, this script layers multiple conditions sequentially and contextually:

- Structural Foundation: Identifies pivots through a tight ZigZag algorithm tuned with a low-depth setting for early detection.

- Momentum Checkpoint: Validates pivots only if RSI extremes and ROC momentum surges align, reducing false breakouts during sideways movements.

- Breakout Validation: Confirms trend continuation when price breaches critical multi-bar highs/lows post-swing formation.

- Risk-Managed Progression: Initiates adaptive ATR-based trailing stops immediately after signal generation, tightening risk dynamically as trends unfold.

- Target Projection: Estimates potential move size by projecting the magnitude of the last completed swing, offering realistic price milestones.

This combination provides a dual-purpose tool for both reversals and breakouts, allowing flexible trading styles within a single indicator.

---

How the Script Works

- Swing Detection

- A swing low is identified when a price bottom forms (via ZigZag) and momentum conditions are met (RSI < 20, ROC > +0.5).

- A swing high is identified when a price top forms and momentum conditions are met (RSI > 80, ROC < -0.5).

- Breakout Confirmation

- After a swing is detected, if price crosses above/below a three-bar swing structure, a secondary breakout signal is triggered.

- Trailing Stop Activation:

- Upon a confirmed swing or breakout, an ATR-multiplied trailing stop is initialized below/above the entry point to secure profits dynamically.

- Projection Logic

- Swing height is measured from the latest high-low sequence, and potential future targets are plotted for visual guidance.

---

Who Can Benefit From This Indicator

- Swing Traders — who seek early entries around reversal zones.

- Scalpers & Intraday Traders — needing fast-reacting momentum-based confirmation.

- Breakout Traders — to time entries after multi-bar compressions.

- Risk Managers — through integrated ATR trailing stops for dynamic exit management.

- Price Action Analysts — utilizing projected swing targets for strategic planning.

---

How to Use

- Entry Identification

- Look for buy signals at swing lows with strong positive momentum.

- Look for sell signals at swing highs with strong negative momentum.

- Use breakout confirmations to validate the trend continuation beyond swings.

- Risk Management

- Monitor trailing stop lines to track trade health.

- Watch projected targets to anticipate realistic move completions.

- Chart Visibility

- All plotted points, breakout markers, trailing stops, and projected levels are generated automatically for clarity.

---

Disclaimer

This script is intended for educational and analytical purposes only.

It does not constitute financial advice, and past performance does not guarantee future results.

All trading involves risk. Users are responsible for their own trading decisions.

This script is a hybrid trading tool combining swing-based structural analysis, momentum filtering, and breakout validation — designed to detect early reversals and confirm trend continuations within a single unified system.

It integrates five major components:

- ZigZag Structural Detection — to identify critical swing highs and lows.

- Momentum Validation — using RSI and Rate of Change (ROC) to confirm the strength behind swings.

- Three-Bar Breakout Confirmation — spotting trend continuation beyond swing structures.

- Dynamic Trailing Stop System — managing trades adaptively via ATR-based trailing stops.

- Projected Target Levels — estimating future price destinations based on measured swings.

---

What Makes This Script Unique

Rather than using standard indicators in isolation, this script layers multiple conditions sequentially and contextually:

- Structural Foundation: Identifies pivots through a tight ZigZag algorithm tuned with a low-depth setting for early detection.

- Momentum Checkpoint: Validates pivots only if RSI extremes and ROC momentum surges align, reducing false breakouts during sideways movements.

- Breakout Validation: Confirms trend continuation when price breaches critical multi-bar highs/lows post-swing formation.

- Risk-Managed Progression: Initiates adaptive ATR-based trailing stops immediately after signal generation, tightening risk dynamically as trends unfold.

- Target Projection: Estimates potential move size by projecting the magnitude of the last completed swing, offering realistic price milestones.

This combination provides a dual-purpose tool for both reversals and breakouts, allowing flexible trading styles within a single indicator.

---

How the Script Works

- Swing Detection

- A swing low is identified when a price bottom forms (via ZigZag) and momentum conditions are met (RSI < 20, ROC > +0.5).

- A swing high is identified when a price top forms and momentum conditions are met (RSI > 80, ROC < -0.5).

- Breakout Confirmation

- After a swing is detected, if price crosses above/below a three-bar swing structure, a secondary breakout signal is triggered.

- Trailing Stop Activation:

- Upon a confirmed swing or breakout, an ATR-multiplied trailing stop is initialized below/above the entry point to secure profits dynamically.

- Projection Logic

- Swing height is measured from the latest high-low sequence, and potential future targets are plotted for visual guidance.

---

Who Can Benefit From This Indicator

- Swing Traders — who seek early entries around reversal zones.

- Scalpers & Intraday Traders — needing fast-reacting momentum-based confirmation.

- Breakout Traders — to time entries after multi-bar compressions.

- Risk Managers — through integrated ATR trailing stops for dynamic exit management.

- Price Action Analysts — utilizing projected swing targets for strategic planning.

---

How to Use

- Entry Identification

- Look for buy signals at swing lows with strong positive momentum.

- Look for sell signals at swing highs with strong negative momentum.

- Use breakout confirmations to validate the trend continuation beyond swings.

- Risk Management

- Monitor trailing stop lines to track trade health.

- Watch projected targets to anticipate realistic move completions.

- Chart Visibility

- All plotted points, breakout markers, trailing stops, and projected levels are generated automatically for clarity.

---

Disclaimer

This script is intended for educational and analytical purposes only.

It does not constitute financial advice, and past performance does not guarantee future results.

All trading involves risk. Users are responsible for their own trading decisions.

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系MastersinMarkets。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

To request access to this script, please contact us privately at mastersinnifty@gmail.com

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

仅限邀请脚本

只有作者授权的用户才能访问此脚本。您需要申请并获得使用许可。通常情况下,付款后即可获得许可。更多详情,请按照下方作者的说明操作,或直接联系MastersinMarkets。

TradingView不建议您付费购买或使用任何脚本,除非您完全信任其作者并了解其工作原理。您也可以在我们的社区脚本找到免费的开源替代方案。

作者的说明

To request access to this script, please contact us privately at mastersinnifty@gmail.com

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。