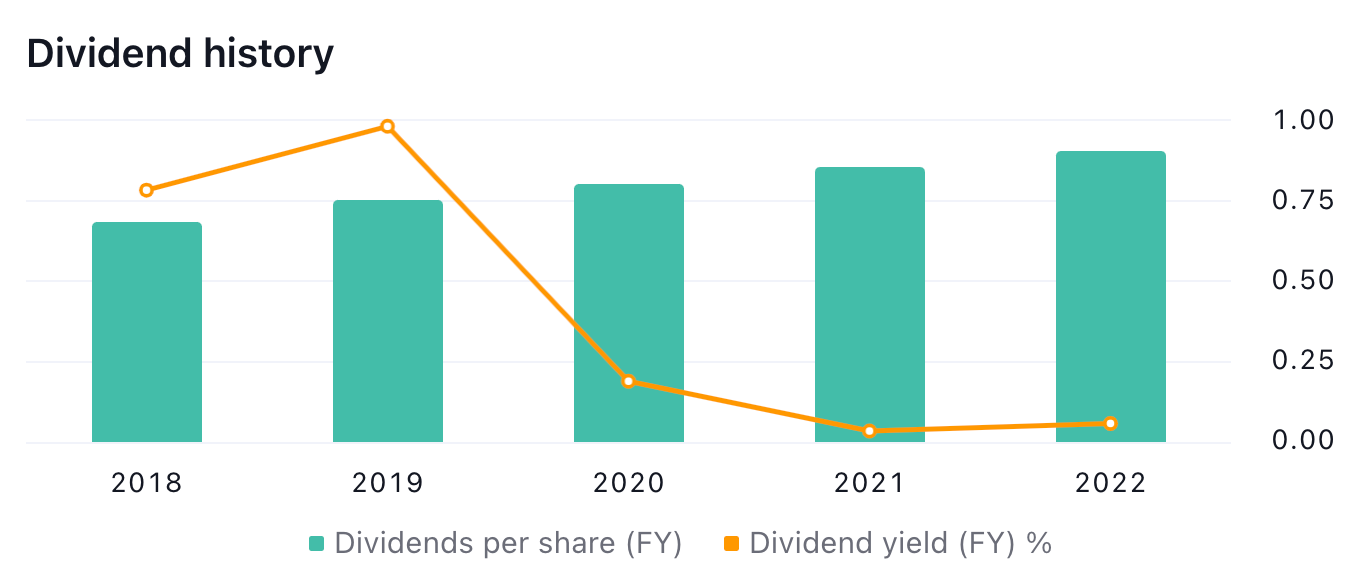

股息历史

股息政策是公司遵循的一套指导方针,用于决定向股东支付多少收益。股息政策主要有四种类型:固定股息政策、渐进股息政策、目标股息政策和剩余股息政策。

固定股息政策意味着公司每年支付固定数额的每股股息,无论其收益或市场状况如何。这项政策向投资者传达了稳定和信心的信号,但也可能限制公司投资增长机会或应对财务困境的能力。

渐进股息政策意味着公司每年以稳定的速度增加每股股息,通常与通货膨胀或收益增长保持一致。这项政策也向投资者传达了稳定和信心的信号,但它允许公司保留部分收益用于再投资或减债。

目标股息政策意味着公司每年支付一定比例的收益作为股息,根据盈利能力调整每股股息数额。这项政策使股东和管理人员的利益保持一致,因为两者都受益于更高的收益和股息。然而,这种政策也可能导致股息波动,这取决于商业周期和市场条件。

剩余股息政策意味着公司只有在满足资本预算和融资需求后才支付股息。该政策意味着股息是在投资所有正净现值项目并保持最佳资本结构后支付给股东的剩余或剩余部分。该政策最大化了公司的价值,但也可能让那些喜欢稳定和可预测股息的投资者失望。

股息投资者应该熟悉的另一个术语是除息日。这是投资者必须在此日期之前购买股票才能获得特定股息的日期。例如,如果一家公司在3月1日宣布股息,除息日为3月15日,支付日为3月31日,投资者必须在3月15日之前购买股票才能在3月31日收到股息。如果投资者在3月15日或之后购买股票,他们将在下一个支付日之前无法收到股息。

总而言之,股息是价值投资的一个重要方面,可以为股东提供收入和稳定性。通过了解股息收益率、派息率和除息日等一些关键概念,投资者可以更好地评估公司的股息政策及其财务状况和业绩。