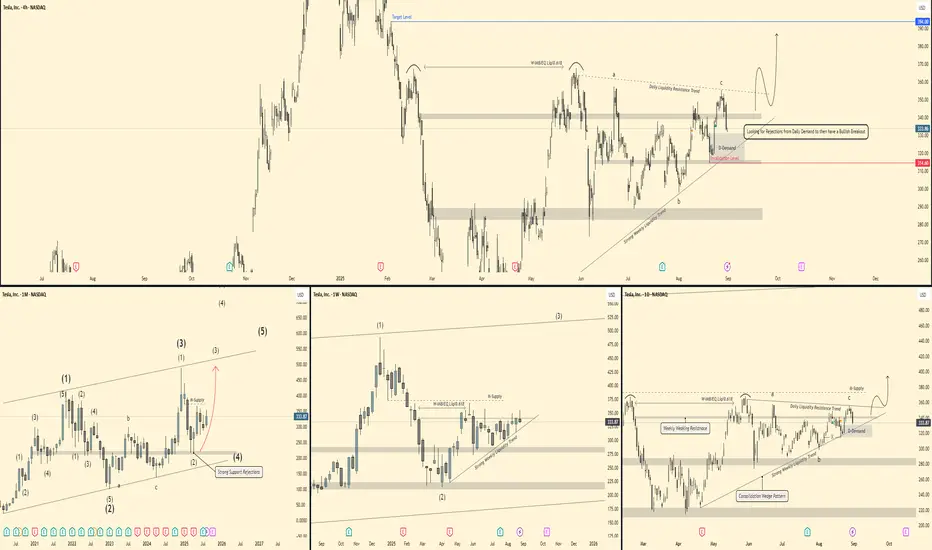

🕰 Monthly View

Price is respecting a long-term ascending channel.

Strong rejections from support confirm bullish momentum.

Current wave count suggests we are working through a larger impulsive structure – potential for Wave (3) continuation higher.

If momentum holds, upside could target the 450–500 zone in the longer run.

📆 Weekly View

Structure shows a 3-wave correction complete (ABC) into demand.

Price has tapped weekly demand + liquidity trendline.

Currently bouncing, with a breakout potential toward 375–400 (supply zone).

Breakout of the wedge pattern would confirm strength and continuation higher.

📅 Daily View

Price is reacting off Daily Demand (≈320–325 zone).

Strong liquidity resistance trend overhead (≈355–365).

If rejections hold and demand stays valid, a bullish breakout setup forms → target near 390–400.

Invalidation if we close below 314 (daily demand break).

⏱ 4H View

Local liquidity sweep into demand.

Bullish scenario: push toward 350–355 short-term.

Watch for confirmation: rejection candles + momentum shift needed before entry.

🎯 Bias & Trade Idea

Bias: Bullish (buy from demand)

Entry Zone: 320–330 (Daily Demand)

Targets:

Short-term → 355

Mid-term → 390–400

Invalidation: Daily close below 314

⚠️ Risk Note

Tesla is highly volatile. Stick to clear confirmations at demand before entry, and manage risk tightly below invalidation.

Price is respecting a long-term ascending channel.

Strong rejections from support confirm bullish momentum.

Current wave count suggests we are working through a larger impulsive structure – potential for Wave (3) continuation higher.

If momentum holds, upside could target the 450–500 zone in the longer run.

📆 Weekly View

Structure shows a 3-wave correction complete (ABC) into demand.

Price has tapped weekly demand + liquidity trendline.

Currently bouncing, with a breakout potential toward 375–400 (supply zone).

Breakout of the wedge pattern would confirm strength and continuation higher.

📅 Daily View

Price is reacting off Daily Demand (≈320–325 zone).

Strong liquidity resistance trend overhead (≈355–365).

If rejections hold and demand stays valid, a bullish breakout setup forms → target near 390–400.

Invalidation if we close below 314 (daily demand break).

⏱ 4H View

Local liquidity sweep into demand.

Bullish scenario: push toward 350–355 short-term.

Watch for confirmation: rejection candles + momentum shift needed before entry.

🎯 Bias & Trade Idea

Bias: Bullish (buy from demand)

Entry Zone: 320–330 (Daily Demand)

Targets:

Short-term → 355

Mid-term → 390–400

Invalidation: Daily close below 314

⚠️ Risk Note

Tesla is highly volatile. Stick to clear confirmations at demand before entry, and manage risk tightly below invalidation.

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。

免责声明

这些信息和出版物并非旨在提供,也不构成TradingView提供或认可的任何形式的财务、投资、交易或其他类型的建议或推荐。请阅读使用条款了解更多信息。