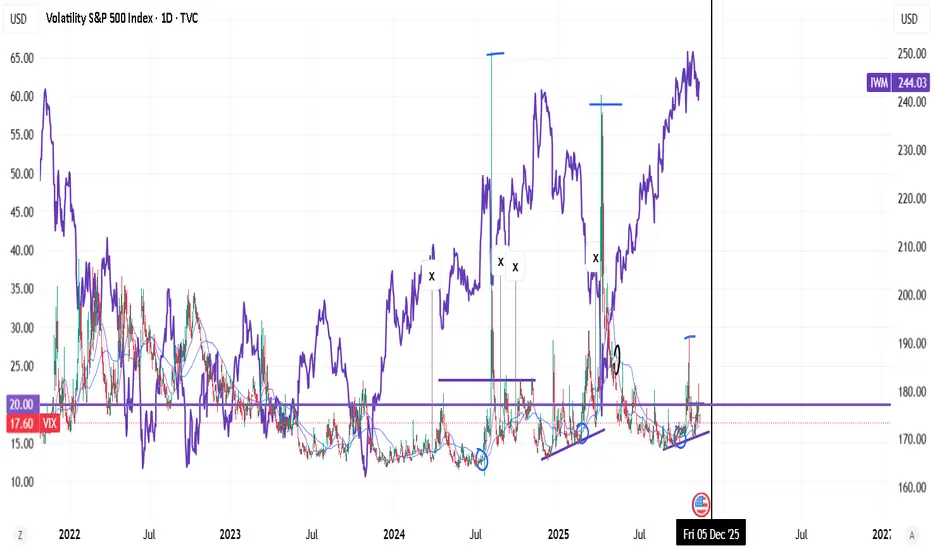

Where VIX gets 10/20/50 upswings, goes in patterns (structure). it seems it's a bad period for small caps.

Also, rising $TNX. which is the case now.

x- stands for bullish weekly macds.

Also, rising $TNX. which is the case now.

x- stands for bullish weekly macds.

注释

why does this matter?, when u get correction. You rather stick with faang or quality, not momentum stocks. You lose time. Qullamaggie said he succeeded only like 30% of times.注释

also. Peak "Lower Highs" (LHIGH) is always the start of new Risk on. 注释

here's proof with $IONQ. Falling VIX and falling

免责声明

这些信息和出版物并不意味着也不构成TradingView提供或认可的金融、投资、交易或其它类型的建议或背书。请在使用条款阅读更多信息。