请不要继续坚持美股泡沫爆破的想法给同志们送上迟来的新年快乐!

去年年末标普最高点位是6986,还是没能突破7000点。估计近期还要会上破7000大关,毕竟上升三角实在是经典得非常老套。继续上破估计是大概率事件。

估计上破后的跟进速度不会太慢。川武大帝的美丽法案的减税福利在第一季就要到账了。

而且这年头,全民都得炒股。不然就是给通胀当义工。现在的z世代没几个会像父辈殷勤在企业打工至退休。炒股才是他们的出路。

现在自媒体的泛滥成灾,不可能学不会炒股。只要足够时间,核弹怎样做也能在youtube学到。更何况现在有AI。所以全民炒股的时代要来了。流入股市的钱可能是我们难以想象。

回想两三个月前,市场都在担心泡沫,估值,市盈

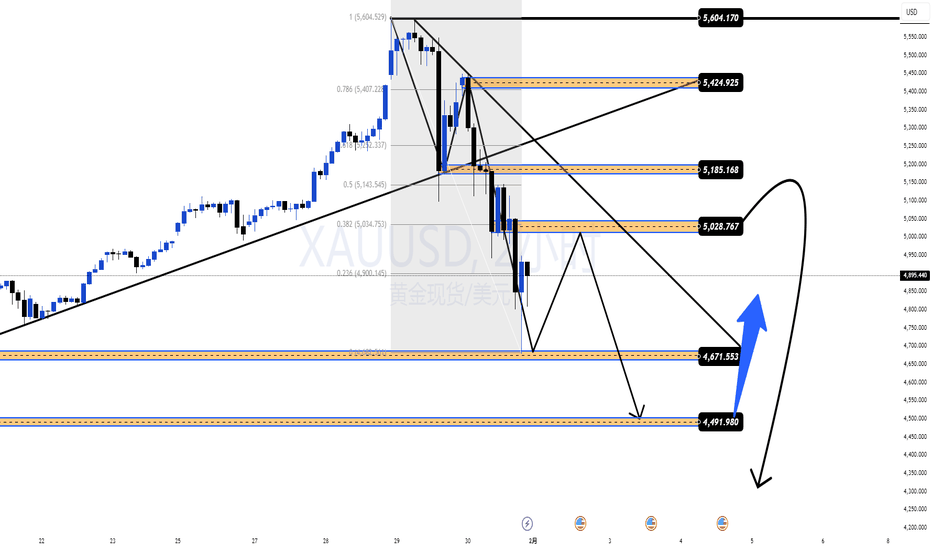

19-20日黄金做多计划上周五在消息面的加持下,价格在美盘极速向下清除了左侧的低阻力流动性池,随时抵达4H 看涨FVG 50%区域后又快速拉回到了1H OB+区域内。

周一期望价格高开,突破周五高点4621后形成结构反转,下方30M看涨OB就会生效,它将是一个摆动点OB,随后再耐心等待价格回到4575区域,在5M图表上观察价格是否会极速反转并创造新的OB+FVG,配合2022模型建立多头仓位,自行分阶段止盈,留尾仓推保护看历史新高。

周一价格如果高开后没有动力,再极速向下,不要追空,仍然关注

4575区域的反转机会。

日内短空机会在频道内更新。新手谨慎做空,耐心等待多头机会。

基于SMC流动性思考,仅做交流学

白银结构性崩塌预警:1980式“瀑布”前的最后备战清单

当前状态:暴风雨前的宁静 很多交易者还在盯着 K 线的高位震荡,试图寻找突破做多的机会。但作为专业交易者,我们必须看到冰山之下的裂痕:

地基塌陷:期限结构(SI1!-SI2!)已跌入深度的 Super Contango(超级升水)。现货买盘消失,这是典型的“有价无市”。

共振确认:XAGUSD 与交叉盘(XAGJPY)出现大周期空头共振。

扳机在即:美元指数(DXY)正在筑底,未来两周是关键变盘窗口。

这不只是一次回调,技术图形显示我们可能正面临一次类似 1980 年的流动性枯竭式崩盘(Waterfall Crash)。

【行动指南:现在该做什么?】 在瀑布

上证指数新高, 是多头的开始还是结束?---各位交易员朋友好久不见,虽然这半年来很少发文章,但是交易却未停过一日,我们直接进入主题,2026 年的第二个交易日 也就是 1 月 6 日,上证指数触及 4083 ,创2015 年 7 月以来新高,听起来很热血沸腾,但技术上只是超过了25 年 11 月14 日的 4034 新高。所以 是新趋势的开始,还是上个趋势的强弩之末,最后的奋力一击呢? 下面从我个人的分析系统的视角出发,做个简单分析,供大家参考。

---B 段中的蓝色区域,是 A段以来最强势的一段上涨。也是A 到 B ,这段宽幅调整以来最强势的上涨,今日的放量也明显增大了,有明显高位离场。从供应的角度来看这似乎是,强弩之末的铁证,

查看所有编辑精选观点

Hyperfork Matrix🔱 Hyperfork Matrix 🔱 A manual Andrews Pitchfork tool with action/reaction propagation lines and lattice matrix functionality. This indicator extends Dr. Alan Andrews' and Patrick Mikula's median line methodology by automating the projection of reaction and action lines at equidistant intervals, cr

Arbitrage Matrix [LuxAlgo]The Arbitrage Matrix is a follow-up to our Arbitrage Detector that compares the spreads in price and volume between all the major crypto exchanges and forex brokers for any given asset.

It provides traders with a comprehensive view of the entire marketplace, revealing hidden relationships among d

Wyckoff Schematic by Kingshuk GhoshThe "Wyckoff Schematic" is a Pine Script indicator that automatically detects and visualizes Wyckoff Method accumulation and distribution patterns in real-time. This professional tool helps traders identify smart money movements, phase transitions, and critical market structure points.

Key Features

Volume Cluster Profile [VCP] (Zeiierman)█ Overview

Volume Cluster Profile (Zeiierman) is a volume profile tool that builds cluster-enhanced volume-by-price maps for both the current market window and prior swing segments.

Instead of treating the profile as a raw histogram only, VCP detects the dominant volume peaks (clusters) insid

DeeptestDeeptest: Quantitative Backtesting Library for Pine Script

━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━━

█ OVERVIEW

Deeptest is a Pine Script library that provides quantitative analysis tools for strategy backtesting. It calculates over 100 statistical metrics including risk-adjusted return ratios (Sharpe

Arbitrage Detector [LuxAlgo]The Arbitrage Detector unveils hidden spreads in the crypto and forex markets. It compares the same asset on the main crypto exchanges and forex brokers and displays both prices and volumes on a dashboard, as well as the maximum spread detected on a histogram divided by four user-selected percenti

Multi-Distribution Volume Profile (Zeiierman)█ Overview

Multi-Distribution Volume Profile (Zeiierman) is a flexible, structure-first volume profile tool that lets you reshape how volume is distributed across price, from classic uniform profiles to advanced statistical curves like Gaussian, Lognormal, Student-t, and more.

Instead of forcin

Multi-Ticker Anchored CandlesMulti-Ticker Anchored Candles (MTAC) is a simple tool for overlaying up to 3 tickers onto the same chart. This is achieved by interpreting each symbol's OHLC data as percentages, then plotting their candle points relative to the main chart's open. This allows for a simple comparison of tickers to tr

Vdubus Divergence Wave Pattern Generator V1The Vdubus Divergence Wave Theory

10 years in the making & now finally thanks to AI I have attempted to put my Trading strategy & logic into a visual representation of how I analyse and project market using Core price action & MacD. Enjoy :)

A Proprietary Structural & Momentum Confluence System

Per Bak Self-Organized CriticalityTL;DR: This indicator measures market fragility. It measures the system's vulnerability to cascade failures and phase transitions. I've added four independent stress vectors: tail risk, volatility regime, credit stress, and positioning extremes. This allows us to quantify how susceptible markets are

查看所有指标和策略

社区趋势

以下是关于富临精工(300432)的技术分析。需要提醒您,当前股价(约8.76元)处于历史较低水平。以下是关于富临精工(300432)的技术分析。需要提醒您,当前股价(约8.76元)处于历史较低水平。

📊 当前技术面要点

股价趋势与位置

· 整体趋势:股价处于长期下跌后的低位震荡筑底阶段。52周波动范围为8.22元至15.34元,目前价格在区间下沿附近运行。

· 关键位置:

· 核心阻力位:10.50元附近。该位置是前期多个低点转换成的阻力,也是下行均线(如60日均线)的压制区域。

· 核心支撑位:8.20元整数关口。这是近期的心理防线,一旦有效跌破,可能打开新的下行空间。

市场动能与指标

· 均线系统:中长期均线(如60日、120日)呈空头排列,但短期均线走平,表明下跌动

查看所有股票观点

社区趋势

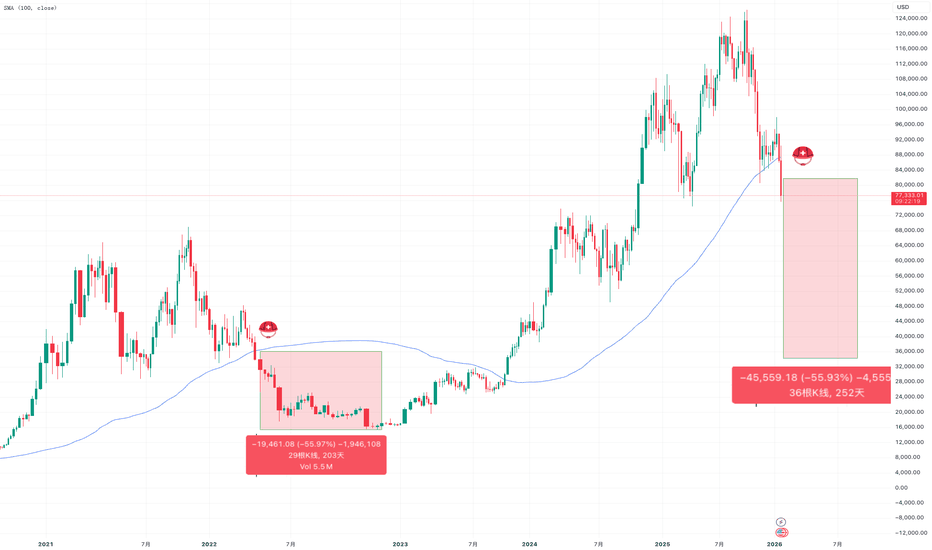

流动性分层理论:2个月前的预演路线完美重合,BTC这里可以抄底了吗?BTC目前下跌已经进入了一个流动性密集区(74k-78k的区间)

为什么这里是流动性密集区?

2025年3月-5月区间的合理低点(被反复测试)

2024年构成区间的最高点

从大周期的起涨点到目前为止的筹码真空带

在整个筹码密集区的不同价格都有抄底或至少是博反弹的人群,并且理由充分。

大量抄底(或博反弹)=买盘,也就是预期市场应该有流动性放大的区域。

在这种区域作为长期资金一定会加以多次试探。

因此在这里形成反弹甚至构成一个横盘区间是非常正常的。

那么为什么不认为这里是这轮下跌的底?

下跌的成交量不够,这里的下跌虽然也有小幅度放量,但远远构不成长期资金会认为“安全”的市场承接

以太坊:最后一役长期的来看,市场是一台称重机

这里2600应该是中短期内最后一个机会了。

若跌破,eth回到1000出头,btc4w-5w区间,这是长期资金合适的布局区。

几年了,始终没有一个长期资本入场的筹码区出现。

若跌不破,定价权争夺机构获胜彻底成定局。信仰者与机构存在不可调和的矛盾,两年了,愈演愈烈。投机玩家流失90%+,接下来生态、叙事重构至少3-5年,且如果长期机构在这一线保持入局,上方空间不大(换言之:无参与价值),未来5-10年,实用时代,比特币更不具备参与价值。

事实是:传统的加密市场已死,而能否出现新的打个大问号。

今年夏天前可以关注下polymarket(世界杯),其他没什么值得看的除

BTC未来行情展望大家好,又到了分享一些新的想法的时间了。我在7月初的文章中写到了,btc的统治地位即将下降,其他币种有可能迎来一波新的爆发。那么现在回顾过去三个月的走势,BTC从当时到最高点126173涨幅是7%左右。ETH的涨幅则是65%。BTC的通知地位下降11%。相信当时看到我的帖子并大饼换仓成其他主流币种的伙伴们肯定都收益颇丰吧。

那么进入今天的主题,直接上结论,我已经在13号都已经清仓啦,群内的小伙伴应该比较清楚,这些天比较忙,发文可能较晚。清仓的原因简单概括为两条。第一是现在的我们应该都还记得几天前史诗级的下跌,这一波基本把做主流山寨杠杆交易的选手杀了个干干净净,其实对市场造成了非常大的伤害,那我

查看所有加密观点

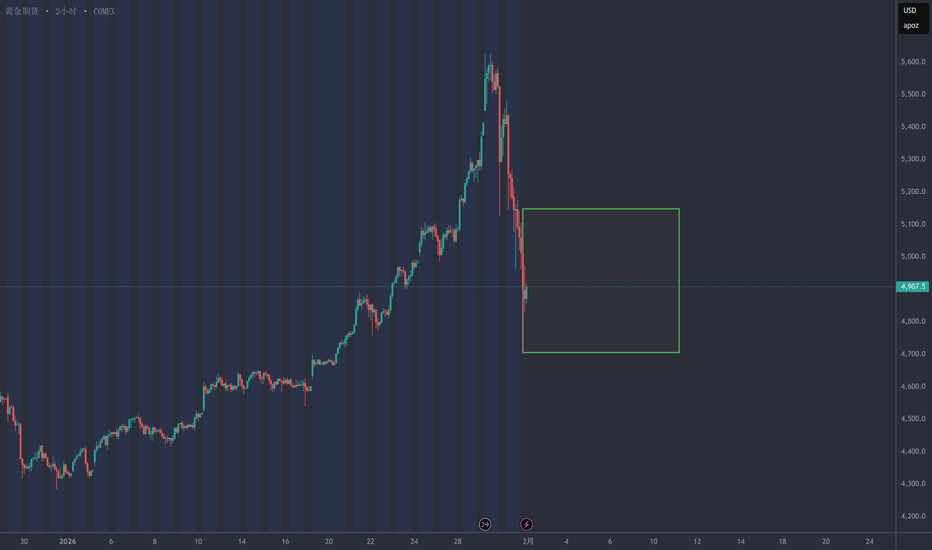

剧烈抛售后高波动,市场重整阶段市场背景

黄金在H1上经历了一次急剧且激烈的抛售,打破了短期看涨结构,在经过一段时间的强劲上涨后。这种走势通常反映了流动性分配和资本再平衡,常见于宏观驱动波动性加剧的时期。

从宏观角度来看:

由于利率预期和即将发布的数据,美元波动性仍然较高。

风险情绪不稳定,资本快速轮动。

黄金仍然是避险资产,但不再以单向流动进行交易。

➡️ 当前阶段:高风险 – 避免FOMO – 仅在关键水平进行交易。

结构与价格动作(H1)

之前的看涨H1结构已被无效化。

价格交易在上升趋势线之下 → 短期趋势疲弱。

当前的反弹是技术性回调,而不是确认的反转。

宽阔的日内区间增加了双方流动性扫荡的概

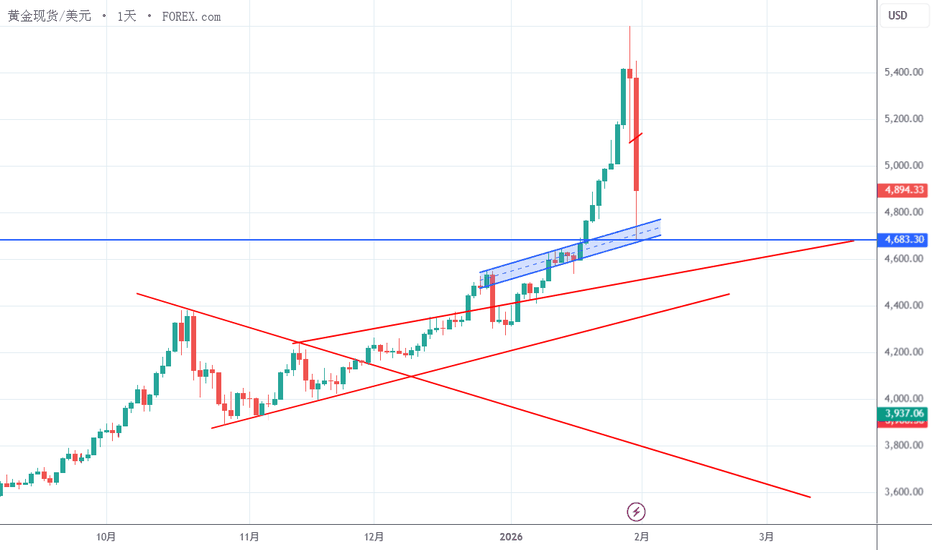

黄金日图级别波浪计数:时间和空间在升级黄金日图级别波浪计数:

波浪根据时间和空间在升级,目前根据结构来看上周四至周五的回调为绿色第四浪修正,目前高概率是已经结束,最多还有一个尾巴回踩一下4600-4500区间。这次回调只是技术上的修正,2月份看好继续上涨。2月份第一周和第二周看做震荡上涨,到第二周基本会非常明朗了。

很多人被这次下跌吓的卵子贴背心去了,他们不知道怎么回事,没遇到过这样的场面,惊慌失措,丑态百出,账户爆仓,小资金投机者平时习惯投机的遇到这样的行情肯定死路一条。后面越来越高小资金投机者没有专业人士保护你,你最后肯定是竹篮打水一场空的。

上周三的2个观点我就已经提示了本周到了该谨慎的

金汇得手:下周行情预测20260131 美元指数本月收长影阴线,下月关注99.3-95.3区间,如果不是极端行情,可能大区间震荡。周线关注96-98.5,日线周五大涨,下周一关注96.5-97.4区间。

黄金受消息面的影响波动异常大,一个月大涨1300美金,月底两天大跌接近800美金,从此可见一定要敬畏市场,控制风险。月线长上影阳线,技术上有回调需求,但是行情要想彻底反转,需要有效下破4310,否则有可能高位震荡一段时间。支撑顶底转换4550附近,差不多也是这波起涨点的位置,强支撑就是4310。如果行情走极端,有效下破4310,也不排除再跌1000美金。目前走势分歧比较大,我们静观其变,不过分看多和空。关注5030-5150-524

黄金暴涨30%后又暴跌近16% 到底发生了什么?黄金暴涨30%后又暴跌近16%——到底发生了什么?

自2026年初以来,黄金价格在仅仅一个月内上涨超过30%,

这一极端涨幅反映了全球对系统性风险与宏观不确定性的深度担忧。

然而,紧接着市场迎来了一次剧烈冲击。

黄金随后出现接近16%的深度回调。

这已经不再是一次普通的技术性调整,

而是一次信心的逆转。

问题不在于走势图。

👉 而在于信任。

黄金因特朗普而上涨——那又是谁让黄金下跌?

这轮剧烈波动,很大程度上源自唐纳德·特朗普。

特朗普的行为完全跳脱旧有框架:

加征关税、制裁、威胁,对盟友与对手同时施压。

旧规则几乎被彻底打破。

更令人担忧的是,

克里斯托弗·沃勒(Christ

查看所有期货观点

欧元 EUR 行情大局以及趋势分析大局趋势:混合状态,偏多,在未来 3–4 周内大概率整体偏多。

关键阻力:日线收盘价 高于12 月 23 日的摆动高点收盘价。该条件已于周五实现,一次修正应已完成。

关键支撑:日线收盘价 低于 1月 16 日的潜在第二浪(W.2)低点收盘价。若收盘跌破该位置,将警告欧元可能继续下跌至 7 月低点下方。

关键因素:周线与日线收盘价均高于各自的周线收盘高点,这是一个周线低点已经完成的强烈形态信号。任何回落都应被视为周线牛市趋势中的修正。

⚠更多交易分析及工具可以关注 NeuraAlgo 进行查看!

NeuraAlgo 实时追踪外汇、加密货币与美股走势,通过趋势强度、市场偏向、情绪结构与资

查看所有外汇观点

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - | ||

| - | - | - | - | - | - | - |

通过我们支持的、经过全面验证和用户审查的经纪商,直接在超级图表上交易。